Region:Global

Author(s):Shubham

Product Code:KRAA1042

Pages:99

Published On:August 2025

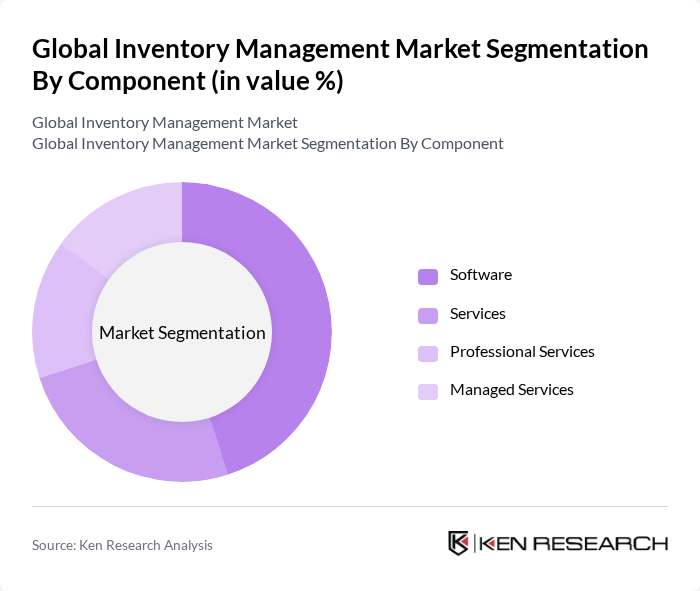

By Component:The components of the inventory management market include software, services, professional services, and managed services. Among these, software solutions are leading due to their ability to automate inventory processes, improve accuracy, and provide real-time data analytics. The demand for integrated software solutions that can seamlessly connect with other business systems is driving growth in this segment .

By Deployment Mode:The deployment modes in the inventory management market include on-premise and cloud-based (SaaS) solutions. Cloud-based solutions are gaining traction due to their scalability, cost-effectiveness, and ease of access, allowing businesses to manage inventory from anywhere. The shift towards digital transformation and remote work is further propelling the adoption of cloud-based inventory management systems .

The Global Inventory Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, IBM Corporation, Microsoft Corporation, Infor, Fishbowl Inventory, NetSuite (Oracle NetSuite), Zoho Corporation (Zoho Inventory), Cin7, SkuVault, Brightpearl (Sage Group), Unleashed Software, DEAR Systems (Cin7 Core), Wasp Barcode Technologies, Manhattan Associates, Blue Yonder (formerly JDA Software), Epicor Software Corporation, Tata Consultancy Services (TCS), Infosys, Wipro contribute to innovation, geographic expansion, and service delivery in this space.

The future of inventory management is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize sustainability, the adoption of eco-friendly inventory practices is expected to rise. Additionally, the integration of IoT devices will enhance real-time tracking capabilities, allowing for more efficient inventory management. Companies that embrace these trends will likely gain a competitive edge, positioning themselves favorably in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Services Professional Services Managed Services |

| By Deployment Mode | On-Premise Cloud-Based (SaaS) |

| By Application | Inventory Control & Tracking Order Management Asset Management Scanning and Barcoding |

| By Enterprise Size | Small & Medium Enterprises (SMEs) Large Enterprises |

| By End-User Industry | Retail & E-commerce Manufacturing Healthcare Logistics & Transportation Automotive Consumer Goods Electronics |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Management | 100 | Inventory Managers, Supply Chain Executives |

| Manufacturing Inventory Control | 80 | Operations Managers, Production Supervisors |

| Warehouse Management Systems | 60 | Warehouse Managers, IT Directors |

| Inventory Optimization Solutions | 50 | Logistics Analysts, Business Development Managers |

| Technology Adoption in Inventory Management | 40 | Chief Technology Officers, Innovation Leads |

The Global Inventory Management Market is valued at approximately USD 6 billion, driven by the increasing demand for efficient supply chain management, the rise of e-commerce, and advancements in technology such as IoT and AI.