Region:Global

Author(s):Geetanshi

Product Code:KRAA2780

Pages:92

Published On:August 2025

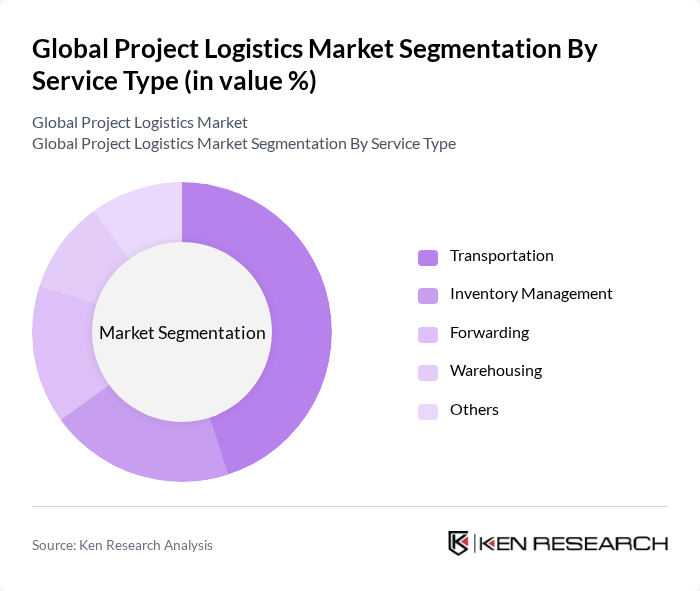

By Service Type:The service type segmentation includes various categories such as transportation, inventory management, forwarding, warehousing, and others. Among these, transportation is the leading sub-segment, driven by the increasing need for efficient movement of goods across borders. The rise in e-commerce, global trade, and the need for specialized handling of oversized and heavy cargo have further amplified the demand for reliable transportation services, making it a critical component of project logistics .

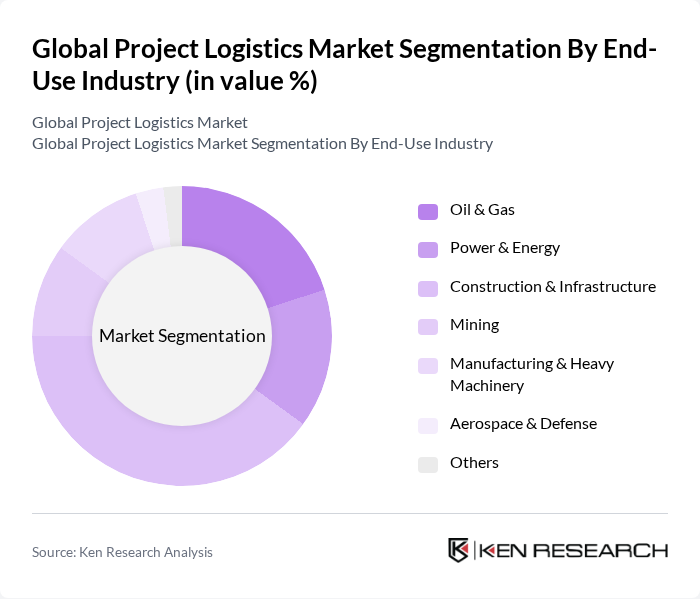

By End-Use Industry:The end-use industry segmentation encompasses oil & gas, power & energy, construction & infrastructure, mining, manufacturing & heavy machinery, aerospace & defense, and others. The construction & infrastructure sector is the dominant sub-segment, fueled by ongoing urbanization and government investments in infrastructure projects. This sector's growth is critical as it requires extensive logistics support for the timely delivery of materials and equipment, especially for large-scale and complex construction ventures .

The Global Project Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, C.H. Robinson, XPO Logistics, GEODIS, DSV, Agility Logistics, CEVA Logistics, Expeditors International, Toll Group, SNCF Logistics, ZIM Integrated Shipping Services, A.P. Moller-Maersk, TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the project logistics market appears promising, driven by ongoing infrastructure investments and technological advancements. As countries prioritize sustainable development, logistics providers will increasingly adopt green practices and innovative technologies. The integration of automation and digital solutions will enhance efficiency and transparency in supply chains. Additionally, the focus on end-to-end visibility will enable companies to respond swiftly to market changes, ensuring resilience and adaptability in a dynamic global landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Transportation Inventory Management Forwarding Warehousing Others |

| By End-Use Industry | Oil & Gas Power & Energy Construction & Infrastructure Mining Manufacturing & Heavy Machinery Aerospace & Defense Others |

| By Transportation Mode | Road Rail Air Sea Multimodal |

| By Geographic Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects Mega Projects |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts Time and Materials Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Logistics | 100 | Project Managers, Logistics Coordinators |

| Oil & Gas Supply Chain Management | 80 | Supply Chain Directors, Operations Managers |

| Renewable Energy Project Logistics | 60 | Logistics Specialists, Procurement Managers |

| Heavy Equipment Transport | 50 | Fleet Managers, Project Engineers |

| Infrastructure Development Logistics | 70 | Construction Managers, Site Supervisors |

The Global Project Logistics Market is valued at approximately USD 440 billion, driven by the increasing demand for efficient supply chain solutions, global trade expansion, and infrastructure projects across various sectors.