Region:Central and South America

Author(s):Shubham

Product Code:KRAA0691

Pages:88

Published On:August 2025

By Type:The logistics technology market is segmented into Transportation Management Systems, Warehouse Management Systems, Fleet Management Solutions, Supply Chain Visibility Tools, Inventory Management Software, Freight Brokerage Platforms, Customs Clearance Solutions, E-commerce Logistics Platforms, and Others. Transportation Management Systems lead the market, driven by their essential role in optimizing transportation operations, reducing costs, and improving service levels. The increasing complexity of supply chains, demand for real-time tracking, and the integration of AI and IoT technologies are further accelerating the adoption of these systems .

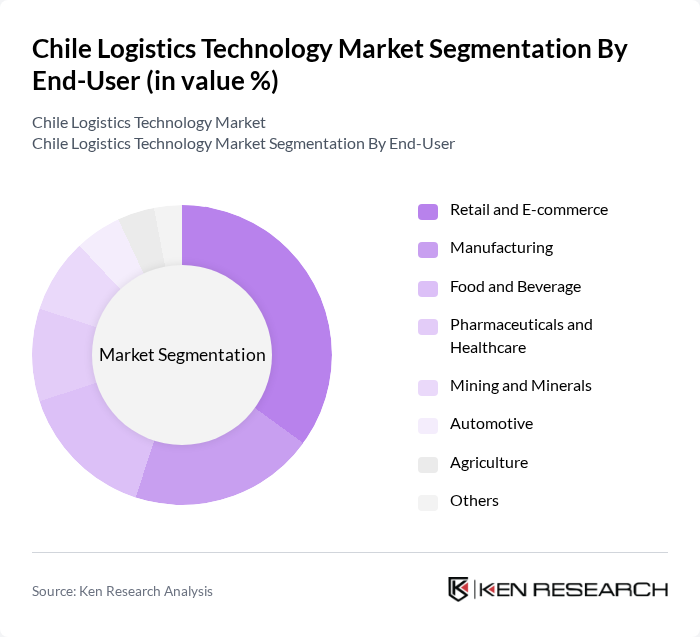

By End-User:The end-user segmentation includes Retail and E-commerce, Manufacturing, Food and Beverage, Pharmaceuticals and Healthcare, Mining and Minerals, Automotive, Agriculture, and Others. Retail and E-commerce is the dominant segment, fueled by the rapid growth of online shopping, the need for agile last-mile delivery, and increasing investments in digital logistics solutions to meet evolving consumer expectations. The focus on customer experience, real-time delivery tracking, and automation is pushing retailers to adopt advanced logistics technologies .

The Chile Logistics Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Chile, Kuehne + Nagel Chile, DSV Chile, Agunsa Logistics, Andes Logistics de Chile, Grupo Ransa (Loginsa), Blue Express, C.H. Robinson, DB Schenker Chile, CEVA Logistics Chile, Geodis Chile, SAP SE, Oracle Corporation, Manhattan Associates, and Trimble Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Chile logistics technology market is poised for significant transformation as companies increasingly embrace digital solutions to enhance efficiency and customer satisfaction. With the rise of e-commerce and government support for infrastructure, logistics firms are likely to invest in advanced technologies. Additionally, the focus on sustainability will drive innovations in green logistics practices. As these trends evolve, the market will witness a shift towards integrated, technology-driven logistics solutions that cater to the growing demands of consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Systems Warehouse Management Systems Fleet Management Solutions Supply Chain Visibility Tools Inventory Management Software Freight Brokerage Platforms Customs Clearance Solutions E-commerce Logistics Platforms Others |

| By End-User | Retail and E-commerce Manufacturing Food and Beverage Pharmaceuticals and Healthcare Mining and Minerals Automotive Agriculture Others |

| By Distribution Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation Intermodal Others |

| By Application | Freight Forwarding Warehousing and Distribution Customs Clearance Last-Mile Delivery Cold Chain Logistics Logistics Analytics Others |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Partnerships Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Customer Type | B2B B2C Government Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Technology Adoption in Retail | 100 | Logistics Managers, IT Directors |

| Supply Chain Innovations in Manufacturing | 80 | Operations Managers, Supply Chain Analysts |

| E-commerce Logistics Solutions | 90 | eCommerce Managers, Fulfillment Coordinators |

| Technology Integration in Transportation | 60 | Fleet Managers, Technology Officers |

| Impact of Automation on Warehousing | 50 | Warehouse Managers, Automation Specialists |

The Chile Logistics Technology Market is valued at approximately USD 1.8 billion, driven by the demand for efficient supply chain solutions, technological advancements, and the growth of e-commerce, which enhances operational efficiency and competitiveness in logistics.