Region:Middle East

Author(s):Geetanshi

Product Code:KRAA2063

Pages:83

Published On:August 2025

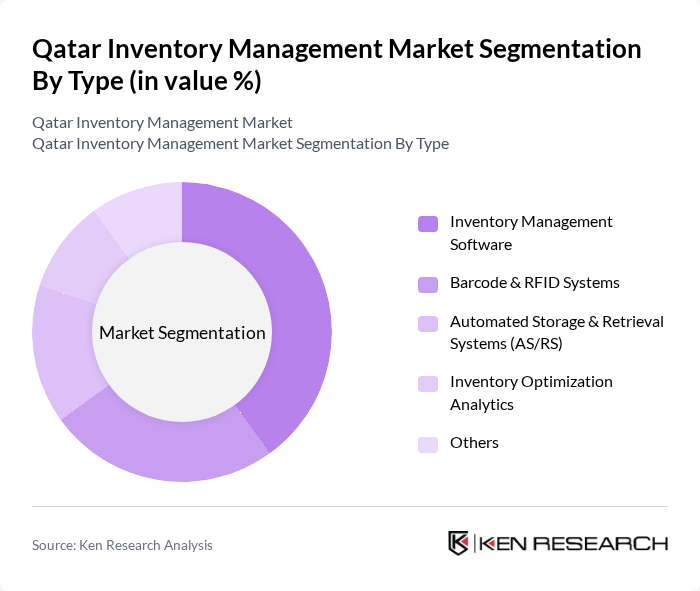

By Type:The market is segmented into various types, includingInventory Management Software, Barcode & RFID Systems, Automated Storage & Retrieval Systems (AS/RS), Inventory Optimization Analytics, and Others. Among these, Inventory Management Software is the leading sub-segment, driven by the increasing need for businesses to streamline operations and enhance visibility across their supply chains. The growing adoption of cloud-based solutions and integration with other enterprise systems have further contributed to the dominance of this segment, offering flexibility and scalability for businesses of all sizes.

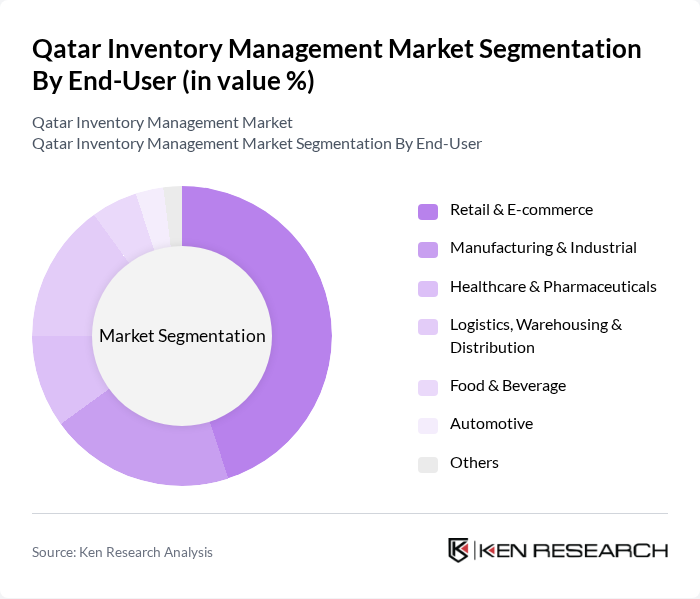

By End-User:The end-user segmentation includesRetail & E-commerce, Manufacturing & Industrial, Healthcare & Pharmaceuticals, Logistics, Warehousing & Distribution, Food & Beverage, Automotive, and Others. The Retail & E-commerce segment is the most significant contributor to the market, driven by the surge in online shopping and the need for efficient inventory management to meet consumer demands. The increasing focus on customer experience, rapid order fulfillment, and the adoption of omnichannel retail strategies have further propelled the growth of this segment.

The Qatar Inventory Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Manhattan Associates, Inc., Infor, Inc., Fishbowl Inventory, NetSuite Inc., Zoho Corporation (Zoho Inventory), Epicor Software Corporation, SkuVault, Cin7 Limited, Brightpearl (a Sage Group company), TradeGecko (now QuickBooks Commerce), Wasp Barcode Technologies, Unleashed Software, DEAR Systems (now Cin7 Core), Ooredoo Qatar Q.P.S.C., Malomatia, Mannai Corporation QPSC, GWC (Gulf Warehousing Company Q.P.S.C.), and Qatar Datamation Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the inventory management market in Qatar appears promising, driven by technological advancements and increasing demand for efficiency. As businesses continue to embrace automation and data analytics, the integration of AI and IoT technologies will enhance inventory accuracy and reduce costs. Furthermore, the growing emphasis on sustainability will push companies to adopt eco-friendly practices, aligning inventory management with broader environmental goals, thus fostering a more resilient market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Barcode & RFID Systems Automated Storage & Retrieval Systems (AS/RS) Inventory Optimization Analytics Others |

| By End-User | Retail & E-commerce Manufacturing & Industrial Healthcare & Pharmaceuticals Logistics, Warehousing & Distribution Food & Beverage Automotive Others |

| By Industry Vertical | Retail Healthcare Automotive Food and Beverage Oil & Gas Construction Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors/Resellers Online Sales Others |

| By Region | Doha Al Rayyan Al Wakrah Umm Salal Al Khor Others |

| By Price Range | Entry-Level Solutions Mid-Range Solutions Premium Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Analysts |

| Manufacturing Supply Chain Optimization | 60 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 50 | eCommerce Operations Managers, Logistics Coordinators |

| Warehouse Management Systems | 40 | Warehouse Managers, IT Managers |

| Logistics Service Providers | 45 | Business Development Managers, Sales Directors |

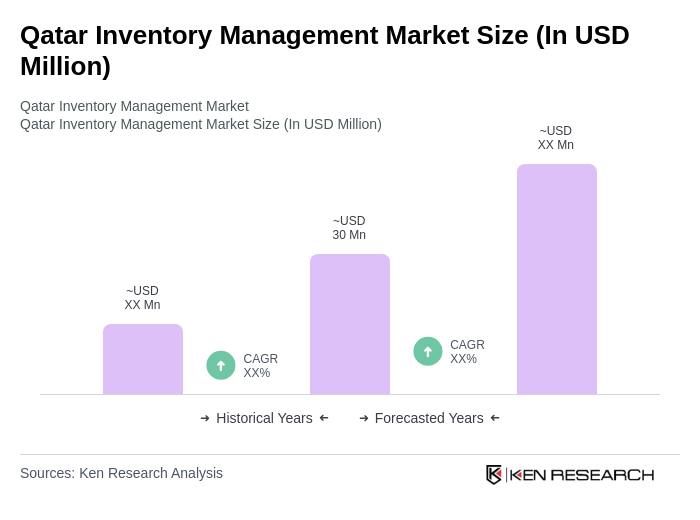

The Qatar Inventory Management Market is valued at approximately USD 30 million, reflecting a five-year historical analysis. This growth is largely attributed to the expansion of retail and e-commerce sectors and the demand for efficient supply chain solutions.