Region:Asia

Author(s):Geetanshi

Product Code:KRAA1179

Pages:86

Published On:August 2025

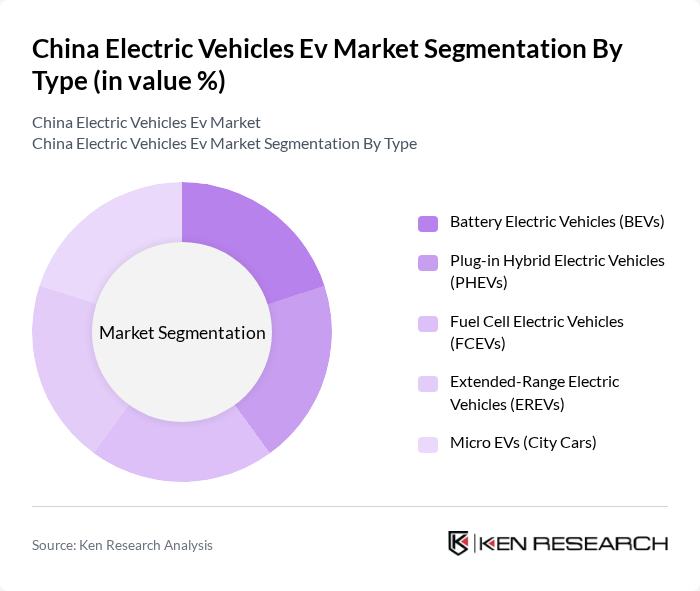

By Type:The electric vehicles market can be segmented into Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Fuel Cell Electric Vehicles (FCEVs), Extended-Range Electric Vehicles (EREVs), and Micro EVs (City Cars). Among these, Battery Electric Vehicles (BEVs) are leading the market due to their zero-emission operation and continuous advancements in battery technology, which have significantly improved their range, affordability, and performance. The growing consumer preference for fully electric vehicles, supported by government incentives, aggressive price competition, and expanding charging infrastructure, has further solidified BEVs' dominance .

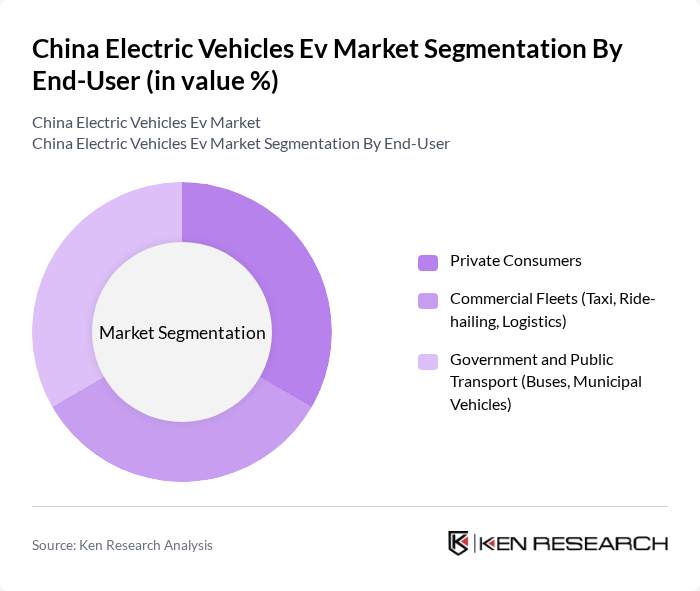

By End-User:The market can be segmented based on end-users, including Private Consumers, Commercial Fleets (Taxi, Ride-hailing, Logistics), and Government and Public Transport (Buses, Municipal Vehicles). The Commercial Fleets segment is experiencing rapid growth, driven by the increasing adoption of electric taxis, ride-hailing vehicles, and logistics fleets. Companies are transitioning to electric vehicles to reduce operational costs, comply with regulatory requirements, and meet sustainability goals, making this segment a major contributor to market expansion .

The China Electric Vehicles Ev Market is characterized by a dynamic mix of regional and international players. Leading participants such as BYD Company Limited, NIO Inc., Xpeng Motors, SAIC Motor Corporation Limited, Geely Automobile Holdings Limited, Great Wall Motors, Changan Automobile, BAIC Group, Dongfeng Motor Corporation, Tesla, Inc., Li Auto Inc., Leapmotor, Seres Group (formerly Sokon Group), Zeekr Intelligent Technology, and Aion (GAC Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle market in China appears promising, driven by ongoing technological advancements and supportive government policies. In future, the market is expected to witness a significant increase in EV adoption, fueled by the expansion of charging networks and the introduction of more affordable models. Additionally, the integration of smart technologies and autonomous driving features is likely to enhance consumer interest, positioning China as a leader in the global EV landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Fuel Cell Electric Vehicles (FCEVs) Extended-Range Electric Vehicles (EREVs) Micro EVs (City Cars) |

| By End-User | Private Consumers Commercial Fleets (Taxi, Ride-hailing, Logistics) Government and Public Transport (Buses, Municipal Vehicles) |

| By Vehicle Size | Micro/Compact Cars Sedans SUVs MPVs (Multi-Purpose Vehicles) Trucks & Light Commercial Vehicles |

| By Charging Type | Home Charging (AC) Public Charging (AC/DC) Fast Charging (DC) Battery Swapping |

| By Distribution Channel | Direct Sales (OEM-owned stores) Authorized Dealerships Online Sales Platforms Fleet Sales |

| By Price Range | Entry/Budget Segment (<¥100,000) Mid-Range Segment (¥100,000–¥250,000) Premium Segment (>¥250,000) |

| By Policy Support | Purchase Subsidies Tax Exemptions Incentives for Charging Infrastructure Local License Plate Privileges |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer EV Adoption Trends | 120 | EV Owners, Potential Buyers |

| Commercial Fleet Electrification | 60 | Fleet Managers, Logistics Coordinators |

| Charging Infrastructure Development | 50 | Infrastructure Developers, City Planners |

| Battery Technology Insights | 40 | R&D Engineers, Product Managers |

| Government Policy Impact | 40 | Policy Makers, Regulatory Affairs Specialists |

The China Electric Vehicles market is valued at approximately USD 375 billion, driven by government policies, consumer demand for sustainable transportation, and advancements in battery technology. This growth reflects a significant increase in electric vehicle adoption across the country.