Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0272

Pages:100

Published On:August 2025

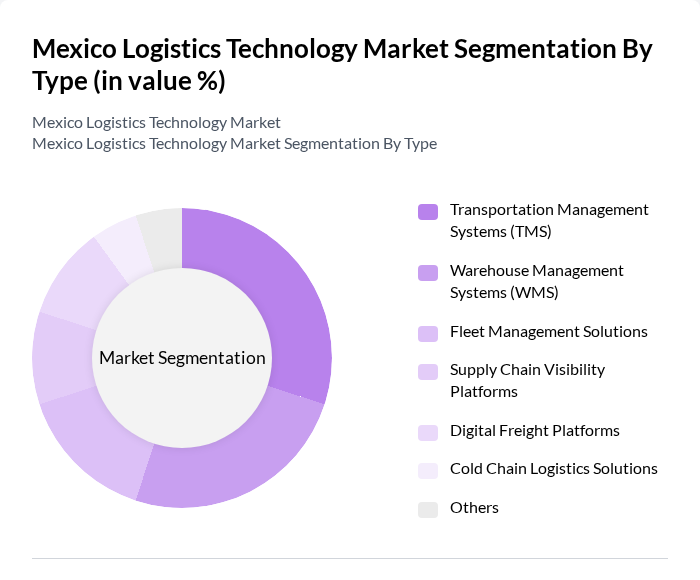

By Type:The logistics technology market is segmented into various types, including Transportation Management Systems (TMS), Warehouse Management Systems (WMS), Fleet Management Solutions, Supply Chain Visibility Platforms, Digital Freight Platforms, Cold Chain Logistics Solutions, and Others. Each of these segments plays a crucial role in enhancing operational efficiency and meeting the growing demands of the logistics sector .

The Transportation Management Systems (TMS) segment is currently leading the market due to the increasing need for efficient transportation solutions that optimize routes, reduce costs, and enhance visibility across the supply chain. Businesses are increasingly adopting TMS to manage their logistics operations more effectively, driven by the growth of e-commerce and the need for real-time tracking. The demand for TMS is further fueled by advancements in technology, such as artificial intelligence and machine learning, which enhance decision-making capabilities .

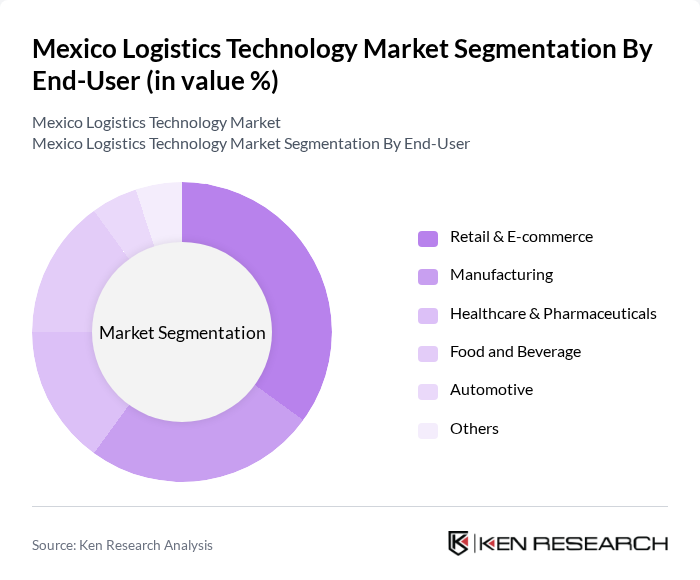

By End-User:The logistics technology market is segmented by end-user into Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Food and Beverage, Automotive, and Others. Each end-user segment has unique requirements and challenges, driving the demand for tailored logistics solutions .

The Retail & E-commerce segment is the dominant force in the logistics technology market, driven by the rapid growth of online shopping and the need for efficient order fulfillment. Retailers are increasingly investing in logistics technology to enhance their supply chain capabilities, improve customer satisfaction, and reduce delivery times. The surge in demand for last-mile delivery solutions and the need for real-time tracking further contribute to the growth of this segment .

The Mexico Logistics Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Mexico, Estafeta, FedEx Mexico, UPS Mexico, Kuehne + Nagel Mexico, XPO Logistics Mexico, Cargamos, 99minutos, Grupo TMM, Solistica, Logística de México (LDM), Traxión, Rappi, Redpack, Envía contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Mexico logistics technology market appears promising, driven by ongoing advancements in automation and digitalization. As companies increasingly adopt IoT and AI technologies, operational efficiencies are expected to improve significantly. Additionally, the focus on sustainability will likely lead to innovative solutions that reduce carbon footprints. With government support and infrastructure investments, the market is poised for growth, creating a more resilient logistics ecosystem that can adapt to changing consumer demands and global challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Systems (TMS) Warehouse Management Systems (WMS) Fleet Management Solutions Supply Chain Visibility Platforms Digital Freight Platforms Cold Chain Logistics Solutions Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Food and Beverage Automotive Others |

| By Service Type | Freight Transportation (Road, Rail, Air, Sea) Warehousing & Distribution Last-Mile Delivery Value-Added Services (Packaging, Labeling, Customs Clearance) Others |

| By Technology | Cloud-Based Solutions On-Premise Solutions Mobile Applications IoT & Telematics Artificial Intelligence & Machine Learning Blockchain Others |

| By Industry Vertical | Automotive Electronics Pharmaceuticals Agriculture Others |

| By Geographic Coverage | Urban Areas Industrial Corridors Border Regions (Cross-Border Logistics) Rural Areas Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Third-Party Logistics Providers (3PLs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Warehouse Management Systems Adoption | 100 | Warehouse Managers, IT Directors |

| Transportation Management Systems Utilization | 80 | Logistics Coordinators, Fleet Managers |

| Supply Chain Visibility Solutions | 70 | Supply Chain Analysts, Operations Managers |

| Last-Mile Delivery Technologies | 90 | Delivery Managers, E-commerce Operations Heads |

| Cold Chain Logistics Technologies | 50 | Quality Assurance Managers, Logistics Directors |

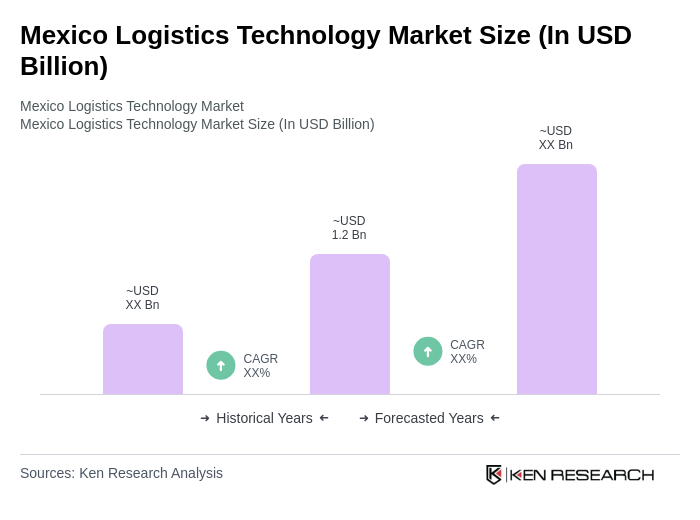

The Mexico Logistics Technology Market is valued at approximately USD 1.2 billion, driven by the increasing demand for efficient supply chain solutions, the rise of e-commerce, and advancements in automation and digital platforms that enhance logistics operations.