Region:Central and South America

Author(s):Shubham

Product Code:KRAA0917

Pages:98

Published On:August 2025

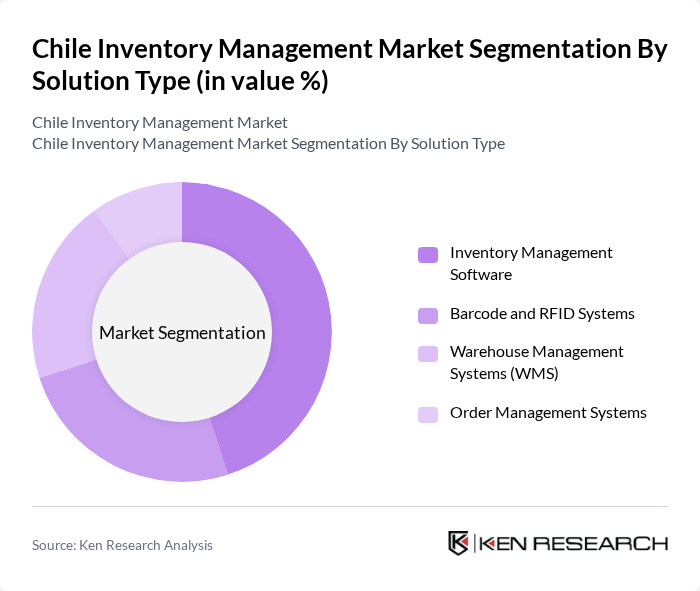

By Solution Type:The solution type segmentation includes various subsegments such as Inventory Management Software, Barcode and RFID Systems, Warehouse Management Systems (WMS), and Order Management Systems. Among these, Inventory Management Software is the leading subsegment, driven by the increasing need for businesses to automate their inventory processes and improve accuracy. The growing trend of digital transformation in various industries has further propelled the adoption of software solutions, making it a critical component of inventory management .

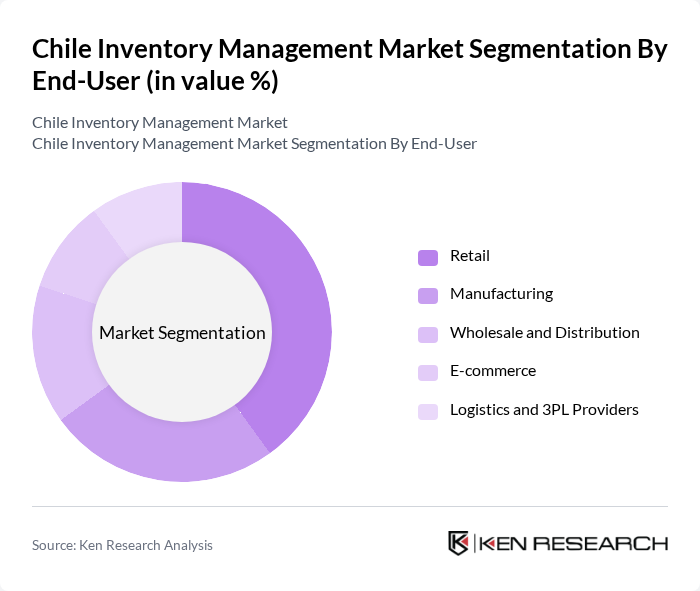

By End-User:The end-user segmentation encompasses Retail, Manufacturing, Wholesale and Distribution, E-commerce, and Logistics and 3PL Providers. The Retail sector is the dominant end-user, as it requires robust inventory management solutions to handle diverse product lines and high turnover rates. The rise of omnichannel retailing has further intensified the need for effective inventory management, making it essential for retailers to adopt advanced systems to meet consumer demands. Manufacturing and logistics sectors are also rapidly increasing their adoption of automated and integrated inventory management solutions to optimize supply chain performance .

The Chile Inventory Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP Chile, Oracle Chile, Infor, Microsoft Dynamics (Chile), TOTVS Chile, Softland Chile, Defontana, Sonda S.A., NetSuite (Oracle), Odoo, Zoho Inventory, Unigis, Brightpearl, QuickBooks Commerce, Cin7 contribute to innovation, geographic expansion, and service delivery in this space .

The Chilean inventory management market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As businesses increasingly adopt automation and data analytics, the focus will shift towards enhancing operational efficiency and customer satisfaction. The integration of AI and IoT technologies will further streamline inventory processes, enabling real-time tracking and predictive analytics. Additionally, the emphasis on sustainability practices will shape inventory strategies, aligning with global trends and consumer preferences for environmentally responsible operations.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Inventory Management Software Barcode and RFID Systems Warehouse Management Systems (WMS) Order Management Systems |

| By End-User | Retail Manufacturing Wholesale and Distribution E-commerce Logistics and 3PL Providers |

| By Industry Vertical | Food and Beverage Pharmaceuticals and Healthcare Electronics and Electricals Apparel and Fashion Automotive |

| By Deployment Mode | On-Premises Cloud-Based |

| By Sales Channel | Direct Sales Distributors/Resellers Online Sales |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Others | Custom Solutions Consulting and Integration Services |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Inventory Control | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 90 | Logistics Coordinators, eCommerce Directors |

| Warehouse Management Systems | 60 | Warehouse Managers, IT Systems Analysts |

| Supply Chain Optimization Practices | 50 | Supply Chain Managers, Business Analysts |

The Chile Inventory Management Market is valued at approximately USD 1.8 billion, reflecting a significant growth driven by the demand for efficient supply chain solutions, technological advancements, and the rise of e-commerce.