Region:Asia

Author(s):Shubham

Product Code:KRAC0723

Pages:93

Published On:August 2025

By Type:The market is segmented into isotonic, hypertonic, hypotonic, electrolyte-enhanced, traditional, functional, and low/no-sugar sports drinks. Each type serves distinct hydration and performance needs. Consistent with industry practice in China, isotonic formats and electrolyte-enhanced variants are widely adopted for rapid fluid and electrolyte replacement during activity, while low/no-sugar and functional (added vitamins, amino acids) offerings are gaining traction with health-conscious consumers and casual users seeking cleaner labels .

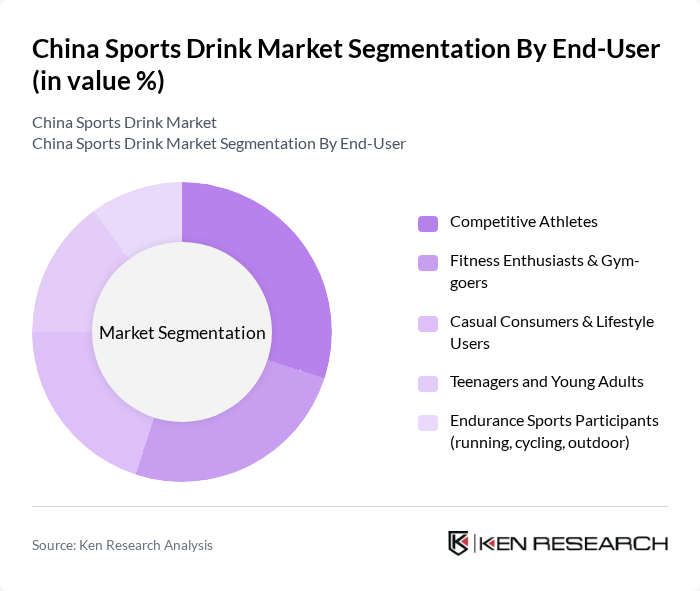

By End-User:The end-user segmentation includes competitive athletes, fitness enthusiasts, casual consumers, teenagers, and endurance sports participants. Competitive athletes remain important users; however, growth increasingly comes from fitness enthusiasts and lifestyle users influenced by wellness trends, convenience of ready-to-drink products, and growing interest in pre- and post-workout hydration .

The China Sports Drink Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Coca-Cola Company (Powerade; Aquarius), PepsiCo, Inc. (Gatorade), Nongfu Spring Co., Ltd. (Nongfu Sports/functional hydration), Hangzhou Wahaha Group Co., Ltd. (Wahaha sports drink lines), Tingyi (Cayman Islands) Holding Corp. (Master Kong sports drinks), Uni-President Enterprises Corporation (Uni-President sports/isotonic), Suntory Holdings Limited (Lucozade Sport; local partnerships), Danone S.A. (Mizone), Otsuka Pharmaceutical Co., Ltd. (Pocari Sweat), Genki Forest (Yuanqi Senlin) – sports/isotonic extensions, Eastroc Beverage Group Co., Ltd. (Dongpeng Special Drink – sports extensions), Shenzhen Eastroc Beverage Co., Ltd. (regional distribution for hydration SKUs), C'estbon Beverage Co., Ltd. (China Resources C'estbon – hydration products), Hebei Yangyuan Zhihui Beverage Co., Ltd. (functional beverage entries), Red Bull Vitamin Drink Co., Ltd. (China) – isotonic/rehydration adjacencies contribute to innovation, geographic expansion, and service delivery in this space .

The future of the China sports drink market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, brands are likely to innovate with functional beverages that cater to specific dietary needs. Additionally, the integration of digital marketing strategies will enhance brand visibility and consumer engagement, particularly among younger demographics. The focus on sustainability will also shape product development, as companies strive to meet eco-friendly standards and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Isotonic Sports Drinks Hypertonic Sports Drinks Hypotonic Sports Drinks Electrolyte-Enhanced Sports Drinks Traditional Sports Drinks Functional Sports Drinks (with added vitamins, amino acids, or herbal extracts) Low/No-Sugar Sports Drinks |

| By End-User | Competitive Athletes Fitness Enthusiasts & Gym-goers Casual Consumers & Lifestyle Users Teenagers and Young Adults Endurance Sports Participants (running, cycling, outdoor) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail (e-commerce and quick commerce) Gyms, Fitness Centers & Sports Venues Vending Machines & Other On-the-go Channels |

| By Packaging Type | PET Bottles Aluminum Cans Pouches Aseptic Cartons (Tetra Pak) Multipacks & Bulk Packs |

| By Price Range | Economy Mid-Range Premium Professional/Performance Tier |

| By Flavor | Citrus (lemon, lime, orange) Berry (strawberry, blueberry, mixed berry) Tropical (mango, pineapple, lychee) Traditional/Original (non-fruit) Tea/Herbal & Functional Flavors |

| By Brand Positioning | Mainstream/Legacy Brands Performance & Professional Sports Lines Natural/Low-Sugar & Clean-Label Lines Imported/International Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Sports Drinks | 120 | Store Managers, Beverage Category Buyers |

| Consumer Preferences in Sports Drinks | 140 | Fitness Enthusiasts, Recreational Athletes |

| Health and Nutrition Insights | 100 | Nutritionists, Dietitians |

| Market Trends in Sports Beverage Consumption | 110 | Market Analysts, Industry Experts |

| Brand Loyalty and Marketing Effectiveness | 80 | Marketing Managers, Brand Strategists |

The China Sports Drink Market is valued at approximately USD 3 billion, reflecting steady growth driven by increased participation in fitness and organized sports, as well as a broader consumer adoption of functional hydration beverages.