Region:Middle East

Author(s):Rebecca

Product Code:KRAC8379

Pages:90

Published On:November 2025

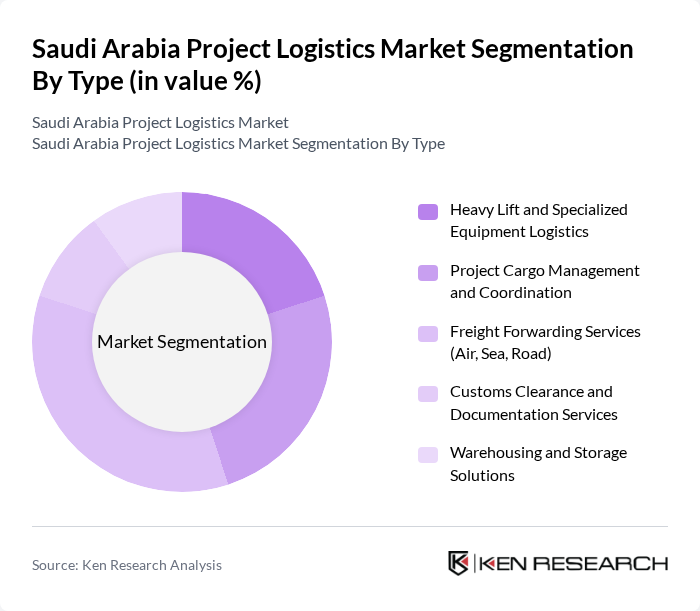

By Type:The market is segmented into various types, including Heavy Lift and Specialized Equipment Logistics, Project Cargo Management and Coordination, Freight Forwarding Services (Air, Sea, Road), Customs Clearance and Documentation Services, and Warehousing and Storage Solutions. Among these, Freight Forwarding Services are particularly dominant due to the increasing volume of international trade and the need for efficient transportation solutions. The demand for specialized logistics services is also rising, driven by the complexity of project requirements in sectors like construction and energy. Transportation services remain the top revenue generator, while warehousing and distribution are the fastest-growing segments, reflecting the sector's focus on supply chain efficiency and value-added services .

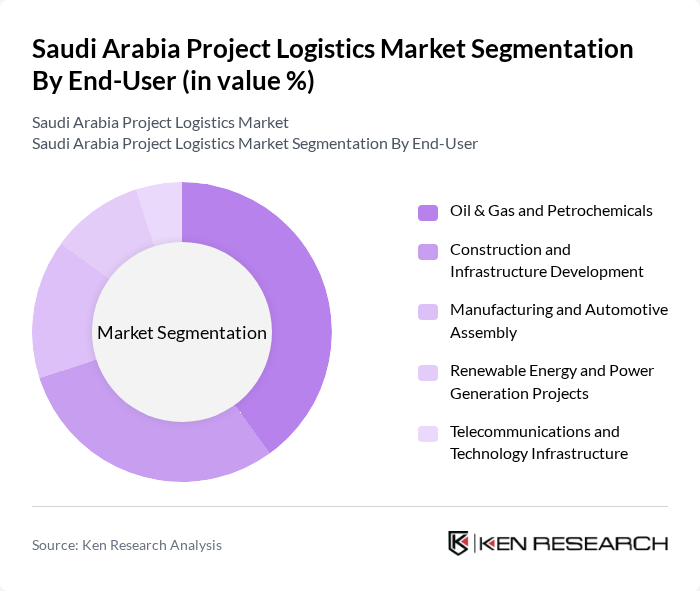

By End-User:The end-user segmentation includes Oil & Gas and Petrochemicals, Construction and Infrastructure Development, Manufacturing and Automotive Assembly, Renewable Energy and Power Generation Projects, and Telecommunications and Technology Infrastructure. The Oil & Gas sector is the leading end-user, driven by ongoing investments in energy projects and the need for specialized logistics services to handle complex cargo. The construction sector is also significant, fueled by large-scale infrastructure projects under Vision 2030. E-commerce, manufacturing, and renewable energy are emerging as important contributors to logistics demand, reflecting the Kingdom’s economic diversification strategy .

The Saudi Arabia Project Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DB Schenker, Kuehne + Nagel, Agility Logistics, DHL Supply Chain, CEVA Logistics, GAC Group, Panalpina (Now Part of DSV), Al-Futtaim Logistics, Bahri (Saudi National Shipping Company), Aramex, Saudi Aramco Logistics (Aramco and DHL Joint Venture), Agility Project Logistics, Al-Muhaidib Group, Al-Jazira Group, Al-Rajhi Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia project logistics market appears promising, driven by ongoing infrastructure investments and technological advancements. The integration of AI and IoT in logistics operations is expected to enhance efficiency and reduce costs. Additionally, the government's commitment to sustainability will likely lead to increased adoption of green logistics practices. As the market evolves, logistics providers must adapt to these trends to remain competitive and capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Type | Heavy Lift and Specialized Equipment Logistics Project Cargo Management and Coordination Freight Forwarding Services (Air, Sea, Road) Customs Clearance and Documentation Services Warehousing and Storage Solutions |

| By End-User | Oil & Gas and Petrochemicals Construction and Infrastructure Development Manufacturing and Automotive Assembly Renewable Energy and Power Generation Projects Telecommunications and Technology Infrastructure |

| By Region | Central Region (Riyadh - 45% Market Share) Eastern Region (Industrial and Petrochemical Hub) Western Region (Jeddah and Red Sea Global) Southern Region |

| By Service Type | Transportation Services (59.29% Market Share) Warehousing and Distribution Services Value-Added Logistics Services Logistics Consulting and Project Management Customs and Compliance Services |

| By Mode of Transport | Road Transport (60% Market Share) Sea Transport (Port-Based Project Cargo) Air Transport (Time-Critical Shipments) Rail Transport (Emerging for Heavy Cargo) Multi-Modal Solutions |

| By Project Size | Small Scale Projects (Under $50 Million) Medium Scale Projects ($50-500 Million) Large Scale Projects ($500 Million - $5 Billion) Mega Projects (Over $5 Billion - NEOM, Red Sea Global) |

| By Policy Support | Government Subsidies for Logistics Infrastructure Tax Incentives and Free Zone Benefits Regulatory Support and Streamlined Customs Public-Private Partnership Opportunities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 60 | Logistics Coordinators, Supply Chain Managers |

| Manufacturing Supply Chain | 50 | Production Managers, Procurement Specialists |

| E-commerce Fulfillment Strategies | 45 | eCommerce Operations Managers, Logistics Analysts |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Distribution Supervisors |

| Freight Forwarding Services | 42 | Freight Managers, Customs Compliance Officers |

The Saudi Arabia Project Logistics Market is valued at approximately USD 28 billion, driven by significant infrastructure projects and initiatives under Vision 2030, which aim to diversify the economy and enhance logistics capabilities across various sectors.