Region:Asia

Author(s):Rebecca

Product Code:KRAA2118

Pages:96

Published On:August 2025

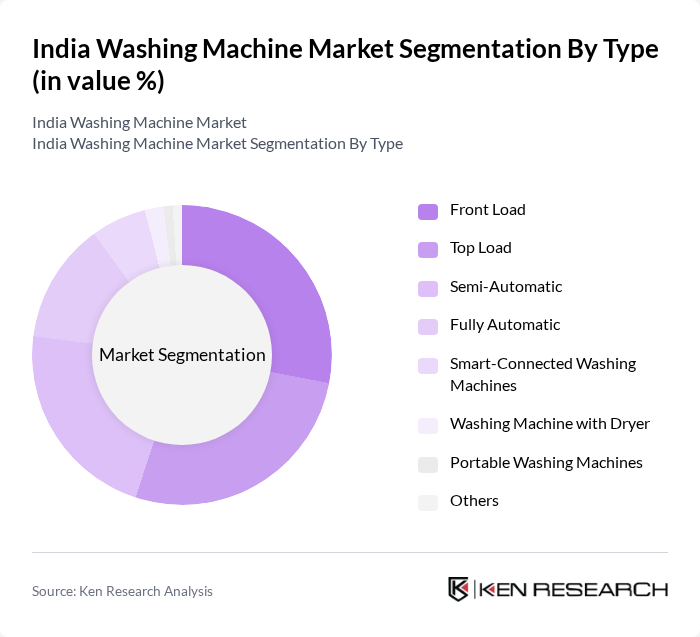

By Type:The washing machine market can be segmented into various types, including Front Load, Top Load, Semi-Automatic, Fully Automatic, Smart-Connected Washing Machines, Washing Machine with Dryer, Portable Washing Machines, and Others. Each type addresses specific consumer preferences and requirements, offering unique features such as water and energy efficiency, automation, connectivity, and compactness to cater to diverse urban and rural needs .

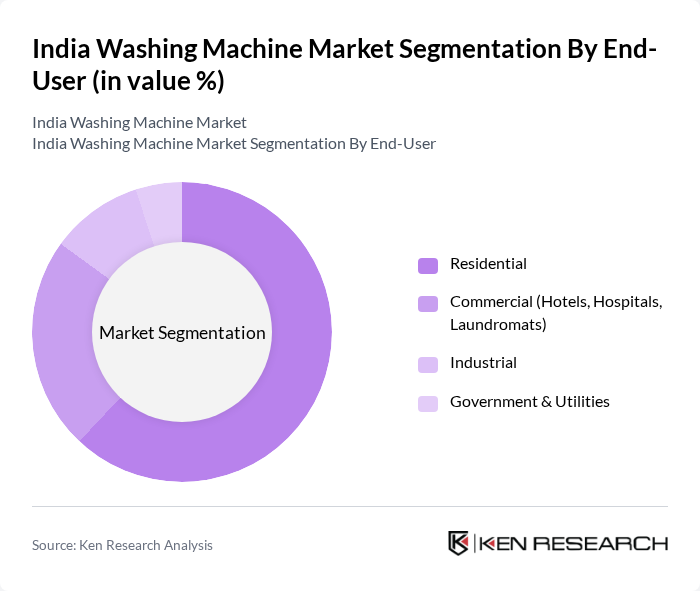

By End-User:The market can also be segmented based on end-users, which include Residential, Commercial (Hotels, Hospitals, Laundromats), Industrial, and Government & Utilities. Each segment has distinct requirements and purchasing behaviors, with residential users driving the bulk of demand, while commercial and industrial segments require higher-capacity and more durable machines for frequent use .

The India Washing Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG Electronics India Pvt. Ltd., Samsung India Electronics Pvt. Ltd., Whirlpool of India Ltd., Bosch Home Appliances (BSH Household Appliances Manufacturing Pvt. Ltd.), Haier Appliances India Pvt. Ltd., Panasonic India Pvt. Ltd., Godrej Appliances, IFB Industries Ltd., Voltas Ltd., Midea Group (Midea India Pvt. Ltd.), Electrolux India Pvt. Ltd., TCL India Pvt. Ltd., Micromax Informatics Ltd., Intex Technologies, Onida Electronics (Mirc Electronics Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India washing machine market appears promising, driven by technological advancements and changing consumer preferences. As urbanization continues, the demand for efficient and smart appliances is expected to rise. Additionally, manufacturers are likely to focus on sustainability and energy efficiency, aligning with government initiatives. The integration of AI and IoT technologies will further enhance user experience, making washing machines more appealing to tech-savvy consumers, thus shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Front Load Top Load Semi-Automatic Fully Automatic Smart-Connected Washing Machines Washing Machine with Dryer Portable Washing Machines Others |

| By End-User | Residential Commercial (Hotels, Hospitals, Laundromats) Industrial Government & Utilities |

| By Region | North India South India East India West India |

| By Price Range | Budget (Below INR 15,000) Mid-Range (INR 15,000–30,000) Premium (Above INR 30,000) |

| By Distribution Channel | Online Retail Offline Retail (Supermarkets, Hypermarkets, Specialty Stores) Direct Sales |

| By Brand | National Brands International Brands Private Labels |

| By Technology | Smart Technology (IoT, Wi-Fi Enabled) Energy-Efficient Technology (Inverter, BEE Star Rated) Conventional Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Household Purchases | 120 | Homeowners, Renters |

| Retail Sales Insights | 60 | Store Managers, Sales Associates |

| Consumer Preferences Survey | 80 | First-time Buyers, Upgraders |

| Market Trends Analysis | 40 | Industry Analysts, Market Researchers |

| Energy Efficiency Awareness | 50 | Environmentally Conscious Consumers, Tech Enthusiasts |

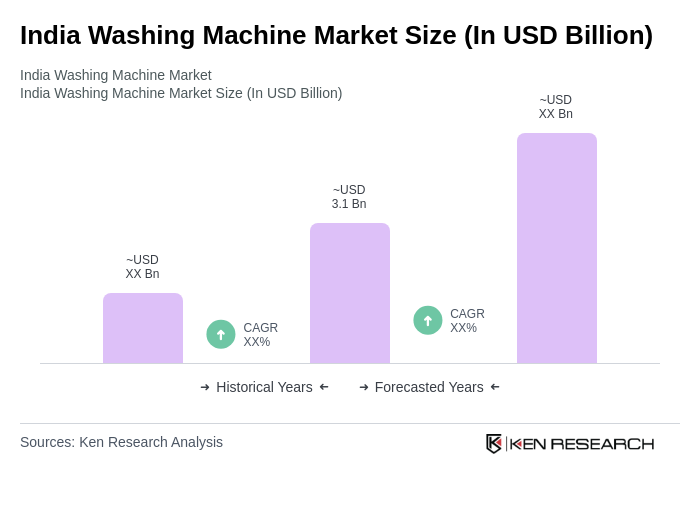

The India Washing Machine Market is valued at approximately USD 3.1 billion, driven by factors such as rising disposable incomes, urbanization, and a growing preference for automated and energy-efficient appliances.