Region:Central and South America

Author(s):Rebecca

Product Code:KRAA5075

Pages:87

Published On:September 2025

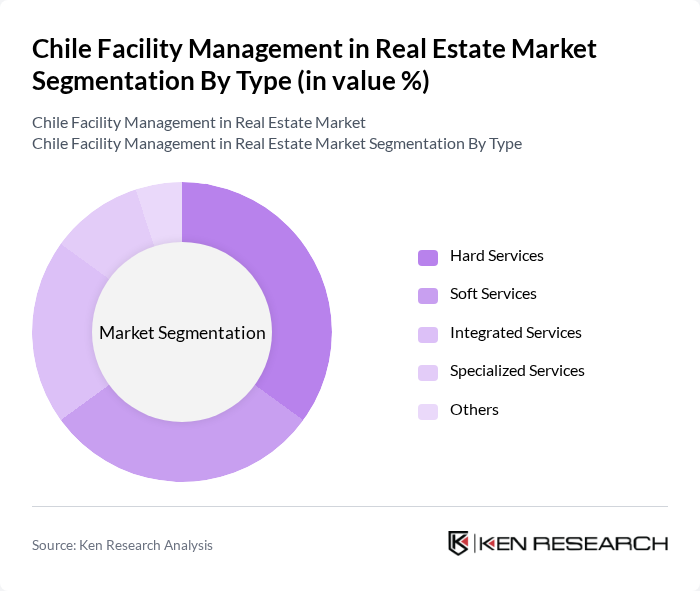

By Type:The facility management market can be segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Each of these segments plays a crucial role in addressing the diverse needs of property management.

The Hard Services segment is currently dominating the market due to the essential nature of maintenance, repair, and operational services required for buildings. This includes HVAC, plumbing, electrical, and other critical infrastructure services that ensure the functionality and safety of properties. The increasing focus on building safety and compliance with regulations has led to a higher demand for these services, making them a priority for facility management companies.

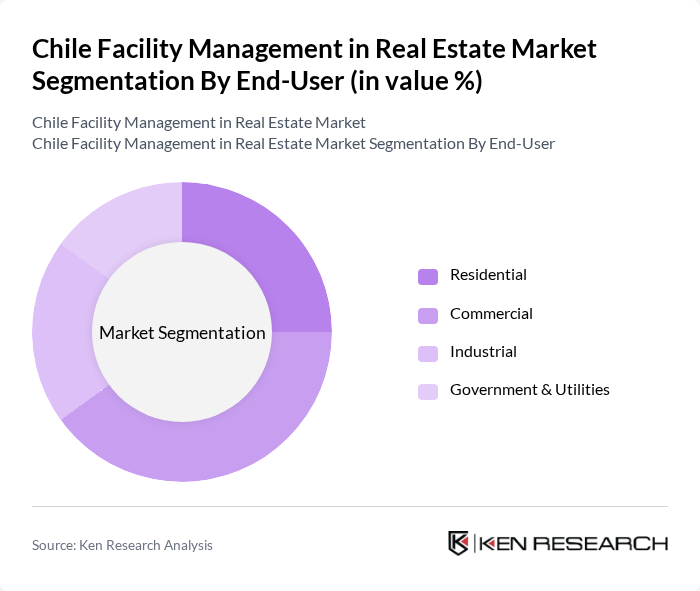

By End-User:The market can be segmented based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and contributes differently to the overall market dynamics.

The Commercial segment is the largest end-user category, driven by the rapid growth of office spaces, retail establishments, and mixed-use developments. The demand for professional facility management services in commercial properties is fueled by the need for operational efficiency, cost management, and compliance with health and safety regulations. As businesses increasingly recognize the value of outsourcing facility management, this segment is expected to continue leading the market.

The Chile Facility Management in Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as ISS Facility Services, Sodexo Chile, JLL Chile, CBRE Chile, G4S Chile, Grupo Prosegur, Aguas Andinas, Securitas Chile, Cencosud, Grupo Eulen, Atento Chile, Grupo Sancor Seguros, Asercom, Grupo Ceres, Facility Management Chile contribute to innovation, geographic expansion, and service delivery in this space.

The Chile facility management market is poised for significant evolution, driven by technological advancements and a growing emphasis on sustainability. As urbanization continues, the demand for integrated facility management services will rise, particularly in commercial real estate. Companies are expected to increasingly adopt smart technologies to enhance operational efficiency. Additionally, government initiatives aimed at infrastructure development will create new opportunities for facility management providers, fostering a more competitive and innovative market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Office Buildings Retail Spaces Educational Institutions Healthcare Facilities |

| By Service Model | Outsourced Services In-House Services |

| By Region | Santiago Valparaíso Concepción Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Compliance Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Real Estate Management | 100 | Facility Managers, Property Owners |

| Residential Property Services | 80 | Property Managers, Tenant Representatives |

| Industrial Facility Operations | 70 | Operations Managers, Safety Officers |

| Green Building Initiatives | 60 | Sustainability Managers, Architects |

| Technology Integration in Facility Management | 90 | IT Managers, Facility Management Software Providers |

The Chile Facility Management in Real Estate Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by urbanization, increased demand for efficient property management solutions, and the expansion of commercial real estate.