Region:Asia

Author(s):Shubham

Product Code:KRAB0711

Pages:84

Published On:August 2025

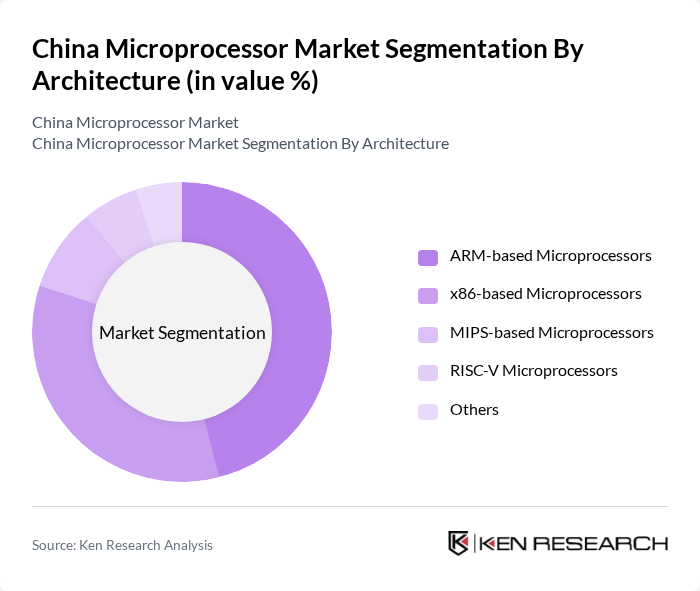

By Architecture:The architecture of microprocessors plays a crucial role in determining their performance and application. The dominant architectures include ARM-based, x86-based, MIPS-based, RISC-V, and others. ARM-based microprocessors are particularly popular due to their energy efficiency and widespread use in mobile devices. x86-based processors are favored in personal computers and servers for their high performance. MIPS and RISC-V architectures are gaining traction in specialized applications, particularly in embedded systems and IoT devices .

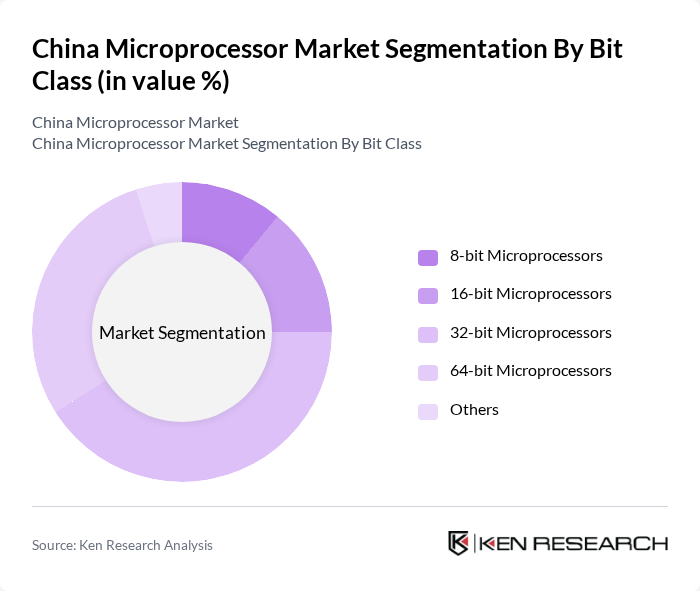

By Bit Class:The bit class of microprocessors is another significant segmentation, including 8-bit, 16-bit, 32-bit, 64-bit, and others. The 32-bit and 64-bit microprocessors dominate the market due to their ability to handle complex computations and larger memory addressing, making them suitable for a wide range of applications from consumer electronics to data centers. The 8-bit and 16-bit microprocessors are primarily used in simpler applications, such as embedded systems and basic consumer devices .

The China Microprocessor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Huawei Technologies Co., Ltd., ZTE Corporation, Advanced Micro Devices, Inc. (AMD), Intel Corporation, Qualcomm Incorporated, MediaTek Inc., NXP Semiconductors N.V., Texas Instruments Incorporated, STMicroelectronics N.V., Renesas Electronics Corporation, Rockchip Electronics Co., Ltd., Allwinner Technology Co., Ltd., Unisoc Technologies Co., Ltd., Loongson Technology Corporation Limited, Shanghai Zhaoxin Semiconductor Co., Ltd., Semiconductor Manufacturing International Corporation (SMIC), Ingenic Semiconductor Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microprocessor market in China appears promising, driven by technological advancements and government support. As AI, IoT, and 5G technologies continue to evolve, the demand for specialized microprocessors will increase. Additionally, the government's commitment to enhancing semiconductor production capabilities will likely lead to a more resilient supply chain. Companies that focus on energy-efficient designs and customizable solutions will be well-positioned to capitalize on emerging trends and meet the diverse needs of various industries.

| Segment | Sub-Segments |

|---|---|

| By Architecture | ARM-based Microprocessors x86-based Microprocessors MIPS-based Microprocessors RISC-V Microprocessors Others |

| By Bit Class | bit Microprocessors bit Microprocessors bit Microprocessors bit Microprocessors Others |

| By End-User | Consumer Electronics Automotive Industrial Automation Telecommunications Healthcare Aerospace and Defense Data Centers & Cloud Computing Others |

| By Application | Embedded Systems High-Performance Computing Networking Equipment Consumer Devices Smart Home Devices IoT Devices Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Value-Added Resellers (VARs) Others |

| By Price Range | Low-End Microprocessors Mid-Range Microprocessors High-End Microprocessors Others |

| By Component | Hardware Software Services Others |

| By Technology Node | nm and Below nm–14nm nm–28nm nm and Above Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 100 | Product Development Managers, Supply Chain Analysts |

| Automotive Microprocessor Suppliers | 60 | Engineering Managers, Procurement Specialists |

| Industrial Automation Firms | 50 | Operations Directors, Technology Officers |

| Research Institutions in Semiconductor Technology | 40 | Research Scientists, Academic Professors |

| Government Regulatory Bodies | 40 | Policy Makers, Industry Regulators |

The China Microprocessor Market is valued at approximately USD 29 billion, driven by the increasing demand for advanced computing solutions across various sectors, including consumer electronics, automotive, and industrial automation.