Region:Asia

Author(s):Geetanshi

Product Code:KRAA0228

Pages:80

Published On:August 2025

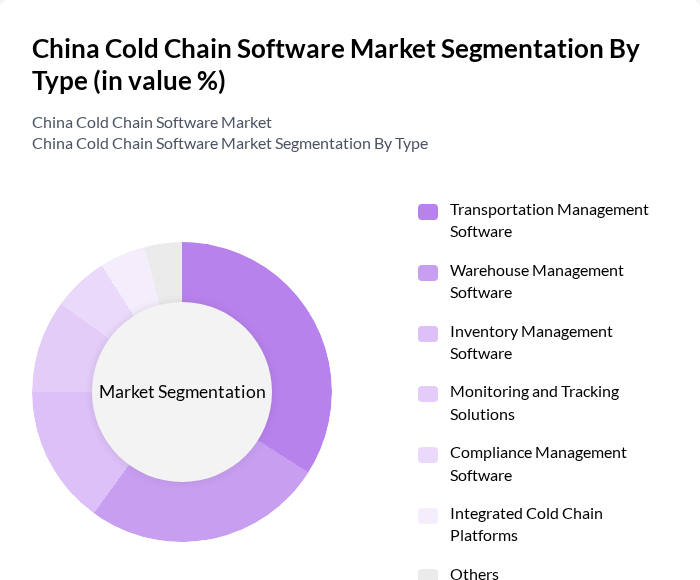

By Type:The market is segmented into various types of software solutions that cater to different aspects of cold chain management. The primary subsegments include Transportation Management Software, Warehouse Management Software, Inventory Management Software, Monitoring and Tracking Solutions, Compliance Management Software, Integrated Cold Chain Platforms, and Others. Among these, Transportation Management Software is currently leading the market due to the increasing need for efficient logistics, route optimization, and real-time tracking of temperature-sensitive shipments .

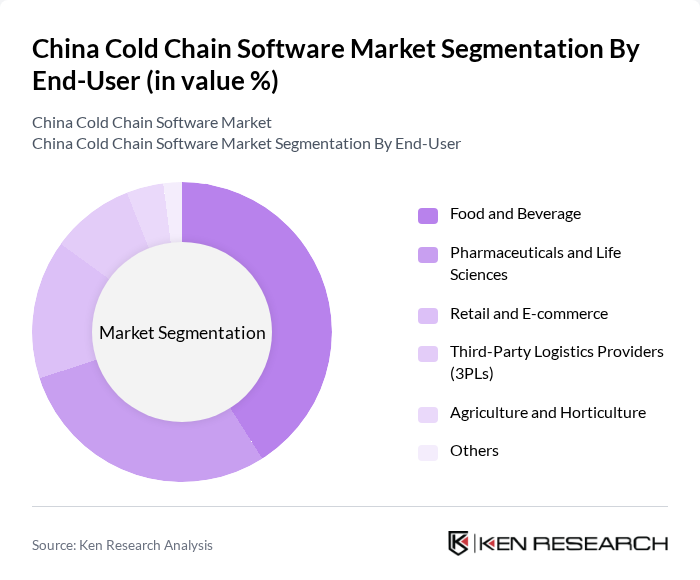

By End-User:The cold chain software market is also segmented by end-users, which include Food and Beverage, Pharmaceuticals and Life Sciences, Retail and E-commerce, Third-Party Logistics Providers (3PLs), Agriculture and Horticulture, and Others. The Food and Beverage sector is the dominant end-user, driven by the increasing demand for fresh produce, frozen foods, and the need for stringent quality control measures in food distribution .

The China Cold Chain Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Haier Biomedical, Alibaba Cloud, JD Logistics, SF Technology (SF Express), ZTE Corporation, Huawei Technologies, Dalian Refrigeration Co., Ltd., Sinotrans Limited, YTO Express Group Co., Ltd., Kingdee Software Group, Neusoft Corporation, Shanghai Jiahua Refrigeration Equipment Co., Ltd., Beijing Shouhang Resources Saving Company, Xiamen Xiangyu Co., Ltd., CJ Rokin Logistics contribute to innovation, geographic expansion, and service delivery in this space .

As the demand for efficient cold chain solutions continues to rise, the market is expected to witness significant technological advancements. The integration of IoT and AI technologies will enhance real-time monitoring and data analytics capabilities, improving operational efficiency. Additionally, the focus on sustainability will drive the adoption of eco-friendly cold chain practices. Companies that leverage these trends will likely gain a competitive edge, positioning themselves favorably in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Inventory Management Software Monitoring and Tracking Solutions Compliance Management Software Integrated Cold Chain Platforms Others |

| By End-User | Food and Beverage Pharmaceuticals and Life Sciences Retail and E-commerce Third-Party Logistics Providers (3PLs) Agriculture and Horticulture Others |

| By Region | North China South China East China West China |

| By Application | Temperature-Controlled Transportation Cold Storage Management Real-Time Monitoring and Alerts Regulatory Compliance Management Asset and Fleet Tracking Route Optimization Others |

| By Technology | IoT Solutions Cloud Computing Artificial Intelligence and Machine Learning Blockchain Technology RFID and Sensor Networks Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment Public-Private Partnerships Others |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Incentives for Technology Adoption Grants for Research and Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Cold Chain | 80 | Supply Chain Managers, Logistics Coordinators |

| Pharmaceutical Cold Chain Management | 60 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Cold Chain Technology Providers | 40 | Product Development Managers, IT Directors |

| Retail Cold Chain Operations | 50 | Operations Managers, Inventory Control Specialists |

| Logistics and Transportation Services | 45 | Fleet Managers, Business Development Executives |

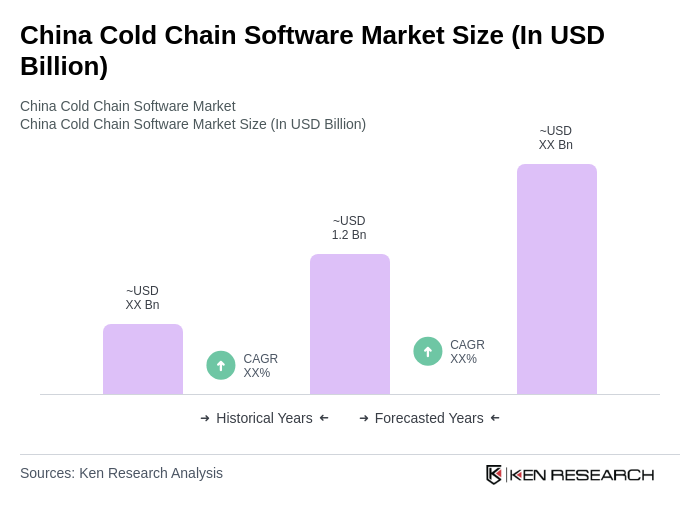

The China Cold Chain Software Market is valued at approximately USD 1.2 billion, driven by the increasing demand for temperature-sensitive products and advancements in digital logistics technologies.