Region:Asia

Author(s):Dev

Product Code:KRAB6539

Pages:83

Published On:October 2025

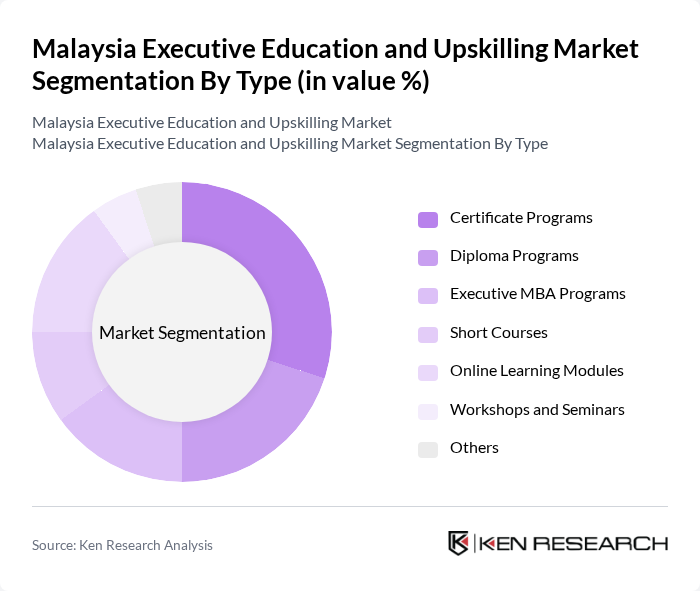

By Type:

The market is segmented into various types, including Certificate Programs, Diploma Programs, Executive MBA Programs, Short Courses, Online Learning Modules, Workshops and Seminars, and Others. Among these, Certificate Programs are currently dominating the market due to their flexibility and shorter duration, appealing to professionals seeking quick skill enhancements. The rise of online learning has also contributed significantly, allowing individuals to access quality education from anywhere, thus increasing participation rates.

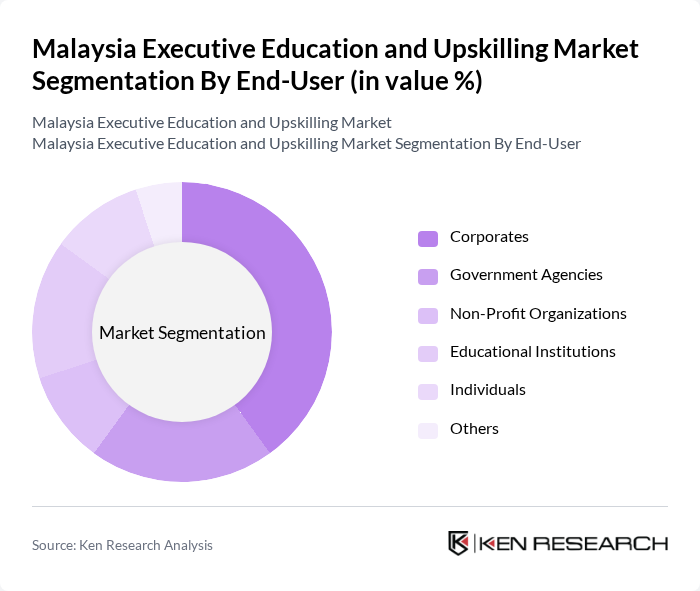

By End-User:

The end-user segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Educational Institutions, Individuals, and Others. Corporates are the leading segment, driven by the need for continuous employee development and competitive advantage in the market. Companies are increasingly investing in upskilling their workforce to adapt to technological changes and improve productivity, making this segment a significant contributor to market growth.

The Malaysia Executive Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universiti Malaya, Asia School of Business, INCEIF - The Global University of Islamic Finance, Monash University Malaysia, Universiti Kebangsaan Malaysia, Universiti Putra Malaysia, Taylor's University, Sunway University, HELP University, UCSI University, Malaysian Institute of Management, The University of Nottingham Malaysia, INTI International University, Brickfields Asia College, ELM Business School contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Malaysia Executive Education and Upskilling Market appears promising, driven by ongoing government support and the increasing integration of technology in learning. As organizations prioritize employee development, the demand for tailored programs that address specific industry needs is expected to rise. Additionally, the shift towards hybrid learning models will likely enhance accessibility and engagement, fostering a culture of continuous learning among professionals. This evolving landscape presents significant opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Certificate Programs Diploma Programs Executive MBA Programs Short Courses Online Learning Modules Workshops and Seminars Others |

| By End-User | Corporates Government Agencies Non-Profit Organizations Educational Institutions Individuals Others |

| By Delivery Mode | In-Person Training Online Training Blended Learning Mobile Learning Others |

| By Duration | Short-Term (Less than 3 months) Medium-Term (3 to 6 months) Long-Term (More than 6 months) Others |

| By Industry Focus | Technology Finance Healthcare Manufacturing Services Others |

| By Certification Type | Accredited Programs Non-Accredited Programs Industry-Specific Certifications Others |

| By Pricing Tier | Premium Mid-Range Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Executive Education Programs | 150 | HR Managers, Training Coordinators |

| Digital Upskilling Initiatives | 100 | IT Managers, Learning & Development Specialists |

| Leadership Development Courses | 80 | Senior Executives, Program Alumni |

| Industry-Specific Upskilling Workshops | 70 | Industry Experts, Workshop Facilitators |

| Government-Funded Training Programs | 60 | Policy Makers, Educational Administrators |

The Malaysia Executive Education and Upskilling Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for skilled professionals and government initiatives aimed at enhancing workforce capabilities.