Region:Central and South America

Author(s):Shubham

Product Code:KRAA0966

Pages:100

Published On:August 2025

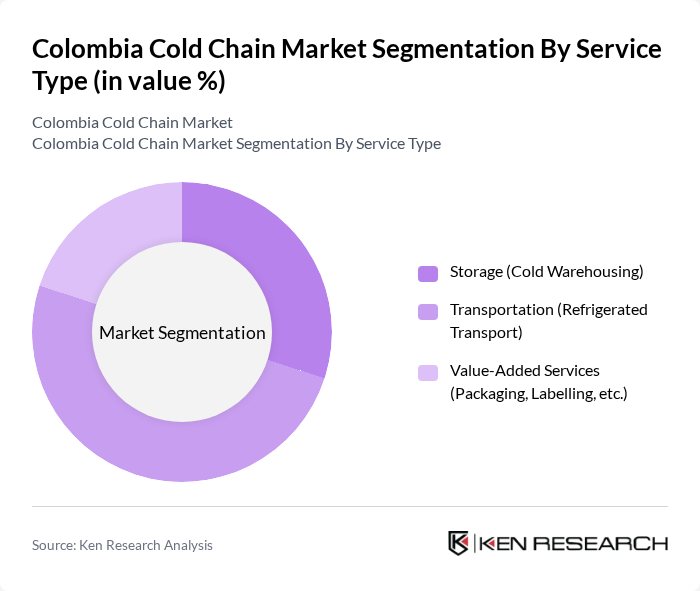

By Service Type:The service type segmentation includes Storage (Cold Warehousing), Transportation (Refrigerated Transport), and Value-Added Services (Packaging, Labelling, etc.). Among these, Transportation is the leading subsegment due to the increasing demand for efficient logistics solutions in the food and pharmaceutical sectors. The rise in e-commerce and international trade has also contributed to the growth of refrigerated transport services, as consumers and businesses seek timely delivery of fresh and temperature-sensitive products .

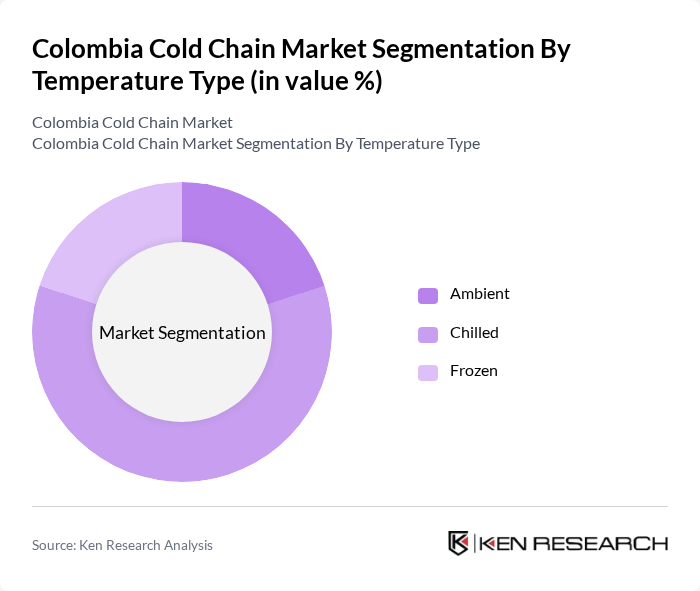

By Temperature Type:The temperature type segmentation includes Ambient, Chilled, and Frozen. The Chilled segment is currently the most dominant due to the growing demand for fresh produce, dairy, and meat products. Consumer preferences for healthier and fresher food options have led to an increase in the consumption of chilled products, driving the need for efficient cold chain solutions to maintain product quality .

The Colombia Cold Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Megafin Logistica Para Alimentos, Frigometro, Apix Logistica Especializada SAS, Frio Aéreo, Logística Fría, Grupo TCC, Servientrega, Kuehne + Nagel, DHL Supply Chain, Grupo Éxito, Alpina, Postobón, Cargill, Nestlé, Unilever contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Colombia cold chain market appears promising, driven by technological advancements and increasing consumer expectations for food quality. The integration of IoT technologies for real-time monitoring is expected to enhance operational efficiency, while the focus on sustainability will lead to the adoption of eco-friendly refrigeration solutions. As the government continues to invest in infrastructure improvements, the market is likely to witness significant growth, fostering innovation and collaboration among stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Storage (Cold Warehousing) Transportation (Refrigerated Transport) Value-Added Services (Packaging, Labelling, etc.) |

| By Temperature Type | Ambient Chilled Frozen |

| By Application | Horticulture (Fresh Fruits and Vegetables) Dairy Products (Milk, Ice-cream, Butter, etc.) Meats and Fish Processed Food Products Pharma, Life Sciences, and Chemicals Others |

| By End-User | Food and Beverage Pharmaceuticals and Life Sciences Agriculture Retail Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Geography | Andean Region Caribbean Region Pacific Region Orinoquía and Amazonía |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 100 | Logistics Managers, Supply Chain Directors |

| Pharmaceutical Cold Storage | 60 | Operations Managers, Quality Assurance Managers |

| Floriculture and Horticulture Logistics | 50 | Procurement Officers, Distribution Managers |

| Temperature-Sensitive Chemical Transport | 40 | Regulatory Affairs Managers, Supply Chain Analysts |

| Retail Cold Chain Management | 50 | Store Managers, Inventory Control Specialists |

The Colombia Cold Chain Market is valued at approximately USD 2.3 billion, driven by the increasing demand for temperature-sensitive goods, advancements in logistics technology, and the growth of the food and pharmaceutical industries.