Region:Europe

Author(s):Shubham

Product Code:KRAC0755

Pages:87

Published On:August 2025

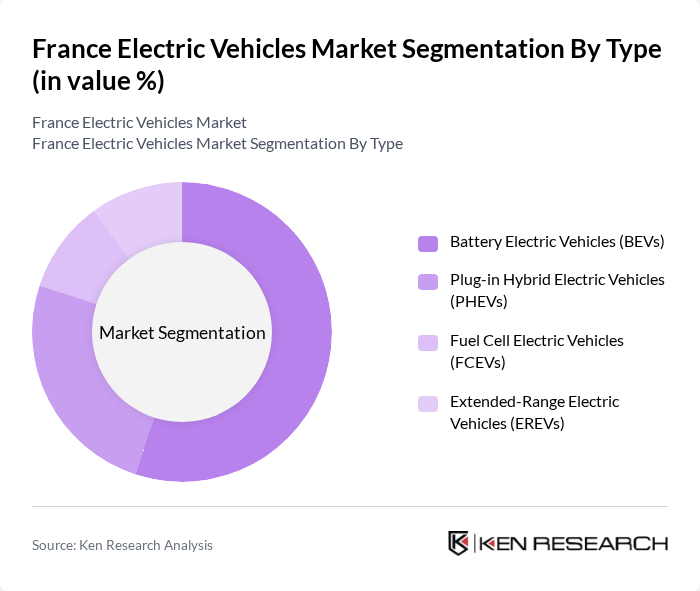

By Type:The market is segmented into various types of electric vehicles, including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Fuel Cell Electric Vehicles (FCEVs), and Extended-Range Electric Vehicles (EREVs). Among these, BEVs are leading the market due to their fully electric nature, which appeals to environmentally conscious consumers, supported by national purchase bonuses and falling battery prices. The increasing availability of charging infrastructure and advancements in battery technology have further bolstered the adoption of BEVs, with monthly market shares for BEVs in the high?teens range and PHEVs in the mid?single to high?single digits.

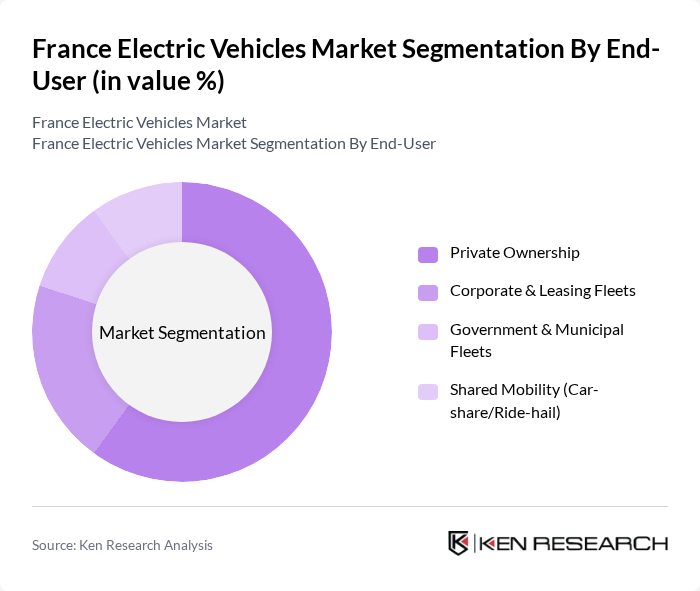

By End-User:The market is categorized into Private Ownership, Corporate & Leasing Fleets, Government & Municipal Fleets, and Shared Mobility (Car-share/Ride-hail). Private ownership is currently the dominant segment, driven by individual consumers' increasing interest in sustainable transportation and national eco?bonus incentives for eligible models. The rise in urbanization and the availability of government incentives have also contributed to the growth of this segment, while corporate fleet electrification mandates further support fleet uptake.

The France Electric Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Renault Group, Stellantis (Peugeot, Citroën, DS Automobiles, Opel/Vauxhall), Tesla, Inc., Volkswagen Group (Volkswagen, Audi, Škoda, Cupra), BMW Group (BMW, MINI), Mercedes-Benz Group AG, Hyundai Motor Company, Kia Corporation, Nissan Motor Co., Ltd., BYD Company Limited, Polestar Automotive Holding UK PLC, MG Motor (SAIC Motor Corporation Limited), Toyota Motor Corporation, Volvo Car Corporation, Dacia (Renault Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle market in France appears promising, driven by ongoing technological advancements and supportive government policies. As battery technology continues to improve, the cost of EVs is expected to decrease, making them more accessible to consumers. Additionally, the expansion of charging infrastructure, particularly in rural areas, will alleviate range anxiety. The integration of smart technologies and increased focus on sustainability will further enhance the attractiveness of electric vehicles, positioning them as a viable alternative to traditional vehicles in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Fuel Cell Electric Vehicles (FCEVs) Extended-Range Electric Vehicles (EREVs) |

| By End-User | Private Ownership Corporate & Leasing Fleets Government & Municipal Fleets Shared Mobility (Car-share/Ride-hail) |

| By Vehicle Type | Passenger Cars (Hatchback/Sedan/SUV/MUV) Light Commercial Vehicles (LCV) Buses (City & Inter-city) Heavy Trucks |

| By Charging Type | AC ?22 kW (Normal) DC 22–150 kW (Fast) DC >150 kW (Ultra-fast) Depot/Workplace Charging |

| By Battery Capacity | <50 kWh –75 kWh >75 kWh NMC vs LFP Chemistries |

| By Price Band | Entry (?€30,000) Mid-Range (€30,001–€55,000) Premium (>€55,000) Luxury (>€90,000) |

| By Sales Channel | Dealerships (Franchised/Agency) Direct-to-Consumer (D2C) Online Marketplaces Corporate Leasing & Subscription |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer EV Adoption | 150 | Current EV Owners, Potential Buyers |

| Charging Infrastructure Providers | 100 | Business Development Managers, Operations Directors |

| Automotive Manufacturers | 80 | Product Managers, Marketing Executives |

| Government Policy Makers | 50 | Regulatory Affairs Specialists, Environmental Policy Analysts |

| Fleet Operators | 70 | Fleet Managers, Sustainability Officers |

The France Electric Vehicles Market is valued at approximately USD 3031 billion, reflecting significant growth driven by increased EV sales, government incentives, and advancements in battery technology. Electric vehicles now account for about one-quarter of new registrations in the country.