Region:Asia

Author(s):Shubham

Product Code:KRAB0823

Pages:82

Published On:August 2025

By Type:The washing machine market can be segmented into various types, including front-loading, top-loading, washer-dryer combos, portable washing machines, commercial washing machines, smart washing machines, semi-automatic washing machines, fully automatic washing machines, and others. Among these, front-loading washing machines are gaining popularity due to their superior energy efficiency and cleaning performance. The integration of smart technologies such as IoT and AI is increasingly influencing consumer preferences, resulting in growing demand for smart washing machines that offer remote control, automation, and enhanced user experience.

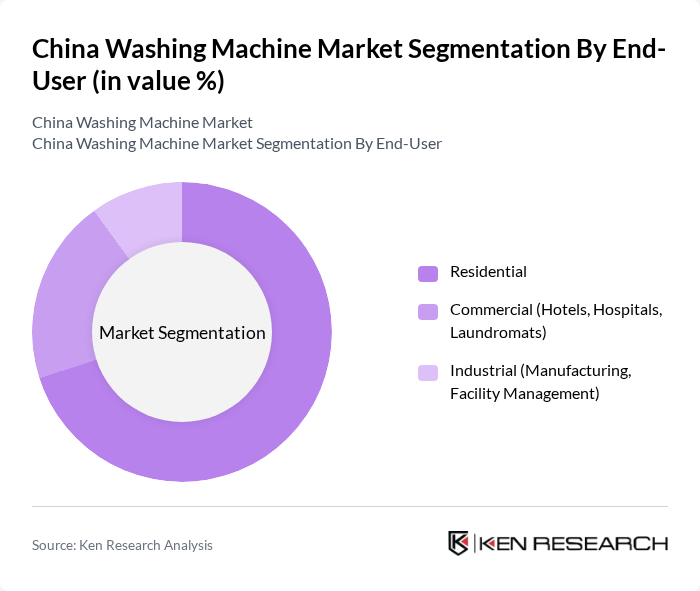

By End-User:The market can be segmented based on end-users into residential, commercial (including hotels, hospitals, and laundromats), and industrial (manufacturing and facility management). The residential segment dominates the market, driven by the increasing number of urban households and the modernization of home appliances. Commercial and industrial segments are also significant, requiring high-capacity machines and advanced features for efficient laundry operations in hospitality, healthcare, and manufacturing environments.

The China Washing Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Haier Group, Midea Group, Little Swan (a Midea Group brand), Whirlpool Corporation, Samsung Electronics, Gree Electric Appliances, Hisense Group, Panasonic Corporation, Electrolux AB, TCL Technology, BSH Hausgeräte GmbH (Bosch, Siemens), Sharp Corporation, AUX Group, Arçelik A.?., AEG (Electrolux) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the washing machine market in China appears promising, driven by technological innovations and evolving consumer preferences. As urbanization continues, the demand for smart and energy-efficient appliances is expected to rise significantly. Manufacturers are likely to focus on integrating IoT capabilities into their products, enhancing user experience. Additionally, the shift towards online sales channels will facilitate greater market penetration, allowing brands to reach a broader audience and adapt to changing shopping behaviors effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Front-Loading Washing Machines Top-Loading Washing Machines Washer-Dryer Combos Portable Washing Machines Commercial Washing Machines Smart Washing Machines Semi-Automatic Washing Machines Fully Automatic Washing Machines Others |

| By End-User | Residential Commercial (Hotels, Hospitals, Laundromats) Industrial (Manufacturing, Facility Management) |

| By Distribution Channel | Supermarkets and Hypermarkets Specialty Stores Online Retail Other Distribution Channels |

| By Price Range | Budget Mid-Range Premium |

| By Brand | Domestic Brands International Brands |

| By Features | Energy-Efficient Models Smart Technology Integration High Capacity Inverter Technology Quick Wash Function |

| By Application | Household Use Commercial Use Industrial Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Washing Machine Purchases | 150 | Homeowners, Apartment Dwellers |

| Retail Sales Insights | 90 | Store Managers, Sales Associates |

| Consumer Preferences and Trends | 120 | General Consumers, Tech-Savvy Buyers |

| Market Entry Strategies for New Brands | 80 | Marketing Managers, Brand Strategists |

| Impact of E-commerce on Washing Machine Sales | 70 | E-commerce Managers, Digital Marketing Specialists |

The China washing machine market is valued at approximately USD 17 billion, driven by factors such as urbanization, rising disposable incomes, and a growing preference for energy-efficient and smart appliances among consumers.