Region:Global

Author(s):Shubham

Product Code:KRAC0857

Pages:95

Published On:August 2025

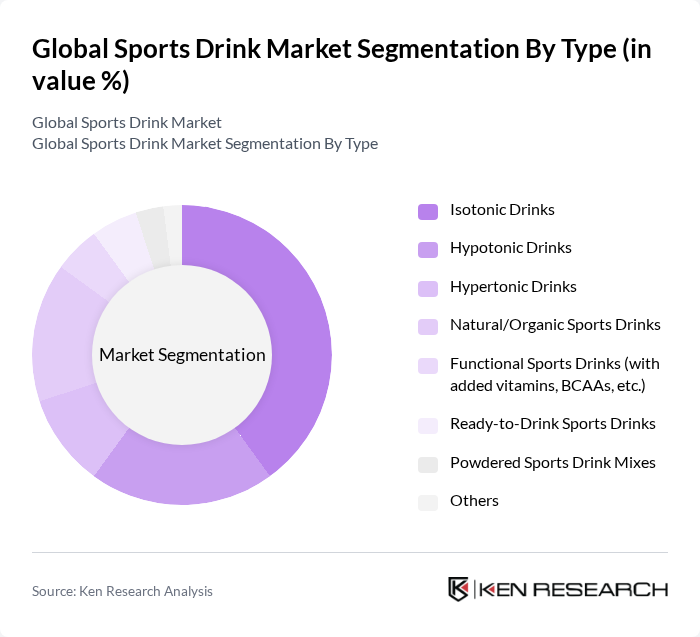

By Type:The market is segmented into various types of sports drinks, including isotonic, hypotonic, hypertonic, natural/organic, functional, ready-to-drink, powdered mixes, and others. Among these, isotonic drinks are the most popular due to their balanced electrolyte content, making them ideal for athletes and fitness enthusiasts. Hypotonic drinks are gaining traction among those seeking quick hydration without excessive calories, while natural and organic options are increasingly favored by health-conscious consumers. Functional sports drinks with added vitamins, BCAAs, and adaptogens are also expanding their market share, driven by demand for enhanced recovery and endurance support.

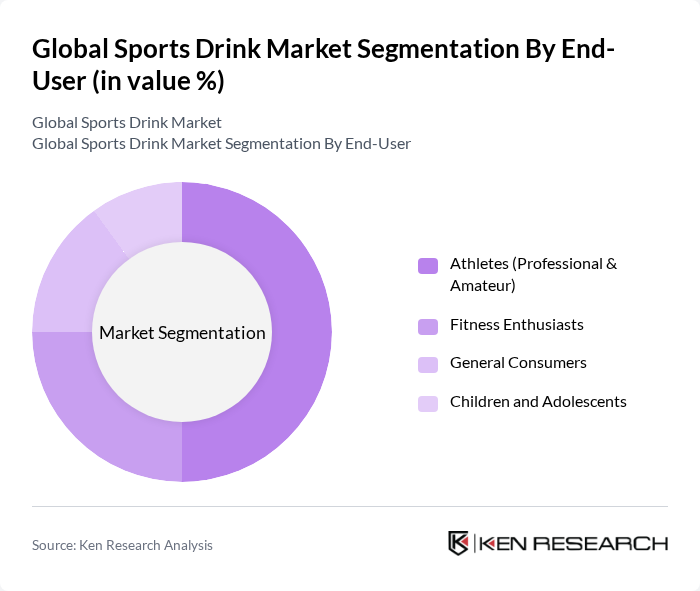

By End-User:The end-user segmentation includes athletes (both professional and amateur), fitness enthusiasts, general consumers, and children and adolescents. Athletes represent the largest segment, driven by their need for optimal hydration and recovery solutions. Fitness enthusiasts are increasingly turning to sports drinks to enhance their workouts, while general consumers are drawn to these products for everyday hydration. The children and adolescents segment is growing as parents seek healthier beverage options for their kids. The market is also seeing increased adoption among casual exercisers and individuals seeking convenient hydration solutions for busy lifestyles.

The Global Sports Drink Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gatorade (PepsiCo, Inc.), Powerade (The Coca-Cola Company), BodyArmor (The Coca-Cola Company), Lucozade (Suntory Beverage & Food Ltd.), Isostar (Ogeu Group), Pocari Sweat (Otsuka Pharmaceutical Co., Ltd.), Vitaminwater (The Coca-Cola Company), Nuun (Nuun Hydration, a Nestlé Health Science company), Cytomax (Cytosport, Inc., a division of PepsiCo), Accelerade (PacificHealth Laboratories, Inc.), Rehydrate (AdvoCare International, LLC), Ultima Replenisher (Ultima Health Products, Inc.), Sqwincher (Kent Precision Foods Group, Inc.), 4Life (4Life Research, LLC), Herbalife (Herbalife Nutrition Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sports drink market appears promising, driven by evolving consumer preferences and innovative product development. As health consciousness continues to rise, brands are likely to focus on creating functional beverages that cater to specific needs, such as hydration and recovery. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility to diverse product offerings, allowing brands to reach a broader audience. Sustainability initiatives will also play a crucial role, as consumers increasingly demand eco-friendly packaging and ethically sourced ingredients.

| Segment | Sub-Segments |

|---|---|

| By Type | Isotonic Drinks Hypotonic Drinks Hypertonic Drinks Natural/Organic Sports Drinks Functional Sports Drinks (with added vitamins, BCAAs, etc.) Ready-to-Drink Sports Drinks Powdered Sports Drink Mixes Others |

| By End-User | Athletes (Professional & Amateur) Fitness Enthusiasts General Consumers Children and Adolescents |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail/E-commerce Health and Fitness Clubs Specialty Stores |

| By Packaging Type | Bottles (PET, Glass) Cans Pouches Tetra Packs/Cartons |

| By Flavor | Citrus Berry Tropical Mixed Fruit Others |

| By Price Range | Premium Mid-Range Budget |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Sports Drinks | 150 | Store Managers, Beverage Category Buyers |

| Consumer Preferences in Sports Nutrition | 150 | Athletes, Fitness Enthusiasts, Health-Conscious Consumers |

| Distribution Channel Insights | 100 | Wholesalers, Distributors, E-commerce Managers |

| Market Trends in Sports Drink Consumption | 80 | Nutritionists, Fitness Trainers, Health Coaches |

| Brand Loyalty and Consumer Behavior | 120 | Regular Consumers, Brand Advocates, Casual Users |

The Global Sports Drink Market is valued at approximately USD 34 billion, reflecting a significant growth trend driven by increasing health consciousness, the rise of fitness culture, and the demand for effective hydration solutions among consumers.