Region:Asia

Author(s):Shubham

Product Code:KRAC0658

Pages:90

Published On:August 2025

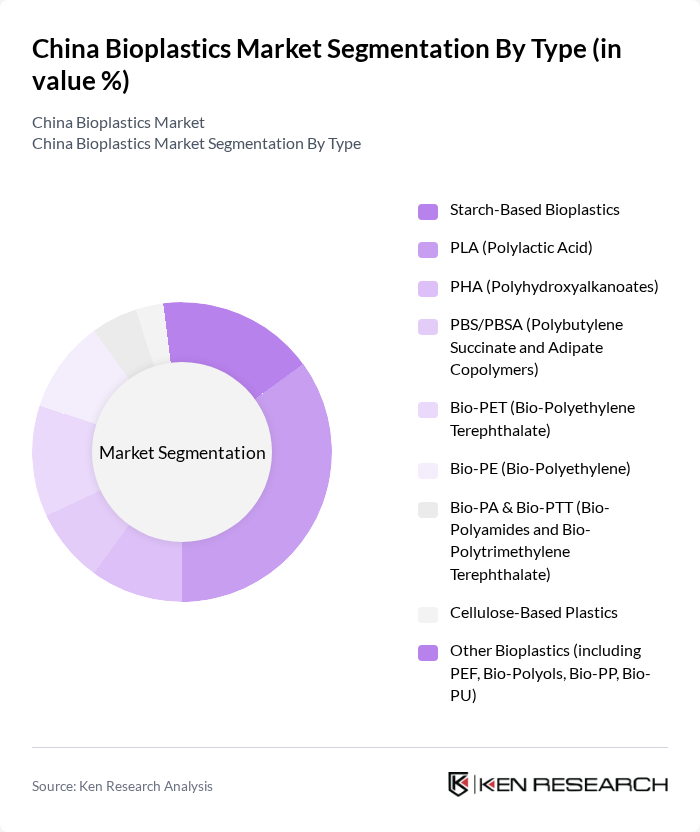

By Type:The bioplastics market can be segmented into various types, including starch-based bioplastics, PLA (Polylactic Acid), PHA (Polyhydroxyalkanoates), PBS/PBSA (Polybutylene Succinate and Adipate Copolymers), Bio-PET (Bio-Polyethylene Terephthalate), Bio-PE (Bio-Polyethylene), Bio-PA & Bio-PTT (Bio-Polyamides and Bio-Polytrimethylene Terephthalate), cellulose-based plastics, and other bioplastics. Among these, PLA is currently the leading subsegment due to its versatility and widespread application in packaging and consumer goods, supported by rapid PLA capacity expansion encouraged under China’s biodegradable-friendly policy framework.

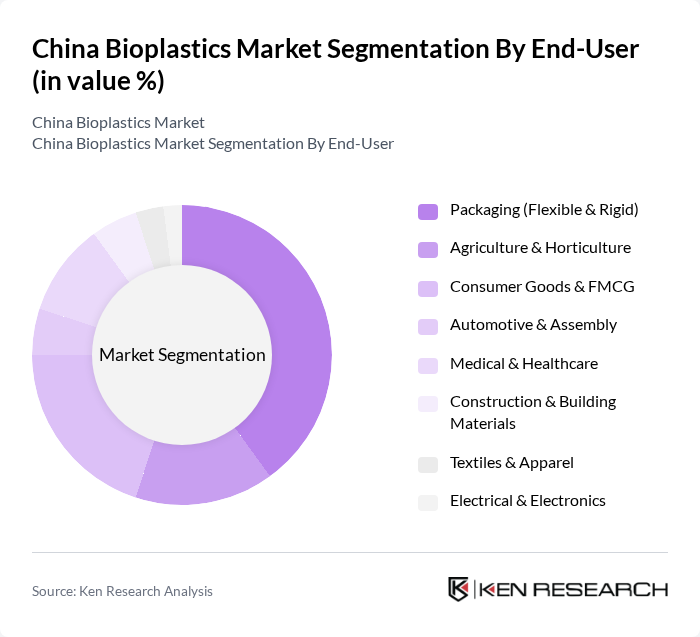

By End-User:The bioplastics market is segmented by end-user industries, including packaging (flexible and rigid), agriculture and horticulture, consumer goods and FMCG, automotive and assembly, medical and healthcare, construction and building materials, textiles and apparel, and electrical and electronics. The packaging segment is the largest due to the increasing demand for sustainable packaging solutions driven by retailer and brand commitments and regulatory pressures favoring biodegradable alternatives in certain use cases.

The China Bioplastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hisun Biomaterials Co., Ltd. (Zhejiang Hisun Biomaterials), TotalEnergies Corbion PLA, BBCA Biochemical Co., Ltd. (Anhui BBCA), COFCO Biotechnology Co., Ltd., Kingfa Sci. & Tech. Co., Ltd. (Kingfa Biobased Materials), BASF SE, NatureWorks LLC, Novamont S.p.A., Danimer Scientific, Shenzhen Esun Industrial Co., Ltd. (eSUN), Zhejiang Huafon Biomaterials Co., Ltd. (PBS/PBAT), Shandong Intco Recycling Resources Co., Ltd. (Biomaterials), BBCA PHBV Industrial Investment Co., Ltd. (PHA), Danhua Chemical Technology Co., Ltd. (China National Chemical Engineering Danhua), Toray Industries, Inc. (Toray Industries Suzhou – Bio-PET) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bioplastics market in China appears promising, driven by increasing environmental consciousness and supportive government policies. As consumer preferences shift towards sustainable products, the demand for bioplastics is expected to rise significantly. Innovations in bioplastic materials and applications will likely enhance product offerings, making them more appealing to consumers. Furthermore, collaborations between bioplastics manufacturers and eco-friendly brands will foster growth, creating a robust ecosystem that supports sustainability and environmental protection in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Starch-Based Bioplastics PLA (Polylactic Acid) PHA (Polyhydroxyalkanoates) PBS/PBSA (Polybutylene Succinate and Adipate Copolymers) Bio-PET (Bio-Polyethylene Terephthalate) Bio-PE (Bio-Polyethylene) Bio-PA & Bio-PTT (Bio-Polyamides and Bio-Polytrimethylene Terephthalate) Cellulose-Based Plastics Other Bioplastics (including PEF, Bio-Polyols, Bio-PP, Bio-PU) |

| By End-User | Packaging (Flexible & Rigid) Agriculture & Horticulture Consumer Goods & FMCG Automotive & Assembly Medical & Healthcare Construction & Building Materials Textiles & Apparel Electrical & Electronics |

| By Application | Flexible Packaging Films & Bags Rigid Packaging (Trays, Cups, Clamshells) Disposable Cutlery, Plates, and Straws Agricultural Films & Mulch Bottles and Containers D Printing Filaments Foam & Biocomposites |

| By Distribution Channel | Direct Sales (B2B/Project-Based) Industrial Distributors E-commerce & Online Portals Specialty Materials Traders |

| By Region | Eastern China (Shanghai, Jiangsu, Zhejiang) Southern China (Guangdong, Guangxi, Hainan) Northern China (Beijing, Tianjin, Hebei) Western China (Sichuan, Chongqing, Shaanxi) |

| By Price Range | Economy Mid-Range Premium |

| By Others | Custom Bioplastics Solutions (Compounds, Masterbatches, OEM Grades) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bioplastics in Packaging | 150 | Packaging Managers, Sustainability Coordinators |

| Bioplastics in Agriculture | 100 | Agricultural Product Managers, Farm Operations Directors |

| Consumer Goods Applications | 80 | Product Development Managers, Brand Managers |

| Automotive Industry Usage | 70 | Procurement Managers, Design Engineers |

| Research Institutions and Academia | 60 | Research Scientists, Environmental Policy Experts |

The China Bioplastics Market is valued at approximately USD 1.6 billion, reflecting strong domestic capacity additions and demand, particularly in packaging and agriculture. This valuation is based on a five-year historical analysis and aligns with recent industry assessments.