Qatar Sports Drink Market Overview

- The Qatar Sports Drink Market is valued at USD 150 million, based on a five-year historical analysis. This growth is primarily driven by the increasing health consciousness among consumers, coupled with a rise in sports participation and fitness activities. The demand for hydration solutions, particularly in the hot climate of Qatar, has significantly contributed to the market's expansion.

- Key players in this market include Doha, Al Rayyan, and Al Wakrah, which dominate due to their high population density and active lifestyle culture. The presence of numerous sports events and fitness facilities in these cities further fuels the demand for sports drinks, making them central hubs for market activity.

- In 2023, the Qatari government implemented regulations to promote healthier beverage options, mandating that all sports drinks must contain a minimum percentage of electrolytes. This initiative aims to enhance public health and ensure that consumers have access to effective hydration solutions, thereby influencing product formulations in the market.

Qatar Sports Drink Market Segmentation

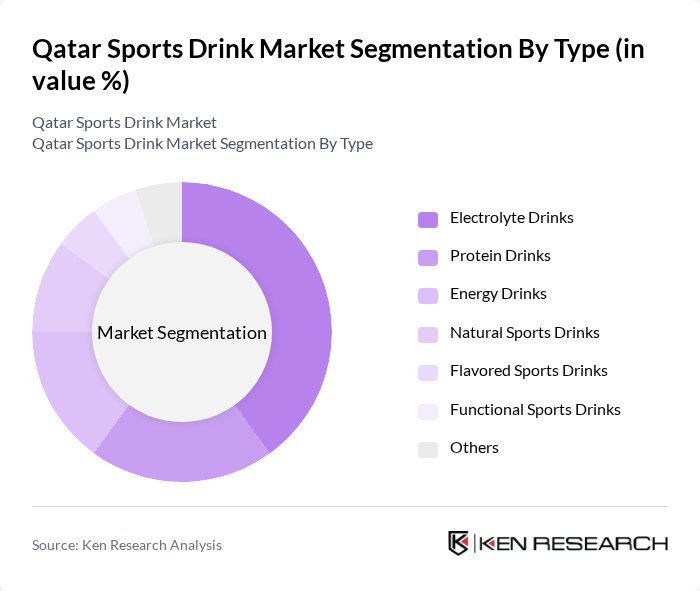

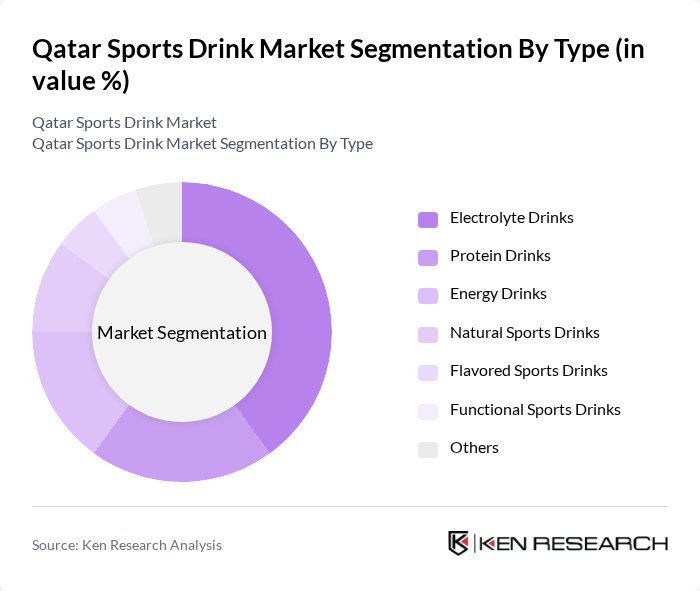

By Type:The sports drink market can be segmented into various types, including electrolyte drinks, protein drinks, energy drinks, natural sports drinks, flavored sports drinks, functional sports drinks, and others. Among these, electrolyte drinks are currently leading the market due to their essential role in hydration and replenishment of lost minerals during physical activities. The growing trend of fitness and sports participation has significantly increased the demand for these drinks, as consumers seek effective solutions to maintain their performance and health.

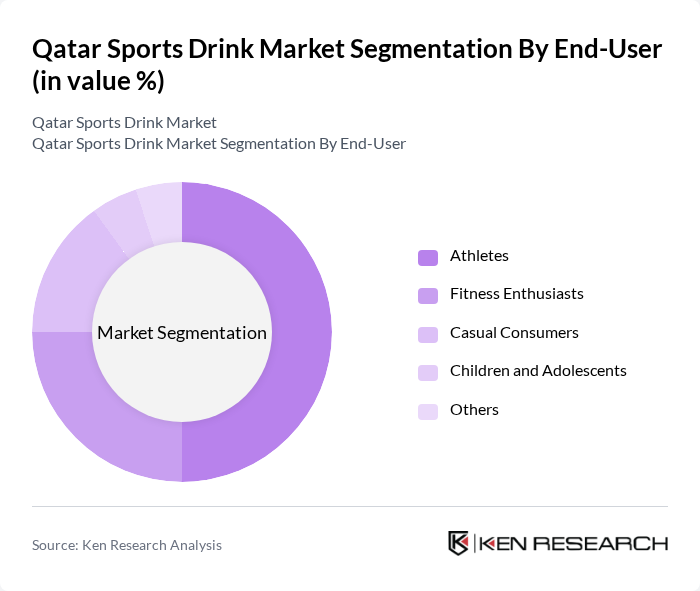

By End-User:The end-user segmentation includes athletes, fitness enthusiasts, casual consumers, children and adolescents, and others. Athletes represent the dominant segment, driven by their need for specialized hydration solutions to enhance performance and recovery. The increasing number of sports events and fitness programs in Qatar has led to a higher consumption of sports drinks among this group, as they seek products that support their rigorous training and competition schedules.

Qatar Sports Drink Market Competitive Landscape

The Qatar Sports Drink Market is characterized by a dynamic mix of regional and international players. Leading participants such as PepsiCo, Coca-Cola, Red Bull, Gatorade, Lucozade, Powerade, Isostar, 100Plus, Monster Beverage Corporation, BodyArmor, Vitaminwater, Propel, Nuun, Reign, Electrolyte contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Sports Drink Market Industry Analysis

Growth Drivers

- Increasing Health Consciousness Among Consumers:The health and wellness trend is significantly influencing the Qatar sports drink market, with a reported 60% of consumers prioritizing healthier beverage options. According to the Qatar National Health Strategy 2018-2022, the government aims to reduce obesity rates by 5% by 2024, driving demand for low-calorie and nutrient-rich sports drinks. This shift is supported by a growing awareness of the importance of hydration and nutrition in maintaining an active lifestyle.

- Rise in Sports Participation and Fitness Activities:The Qatar Sports Federation reported a 30% increase in registered athletes from 2020 to 2023, reflecting a growing interest in sports and fitness. This surge is further supported by government initiatives promoting physical activity, such as the Qatar National Sports Day. As more individuals engage in sports, the demand for sports drinks, which aid in hydration and recovery, is expected to rise, creating a robust market environment.

- Expansion of Retail Channels and E-commerce:The retail landscape in Qatar is evolving, with a 25% increase in the number of health-focused retail outlets and e-commerce platforms since 2021. The Qatar Chamber of Commerce reports that online sales of sports drinks have surged, driven by convenience and accessibility. This expansion allows brands to reach a broader audience, catering to the increasing consumer preference for purchasing health products online, thus enhancing market growth.

Market Challenges

- Intense Competition Among Existing Brands:The Qatar sports drink market is characterized by fierce competition, with over 15 established brands vying for market share. This saturation leads to aggressive pricing strategies and marketing campaigns, making it challenging for new entrants to gain traction. According to industry reports, the top five brands account for 70% of the market, creating barriers for smaller companies and limiting overall market growth potential.

- Regulatory Hurdles and Compliance Issues:Navigating the regulatory landscape in Qatar poses significant challenges for sports drink manufacturers. The Ministry of Public Health enforces strict labeling and safety regulations, which can delay product launches and increase operational costs. In future, 40% of new product applications faced compliance issues, highlighting the need for companies to invest in regulatory expertise to ensure adherence to local laws and standards.

Qatar Sports Drink Market Future Outlook

The Qatar sports drink market is poised for dynamic growth, driven by evolving consumer preferences and increasing health awareness. As the demand for innovative, functional beverages rises, brands are likely to focus on developing products that cater to specific health needs. Additionally, the integration of technology in marketing and distribution channels will enhance consumer engagement, while sustainability initiatives will shape product development. Overall, the market is expected to adapt to these trends, fostering a competitive and diverse landscape.

Market Opportunities

- Growing Demand for Organic and Natural Sports Drinks:With a 40% increase in consumer interest in organic products, there is a significant opportunity for brands to introduce natural sports drinks. This trend aligns with the global shift towards healthier, cleaner labels, allowing companies to capture a niche market segment that prioritizes organic ingredients and sustainability in their purchasing decisions.

- Collaborations with Fitness Influencers and Events:Partnering with fitness influencers and sponsoring local sports events can enhance brand visibility and credibility. In future, brands that engaged in influencer marketing saw a 20% increase in sales. By leveraging these collaborations, companies can effectively reach target demographics, driving consumer interest and expanding their market presence in Qatar.