Region:Middle East

Author(s):Shubham

Product Code:KRAA1123

Pages:83

Published On:August 2025

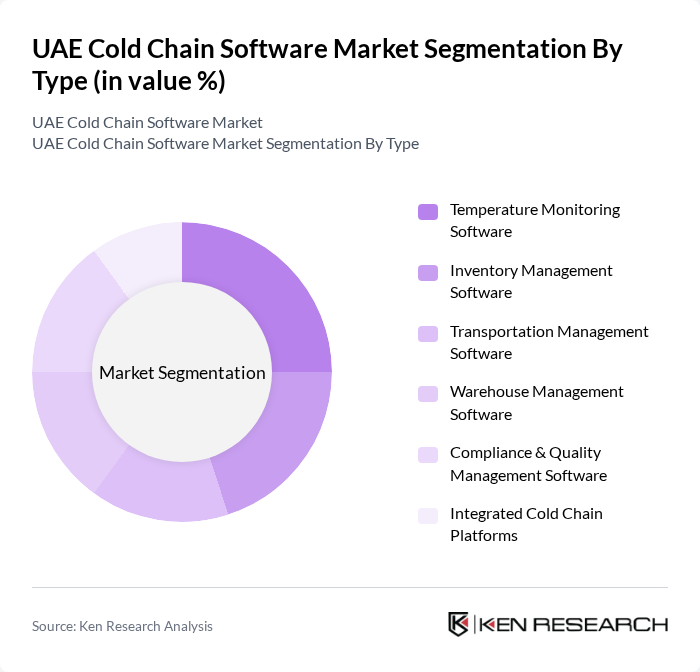

By Type:The segmentation by type includes various software solutions tailored for cold chain management. The subsegments are Temperature Monitoring Software, Inventory Management Software, Transportation Management Software, Warehouse Management Software, Compliance & Quality Management Software, and Integrated Cold Chain Platforms. Each of these plays a crucial role in ensuring the efficiency and reliability of cold chain operations. Temperature Monitoring Software provides real-time tracking and alerts for temperature deviations; Inventory Management Software optimizes stock levels and reduces spoilage; Transportation Management Software enables route optimization and compliance; Warehouse Management Software ensures proper storage conditions; Compliance & Quality Management Software supports regulatory adherence; and Integrated Cold Chain Platforms offer end-to-end visibility across the supply chain .

The Temperature Monitoring Software segment is currently leading the market due to the increasing emphasis on maintaining optimal temperature conditions for perishable goods. This software enables real-time monitoring and alerts, ensuring compliance with safety standards. The growing awareness of food safety and the need for regulatory compliance in the food and pharmaceutical industries further drive the demand for this segment. As a result, businesses are increasingly investing in advanced temperature monitoring solutions to enhance their operational efficiency .

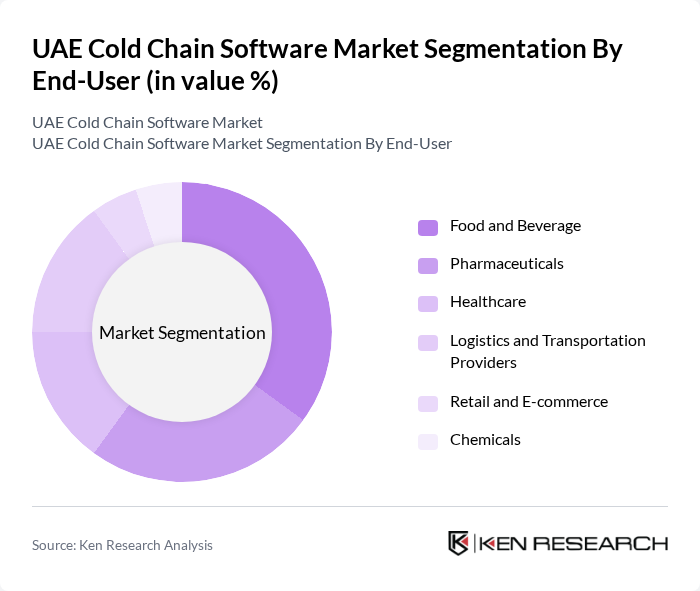

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Healthcare, Logistics and Transportation Providers, Retail and E-commerce, and Chemicals. Each sector has unique requirements for cold chain management, influencing the adoption of specific software solutions tailored to their operational needs. Food and Beverage requires robust monitoring for freshness; Pharmaceuticals and Healthcare demand strict compliance and traceability; Logistics and Transportation Providers focus on real-time tracking and delivery optimization; Retail and E-commerce emphasize last-mile delivery and inventory accuracy; Chemicals require specialized handling and regulatory compliance .

The Food and Beverage sector dominates the end-user market due to the high volume of perishable goods requiring strict temperature control during storage and transportation. The increasing consumer demand for fresh and safe food products drives investments in cold chain software solutions. Additionally, the rise of e-commerce in the food sector has further accelerated the need for efficient cold chain management systems to ensure product quality and safety during delivery .

The UAE Cold Chain Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Infor, SAP SE, Oracle Corporation, BluJay Solutions (now part of E2open), Manhattan Associates, Honeywell International Inc., Tive Inc., Sensitech Inc. (Carrier Global Corporation), Controlant, Zetes Industries (Panasonic Group), GAC Dubai, Mohebi Logistics, CEVA Logistics, Agility Logistics, Emirates Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The UAE cold chain software market is poised for significant transformation as technological advancements and regulatory pressures shape the landscape. In future, the integration of IoT and AI technologies is expected to enhance operational efficiency, enabling real-time monitoring and predictive analytics. Additionally, the focus on sustainability will drive innovations in energy-efficient cold chain solutions, aligning with the UAE's commitment to environmental goals. These trends will create a dynamic environment for growth and investment in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Temperature Monitoring Software Inventory Management Software Transportation Management Software Warehouse Management Software Compliance & Quality Management Software Integrated Cold Chain Platforms |

| By End-User | Food and Beverage Pharmaceuticals Healthcare Logistics and Transportation Providers Retail and E-commerce Chemicals |

| By Application | Cold Storage Management Transportation and Distribution Order Fulfillment Regulatory Compliance and Reporting Asset Tracking & Traceability Predictive Maintenance |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Sales Channel | Direct Sales Distributors/Resellers Online Sales System Integrators |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Cold Chain | 60 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Storage | 50 | Quality Assurance Managers, Operations Directors |

| Retail Cold Chain Solutions | 40 | Retail Operations Managers, Procurement Specialists |

| Technology Providers for Cold Chain | 45 | Product Managers, Business Development Executives |

| Logistics Infrastructure Development | 55 | Urban Planners, Infrastructure Analysts |

The UAE Cold Chain Software Market is valued at approximately USD 140 million, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with the need for efficient logistics and supply chain management solutions.