Region:Middle East

Author(s):Dev

Product Code:KRAD3303

Pages:99

Published On:November 2025

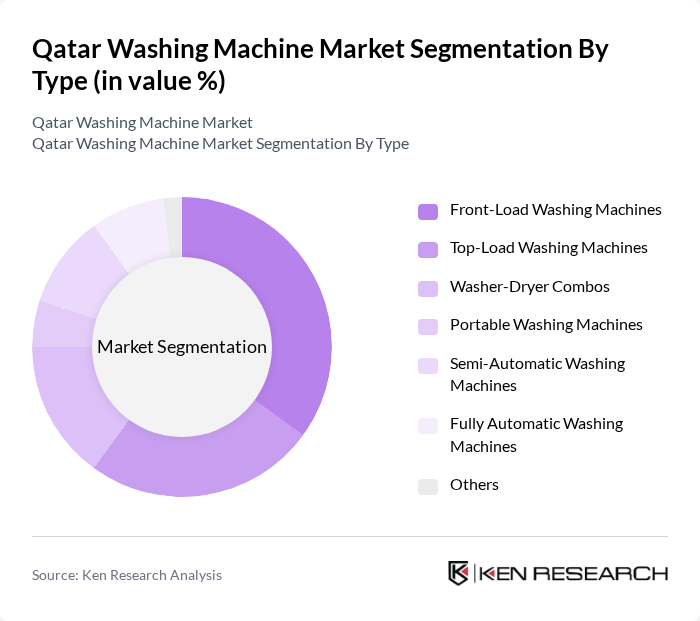

By Type:The washing machine market can be segmented into various types, including Front-Load Washing Machines, Top-Load Washing Machines, Washer-Dryer Combos, Portable Washing Machines, Semi-Automatic Washing Machines, Fully Automatic Washing Machines, and Others. Among these, Front-Load Washing Machines are gaining popularity due to their energy efficiency and superior cleaning performance. Consumers are increasingly opting for models that offer advanced features such as inverter motors, steam cleaning, and better water conservation, leading to a shift towards fully automatic and energy-efficient options. The adoption of smart and connected washing machines is also rising, particularly in the premium segment.

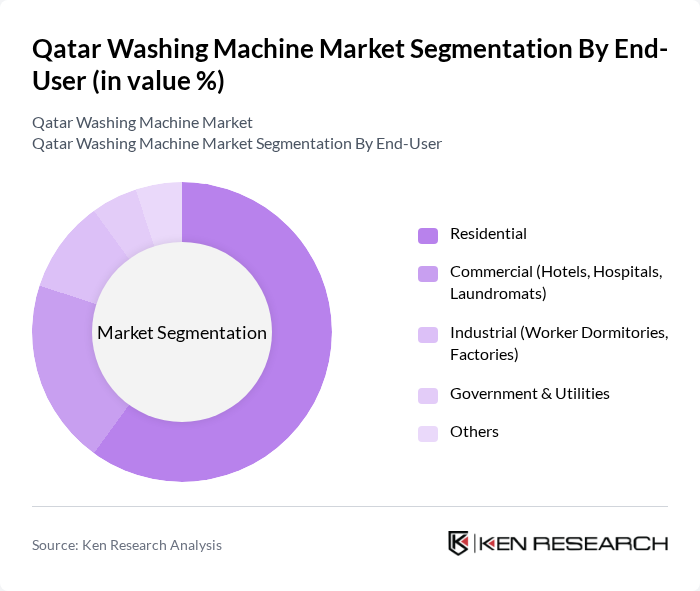

By End-User:The market can be segmented based on end-users, including Residential, Commercial (Hotels, Hospitals, Laundromats), Industrial (Worker Dormitories, Factories), Government & Utilities, and Others. The Residential segment is the largest, driven by the increasing number of households and the growing trend of modern living. Consumers are looking for convenience and efficiency, which is propelling the demand for washing machines in residential settings. The commercial segment is also expanding, supported by growth in hospitality and healthcare infrastructure, while industrial demand is sustained by large-scale worker accommodations in the petrochemical and construction sectors.

The Qatar Washing Machine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, LG Electronics, Whirlpool Corporation, Bosch Home Appliances, Electrolux, Panasonic, Haier Group, Miele, Sharp Corporation, Beko, Siemens, Hisense, GE Appliances, TCL Technology, Gorenje, Jumbo Electronics (Qatar distributor/retailer), Techno Blue (Qatar distributor/retailer), Carrefour Qatar (major retail channel), Lulu Hypermarket (major retail channel) contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar washing machine market is poised for significant growth driven by urbanization, rising disposable incomes, and a shift towards energy-efficient appliances. As consumers increasingly prioritize sustainability, manufacturers are likely to innovate and introduce smart, eco-friendly models. Additionally, the expansion of e-commerce platforms will facilitate easier access to a wider range of products. Overall, the market is expected to evolve, with a focus on technology integration and consumer-centric solutions, enhancing the overall user experience in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Front-Load Washing Machines Top-Load Washing Machines Washer-Dryer Combos Portable Washing Machines Semi-Automatic Washing Machines Fully Automatic Washing Machines Others |

| By End-User | Residential Commercial (Hotels, Hospitals, Laundromats) Industrial (Worker Dormitories, Factories) Government & Utilities Others |

| By Capacity | Below 6 kg kg - 8 kg kg - 10 kg Above 10 kg Others |

| By Brand | Local Brands (e.g., Jumbo Electronics, Techno Blue) International Brands (e.g., Samsung, LG, Whirlpool, Bosch) Premium Brands (e.g., Miele, Siemens) Others |

| By Distribution Channel | Online Retail (e.g., Carrefour Qatar, Lulu Webstore) Offline Retail (e.g., Hypermarkets, Specialty Stores) Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Technology | Conventional Washing Machines Smart Washing Machines (IoT-enabled) Energy-Efficient Models Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | Household Decision Makers, Appliance Users |

| Market Trends Analysis | 80 | Market Analysts, Industry Experts |

| Product Feature Evaluation | 60 | Product Development Managers, Engineers |

| Sales Channel Effectiveness | 70 | Sales Representatives, Marketing Managers |

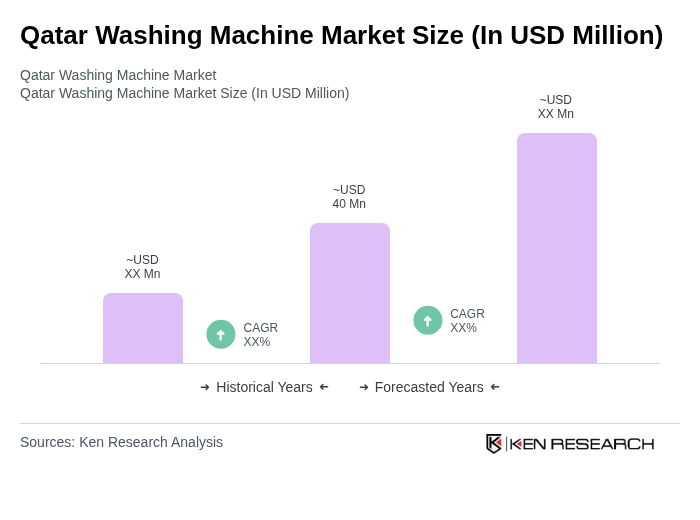

The Qatar washing machine market is valued at approximately USD 40 million, driven by factors such as urbanization, rising disposable incomes, and a growing preference for energy-efficient appliances among consumers.