Region:Asia

Author(s):Rebecca

Product Code:KRAB6427

Pages:85

Published On:October 2025

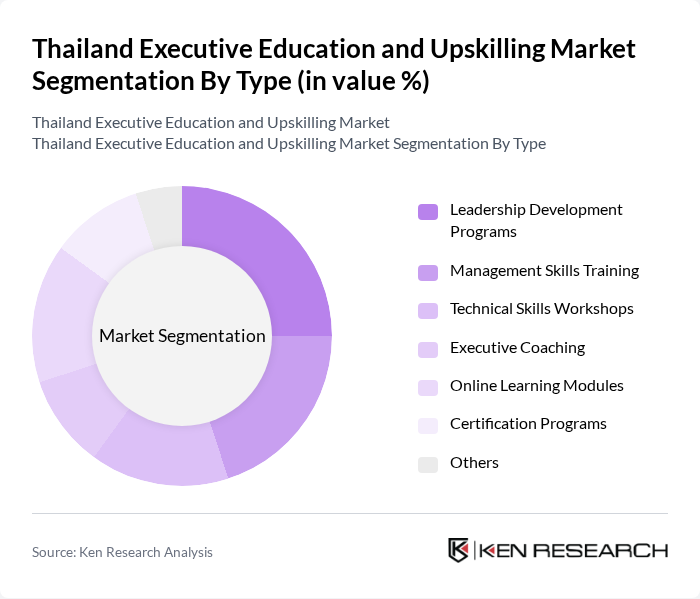

By Type:The market is segmented into various types of educational programs aimed at enhancing executive skills. The subsegments include Leadership Development Programs, Management Skills Training, Technical Skills Workshops, Executive Coaching, Online Learning Modules, Certification Programs, and Others. Each of these subsegments caters to specific needs within the corporate sector, focusing on different aspects of professional development.

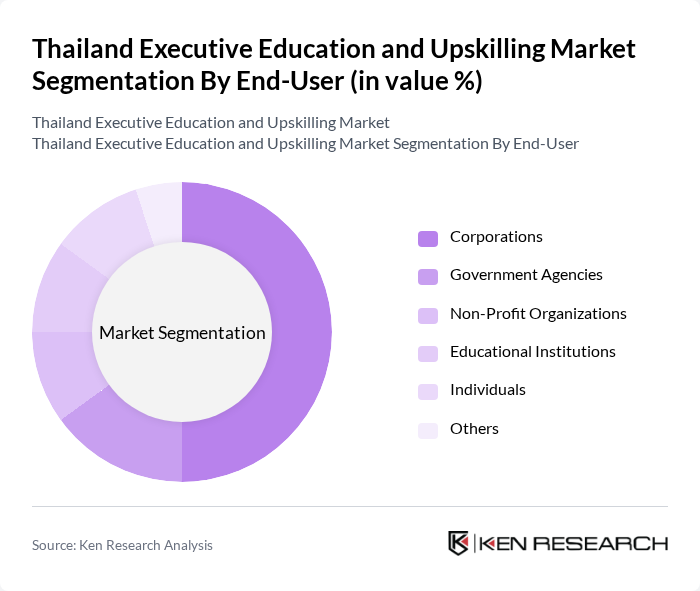

By End-User:The end-user segmentation includes Corporations, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Each segment represents a distinct group that seeks executive education and upskilling opportunities to enhance their workforce capabilities and improve overall performance.

The Thailand Executive Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bangkok Business School, Chulalongkorn University, Thammasat University, Sasin School of Management, Asian Institute of Technology, King Mongkut's University of Technology Thonburi, National Institute of Development Administration, Mahidol University International College, University of the Thai Chamber of Commerce, Bangkok University, Panyapiwat Institute of Management, Rangsit University, Assumption University, Siam University, Kasetsart University contribute to innovation, geographic expansion, and service delivery in this space.

The future of the executive education and upskilling market in Thailand appears promising, driven by ongoing digital transformation and government initiatives. As organizations increasingly prioritize leadership development and digital skills, the demand for tailored educational programs is expected to rise. Furthermore, the integration of technology in learning methodologies will likely enhance accessibility and engagement, fostering a culture of lifelong learning among professionals across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Leadership Development Programs Management Skills Training Technical Skills Workshops Executive Coaching Online Learning Modules Certification Programs Others |

| By End-User | Corporations Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Courses Hybrid Learning Workshops and Seminars Others |

| By Duration | Short-Term Courses (1-3 days) Medium-Term Courses (1-3 months) Long-Term Programs (6 months and above) Others |

| By Industry Focus | Finance and Banking Healthcare Technology Manufacturing Hospitality Others |

| By Certification Type | Professional Certifications Academic Degrees Industry-Specific Certifications Others |

| By Pricing Tier | Premium Programs Mid-Range Programs Budget Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 150 | HR Directors, Training Managers |

| Upskilling Initiatives in Technology | 100 | IT Managers, Learning & Development Specialists |

| Leadership Development Courses | 80 | Senior Executives, Program Coordinators |

| Industry-Specific Training Programs | 70 | Operations Managers, Sector Specialists |

| Online Learning Platforms for Professionals | 90 | eLearning Managers, Content Developers |

The Thailand Executive Education and Upskilling Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the increasing demand for skilled professionals and the rapid digital transformation across various sectors.