Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0048

Pages:96

Published On:December 2025

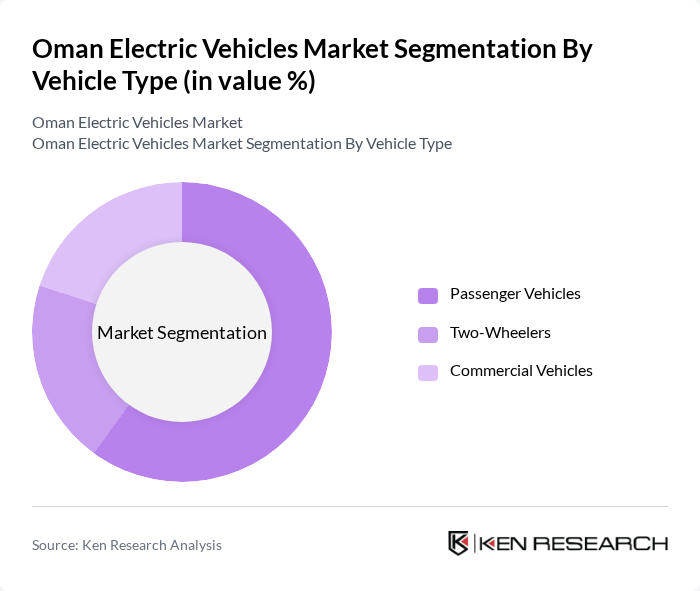

By Vehicle Type:The vehicle type segmentation includes passenger vehicles, two-wheelers, and commercial vehicles. Among these, passenger vehicles dominate the market due to increasing consumer preference for personal electric mobility solutions, driven by rising environmental awareness and government incentives. The growing availability of models and improved charging infrastructure further support this trend, making passenger vehicles the leading segment in the Oman Electric Vehicles Market.

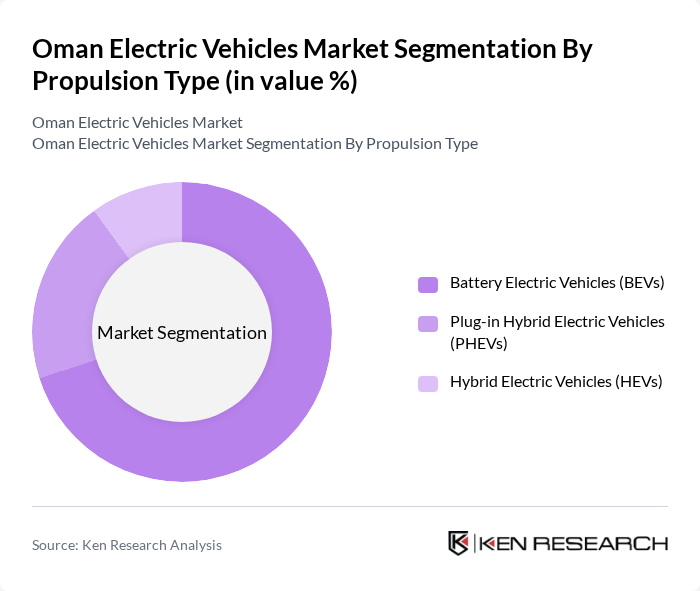

By Propulsion Type:The propulsion type segmentation consists of battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and hybrid electric vehicles (HEVs). Battery electric vehicles are leading this segment, primarily due to advancements in battery technology, which have enhanced their range and performance. The increasing availability of charging infrastructure and government incentives for fully electric vehicles further solidify BEVs as the dominant propulsion type in the market.

The Oman Electric Vehicles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mays Motors (Oman), Oman Oil Marketing Company, Renault Group, Tesla, BMW Group, Hyundai Motor Company, Nissan Motor Corporation, Kia Corporation, Toyota Motor Corporation, General Motors (Chevrolet), BYD Auto, MG Motor, Audi AG, Porsche Middle East & Africa, and Volvo Car Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman electric vehicles market appears promising, driven by government initiatives and increasing consumer awareness. The National Green Mobility Company (NGMC) plans to distribute 500 EVs in the coming years and establish a National Research and Innovation Centre by the end of the decade. Additionally, Oman aims to sell only zero-emission vehicles in the future, aligning with global sustainability goals. These strategic moves indicate a robust commitment to developing a comprehensive EV ecosystem, fostering innovation, and enhancing infrastructure to support electric mobility.

| Segment | Sub-Segments |

|---|---|

| By Vehicle Type | Passenger Vehicles Two-Wheelers Commercial Vehicles |

| By Propulsion Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) |

| By End-User | Private Individual Owners Commercial Fleet Operators Government & Public-Sector Fleets Shared Mobility Providers |

| By Battery Capacity | Up to 50 kWh –75 kWh Above 75 kWh |

| By Range | Up to 150 km –300 km Above 300 km |

| By Region | North Oman South Oman Central Oman |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness and Adoption | 150 | General Public, Potential EV Buyers |

| Industry Stakeholder Insights | 100 | Automotive Manufacturers, Distributors |

| Government Policy Impact | 80 | Policy Makers, Regulatory Authorities |

| Charging Infrastructure Development | 70 | Infrastructure Providers, Energy Sector Experts |

| Environmental Impact Perception | 60 | Environmental NGOs, Sustainability Advocates |

The Oman Electric Vehicles Market is valued at approximately USD 0.65 billion, reflecting significant growth driven by factors such as decreasing battery prices, strategic partnerships, and government policies aligned with the nation's net-zero vision.