Region:Europe

Author(s):Shubham

Product Code:KRAA0711

Pages:85

Published On:August 2025

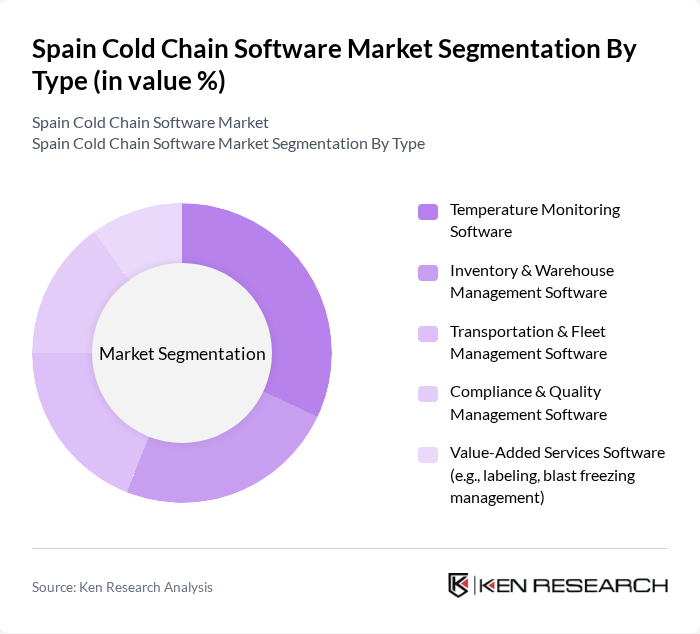

By Type:The segmentation by type includes various software solutions tailored for cold chain management. The subsegments are:

The leading subsegment in this category is Temperature Monitoring Software, which is crucial for ensuring that products remain within specified temperature ranges during storage and transportation. The increasing focus on food safety and regulatory compliance has driven demand for these solutions, as businesses seek to minimize spoilage and maintain product quality. Additionally, advancements in IoT technology, such as real-time data logging and remote temperature alerts, have enhanced the capabilities of temperature monitoring systems, making them more attractive to end-users .

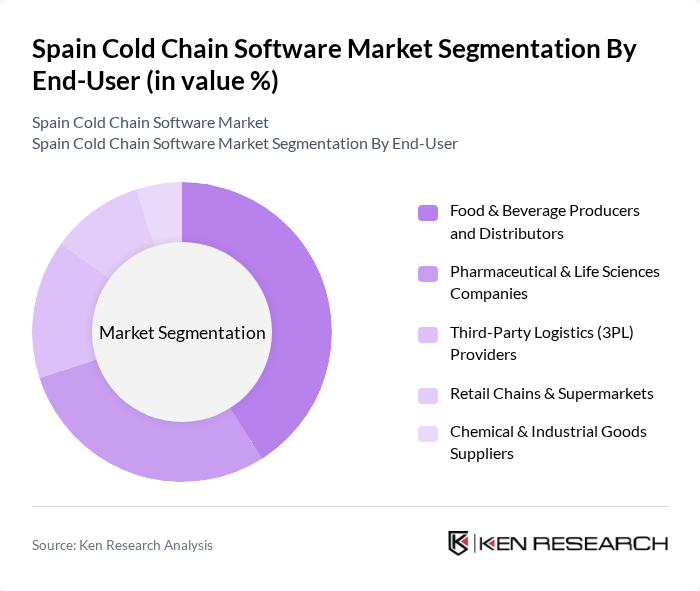

By End-User:The segmentation by end-user includes various industries that utilize cold chain software. The subsegments are:

The Food & Beverage Producers and Distributors segment leads the market due to the high volume of perishable goods that require strict temperature control. The growing consumer demand for fresh and safe food products has prompted these companies to invest in advanced cold chain software solutions. Additionally, the pharmaceutical sector is also a significant contributor, driven by the need for compliance with stringent regulations regarding the storage and transportation of temperature-sensitive medications .

The Spain Cold Chain Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zetes Industries (A Panasonic Company), Infratras (Grupo Infratras), Aliernet, Frigicoll, Mecalux Software Solutions, Generix Group, Almacenaje y Logística Frigorífica S.A. (ALFSA), Grupo Carreras, Tesisquare, Sensitech (A Carrier Company), WITRON Logistik + Informatik GmbH, Locus Traxx Europe, Controlant, SSI Schäfer, SAP SE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain software market in Spain appears promising, driven by technological advancements and increasing regulatory pressures. As companies seek to enhance operational efficiency, the adoption of automation and data analytics will become more prevalent. Furthermore, the shift towards sustainability will encourage businesses to invest in eco-friendly cold chain solutions. These trends indicate a robust growth trajectory, with companies increasingly prioritizing investments in innovative technologies to meet evolving consumer demands and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Temperature Monitoring Software Inventory & Warehouse Management Software Transportation & Fleet Management Software Compliance & Quality Management Software Value-Added Services Software (e.g., labeling, blast freezing management) |

| By End-User | Food & Beverage Producers and Distributors Pharmaceutical & Life Sciences Companies Third-Party Logistics (3PL) Providers Retail Chains & Supermarkets Chemical & Industrial Goods Suppliers |

| By Component | Standalone Software Solutions Integrated Hardware-Software Platforms Support, Implementation & Maintenance Services |

| By Sales Channel | Direct Enterprise Sales Value-Added Resellers & Distributors Online SaaS Platforms |

| By Deployment Mode | Cloud-Based Solutions On-Premise Solutions |

| By Price Range | Entry-Level Solutions Mid-Tier Solutions Enterprise/Premium Solutions |

| By Application | Cold Storage Facility Management Cold Transportation Management Order Fulfillment & Traceability Regulatory Compliance & Audit Management |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Cold Chain | 100 | Logistics Managers, Supply Chain Analysts |

| Pharmaceutical Cold Chain Management | 70 | Quality Assurance Managers, Compliance Officers |

| Retail Cold Chain Solutions | 50 | Operations Directors, IT Managers |

| Cold Chain Technology Providers | 40 | Product Development Managers, Sales Executives |

| Logistics and Transportation Services | 60 | Fleet Managers, Business Development Managers |

The Spain Cold Chain Software Market is valued at approximately USD 470 million, reflecting a significant growth driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors.