Region:Asia

Author(s):Shubham

Product Code:KRAA1836

Pages:81

Published On:August 2025

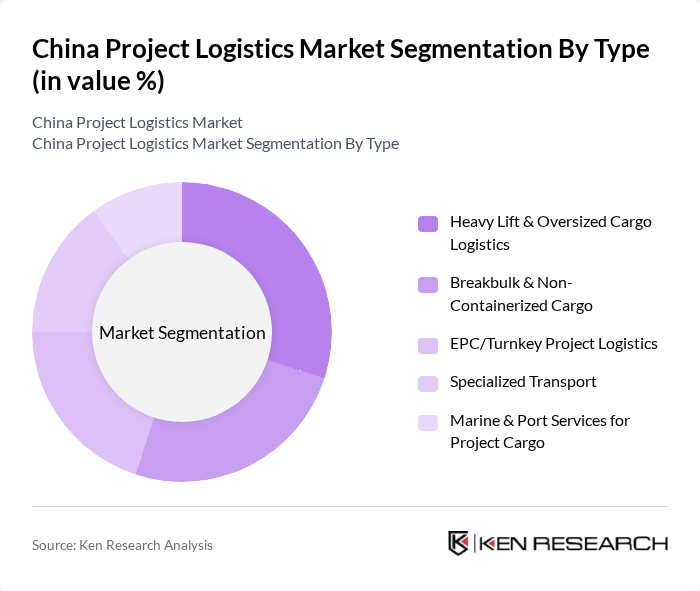

By Type:The market is segmented into various types, including Heavy Lift & Oversized Cargo Logistics, Breakbulk & Non-Containerized Cargo, EPC/Turnkey Project Logistics, Specialized Transport, and Marine & Port Services for Project Cargo. Each of these subsegments plays a crucial role in addressing the diverse needs of project logistics, with Heavy Lift & Oversized Cargo Logistics being particularly significant due to the increasing scale of construction, energy, and industrial projects and the need for multimodal coordination and engineered lifting/transport solutions.

By End-User:The end-user segmentation includes Oil & Gas and Petrochemicals, Power Generation, Renewable Energy, Construction & Infrastructure, Mining & Quarrying, and Industrial Manufacturing. The Construction & Infrastructure segment is currently leading the market due to ongoing urbanization, transport corridor build-out, and large-scale industrial and energy projects that require integrated project logistics, heavy-lift engineering, and multimodal transport.

The China Project Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sinotrans Limited, China COSCO Shipping Corporation, COSCO Shipping Specialized Carriers Co., Ltd., China Merchants Logistics, Kerry Logistics Network, SF Supply Chain (SF Holding), DSV, Kuehne+Nagel, CEVA Logistics, DB Schenker, Bolloré Logistics (now part of CMA CGM Air Cargo & CEVA), Yusen Logistics, Expeditors, GEODIS, and Rhenus Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the China project logistics market appears promising, driven by ongoing infrastructure investments and the expansion of renewable energy projects. As the government continues to prioritize sustainable development, logistics providers will need to adapt to new technologies and practices. The integration of automation and AI in logistics operations will enhance efficiency, while the demand for real-time tracking solutions will grow, ensuring transparency and reliability in supply chains. Companies that embrace these trends will likely gain a competitive edge in the evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy Lift & Oversized Cargo Logistics Breakbulk & Non-Containerized Cargo EPC/Turnkey Project Logistics Specialized Transport (modular trailers, self-propelled modular transporters) Marine & Port Services for Project Cargo |

| By End-User | Oil & Gas and Petrochemicals Power Generation (thermal, hydro, nuclear) Renewable Energy (wind, solar) Construction & Infrastructure (bridges, metros, airports) Mining & Quarrying Industrial Manufacturing (heavy machinery, steel, shipbuilding) |

| By Service Type | Transportation (road, rail, barge, coastal shipping) Project Freight Forwarding Customs Compliance & Permit Management Warehousing, Staging & Laydown Yards Engineering, Route Survey & Project Management Value-Added Services (packaging, lifting, rigging) |

| By Mode of Transport | Road (heavy-haul, multi-axle) Rail (special wagons) Air (charters for out-of-gauge) Sea (breakbulk, Ro-Ro, heavy-lift vessels) Inland Waterways & Barge |

| By Geographic Scope | Domestic Projects Cross-Border/Belt and Road Projects International Outbound Projects Remote/Challenging Terrain Projects (western provinces) |

| By Contract Type | Lump Sum Turnkey (LSTK) EPC/EPCM Contracts Time & Materials Framework/Rate Agreements |

| By Project Size | Small (up to 100 tons OOG) Medium (100–1,000 tons OOG) Large (1,000–10,000 tons OOG) Mega (>10,000 tons OOG) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Logistics | 100 | Project Managers, Logistics Coordinators |

| Manufacturing Supply Chain Logistics | 80 | Supply Chain Managers, Operations Directors |

| Energy Sector Logistics Management | 70 | Logistics Engineers, Procurement Managers |

| Pharmaceutical Distribution Logistics | 60 | Regulatory Affairs Managers, Distribution Supervisors |

| Retail Logistics Operations | 90 | Warehouse Managers, Inventory Control Specialists |

The China Project Logistics Market is valued at approximately USD 8 billion, reflecting specialized logistics for heavy-lift, breakbulk, and EPC movements. This market is distinct from the broader logistics sector and is driven by infrastructure and energy project expansions.