Region:Africa

Author(s):Shubham

Product Code:KRAA6199

Pages:85

Published On:September 2025

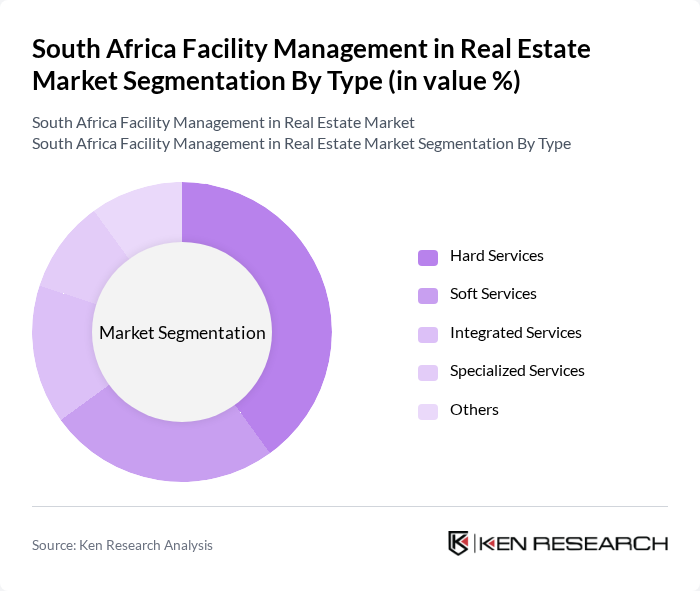

By Type:The facility management market can be segmented into various types, including Hard Services, Soft Services, Integrated Services, Specialized Services, and Others. Among these, Hard Services, which encompass maintenance and repair activities, are currently leading the market due to the essential nature of these services in ensuring operational efficiency and safety in buildings. The increasing complexity of building systems and the need for compliance with safety regulations further bolster the demand for Hard Services.

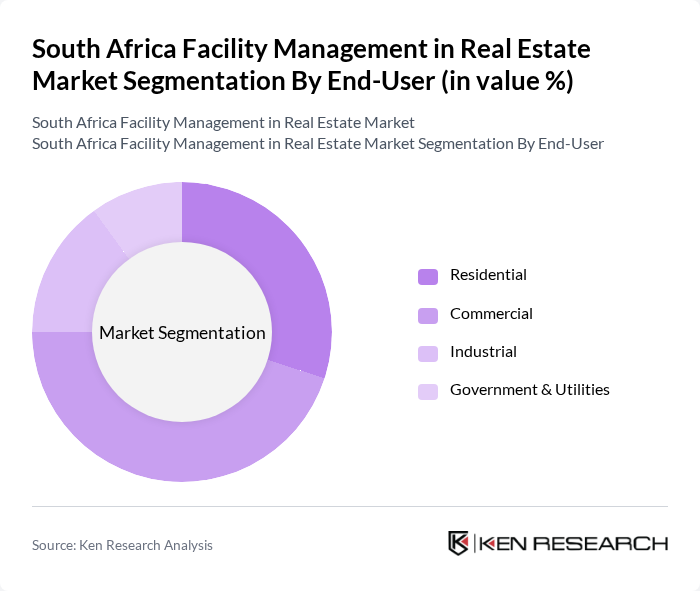

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Commercial sector is the dominant segment, driven by the growing number of office spaces and retail establishments in urban areas. The demand for professional facility management services in commercial properties is fueled by the need for enhanced operational efficiency, cost management, and compliance with health and safety regulations.

The South Africa Facility Management in Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bidvest Facilities Management, Servest Group, Tsebo Solutions Group, G4S Facilities Management, CSG Holdings, JHI Properties, Broll Property Group, Atterbury Property Holdings, Redefine Properties, Growthpoint Properties, Old Mutual Property, Investec Property, Emira Property Fund, Vukile Property Fund, Attacq Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African facility management market appears promising, driven by urbanization and technological advancements. As cities continue to grow, the demand for integrated facility management services will increase, particularly in commercial real estate. Additionally, the emphasis on sustainability and health standards will shape service offerings, pushing companies to innovate. The market is expected to adapt to these trends, fostering a more efficient and environmentally responsible facility management landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Specialized Services Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Service Model | Outsourced In-House Hybrid |

| By Sector | Corporate Offices Retail Spaces Educational Institutions Healthcare Facilities |

| By Geographic Distribution | Urban Areas Suburban Areas Rural Areas |

| By Contract Type | Fixed-Term Contracts Ad-Hoc Contracts Long-Term Contracts |

| By Pricing Model | Cost-Plus Pricing Fixed Pricing Performance-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Property Management | 100 | Facility Managers, Property Owners |

| Residential Facility Services | 80 | Property Managers, Tenant Relations Officers |

| Industrial Facility Operations | 70 | Operations Managers, Safety Compliance Officers |

| Real Estate Development Insights | 90 | Real Estate Developers, Project Managers |

| Sustainability in Facility Management | 60 | Sustainability Officers, Environmental Consultants |

The South Africa Facility Management in Real Estate Market is valued at approximately USD 2.5 billion, reflecting a significant growth driven by urbanization, demand for efficient property management, and sustainable building practices.