Region:Europe

Author(s):Geetanshi

Product Code:KRAA2054

Pages:95

Published On:August 2025

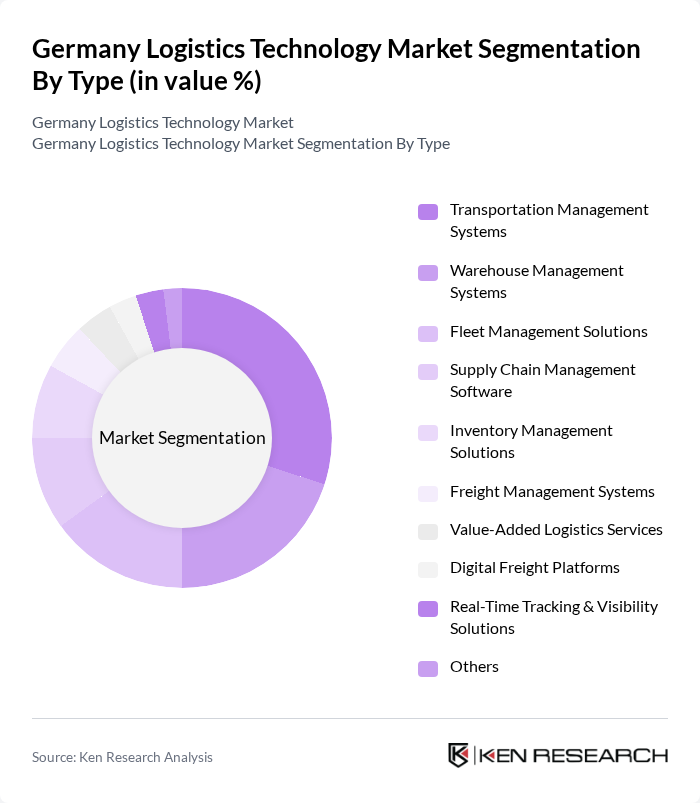

By Type:The logistics technology market is segmented into Transportation Management Systems, Warehouse Management Systems, Fleet Management Solutions, Supply Chain Management Software, Inventory Management Solutions, Freight Management Systems, Value-Added Logistics Services, Digital Freight Platforms, Real-Time Tracking & Visibility Solutions, and Others. Among these, Transportation Management Systems lead the market due to their essential role in optimizing logistics operations, reducing operational costs, and enabling real-time visibility and automation .

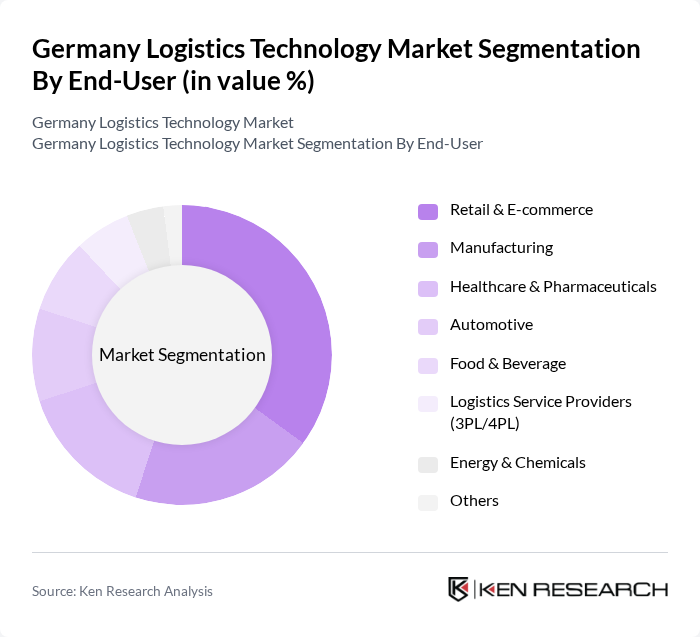

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, Logistics Service Providers (3PL/4PL), Energy & Chemicals, and Others. Retail & E-commerce is the dominant end-user, driven by the rapid growth of online shopping, evolving consumer expectations for faster delivery, and the need for highly efficient, technology-enabled logistics solutions .

The Germany Logistics Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Deutsche Post DHL Group, Siemens AG, Kuehne + Nagel International AG, DB Schenker, Hellmann Worldwide Logistics SE & Co. KG, DPDgroup (GeoPost), Rhenus Logistics, Transporeon (Trimble Inc.), C.H. Robinson Worldwide, Inc., FourKites, Inc., Project44, Inc., Freightos Limited, Locus.sh, Geodis S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics technology market in Germany appears promising, driven by ongoing advancements in automation and a strong push towards sustainability. As companies increasingly adopt smart logistics solutions, the integration of AI and IoT technologies will enhance operational efficiency and data-driven decision-making. Furthermore, the focus on real-time analytics will enable businesses to respond swiftly to market changes, ensuring competitiveness in a rapidly evolving landscape. The emphasis on green logistics will also shape future investments and innovations in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Systems Warehouse Management Systems Fleet Management Solutions Supply Chain Management Software Inventory Management Solutions Freight Management Systems Value-Added Logistics Services Digital Freight Platforms Real-Time Tracking & Visibility Solutions Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Logistics Service Providers (3PL/4PL) Energy & Chemicals Others |

| By Application | Last-Mile Delivery Optimization Inventory Optimization Order Fulfillment Automation Route Planning & Optimization Demand Forecasting & Analytics Real-Time Shipment Tracking Warehouse Automation Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport Others |

| By Sales Channel | Direct Sales Online Sales Distributors System Integrators Others |

| By Customer Type | B2B B2C C2C Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Automation Solutions | 60 | Warehouse Managers, Operations Directors |

| Supply Chain Visibility Technologies | 50 | IT Managers, Supply Chain Analysts |

| Last-Mile Delivery Innovations | 45 | Logistics Coordinators, Delivery Managers |

| Cold Chain Logistics Technologies | 40 | Quality Assurance Managers, Procurement Specialists |

| Data Analytics in Logistics | 55 | Data Scientists, Business Intelligence Analysts |

The Germany Logistics Technology Market is valued at approximately USD 13 billion, driven by the increasing demand for efficient supply chain solutions, digital transformation, and the growth of e-commerce, which requires advanced logistics systems for managing complex operations.