Region:Global

Author(s):Geetanshi

Product Code:KRAA2731

Pages:81

Published On:August 2025

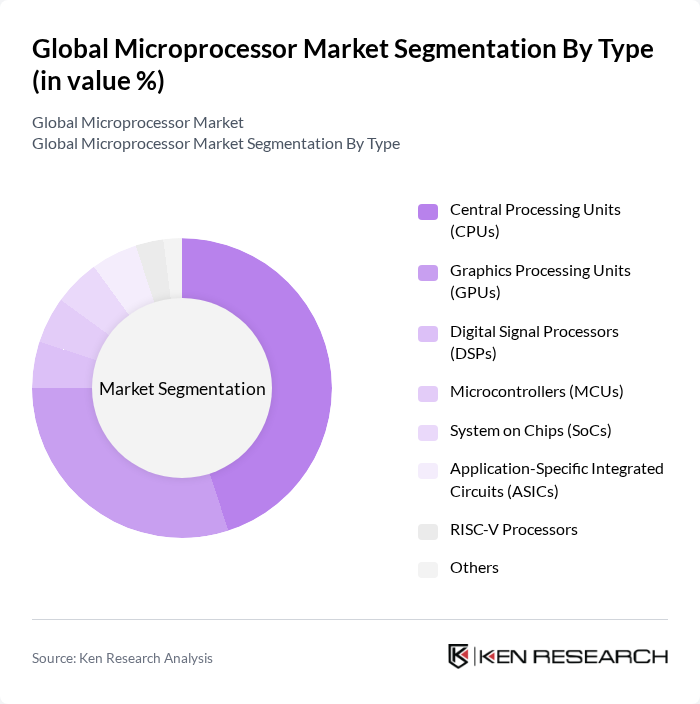

By Type:The microprocessor market is segmented into various types, including Central Processing Units (CPUs), Graphics Processing Units (GPUs), Digital Signal Processors (DSPs), Microcontrollers (MCUs), System on Chips (SoCs), Application-Specific Integrated Circuits (ASICs), RISC-V Processors, and Others. Among these, CPUs and GPUs are the most dominant segments due to their critical roles in computing and graphics processing, respectively. The increasing demand for high-performance computing, artificial intelligence, and gaming applications has significantly boosted the market for these types. GPUs, in particular, are experiencing rapid growth driven by AI and parallel-computing workloads, while RISC-V processors are gaining traction due to their customization flexibility .

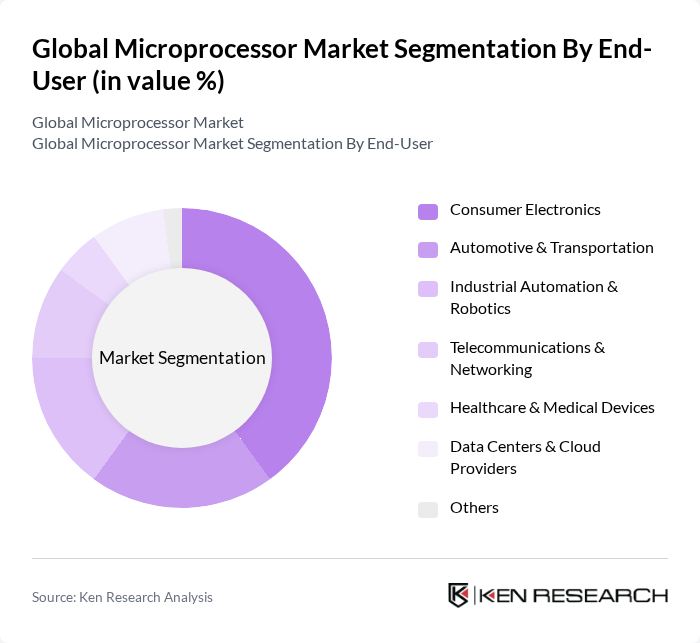

By End-User:The end-user segmentation of the microprocessor market includes Consumer Electronics, Automotive & Transportation, Industrial Automation & Robotics, Telecommunications & Networking, Healthcare & Medical Devices, Data Centers & Cloud Providers, and Others. The Consumer Electronics segment leads the market, driven by the increasing adoption of smart devices and the demand for enhanced processing capabilities in smartphones, tablets, and smart home devices. Automotive and transportation applications are also growing rapidly due to the integration of advanced driver-assistance systems and electrification trends .

The Global Microprocessor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Intel Corporation, Advanced Micro Devices, Inc. (AMD), NVIDIA Corporation, Qualcomm Incorporated, Arm Holdings plc, Texas Instruments Incorporated, Broadcom Inc., MediaTek Inc., IBM Corporation, STMicroelectronics N.V., Micron Technology, Inc., Infineon Technologies AG, Renesas Electronics Corporation, ON Semiconductor Corporation, Samsung Electronics Co., Ltd., Apple Inc., NXP Semiconductors N.V., Marvell Technology, Inc., Realtek Semiconductor Corp., VIA Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the microprocessor market is poised for transformative growth, driven by advancements in technology and increasing demand for high-performance solutions. As industries adopt AI, machine learning, and IoT applications, the need for specialized microprocessors will intensify. Additionally, the shift towards energy-efficient designs and the integration of AI capabilities into processors will shape product development. Companies that can innovate rapidly while addressing supply chain challenges will likely emerge as leaders in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Central Processing Units (CPUs) Graphics Processing Units (GPUs) Digital Signal Processors (DSPs) Microcontrollers (MCUs) System on Chips (SoCs) Application-Specific Integrated Circuits (ASICs) RISC-V Processors Others |

| By End-User | Consumer Electronics Automotive & Transportation Industrial Automation & Robotics Telecommunications & Networking Healthcare & Medical Devices Data Centers & Cloud Providers Others |

| By Application | Embedded Systems High-Performance Computing Mobile Devices & Smartphones Data Centers & Servers Gaming & Graphics Edge Computing & IoT Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Value-Added Resellers (VARs) Others |

| By Price Range | Low-End Microprocessors Mid-Range Microprocessors High-End Microprocessors Others |

| By Component | Hardware Firmware & Software Services |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, UK, France, Rest of Europe) Asia-Pacific (China, Japan, South Korea, Taiwan, India, Rest of APAC) Latin America Middle East & Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Manufacturers | 120 | Product Development Managers, Supply Chain Analysts |

| Automotive Microprocessor Applications | 90 | Engineering Managers, Procurement Specialists |

| Industrial Automation Solutions | 70 | Operations Managers, Technical Directors |

| Telecommunications Equipment Providers | 60 | Network Engineers, Product Managers |

| Embedded Systems Developers | 50 | Software Engineers, System Architects |

The Global Microprocessor Market is valued at approximately USD 112 billion, driven by the increasing demand for advanced computing solutions across various sectors, including consumer electronics, automotive, and data centers.