Region:Africa

Author(s):Geetanshi

Product Code:KRAA3281

Pages:81

Published On:September 2025

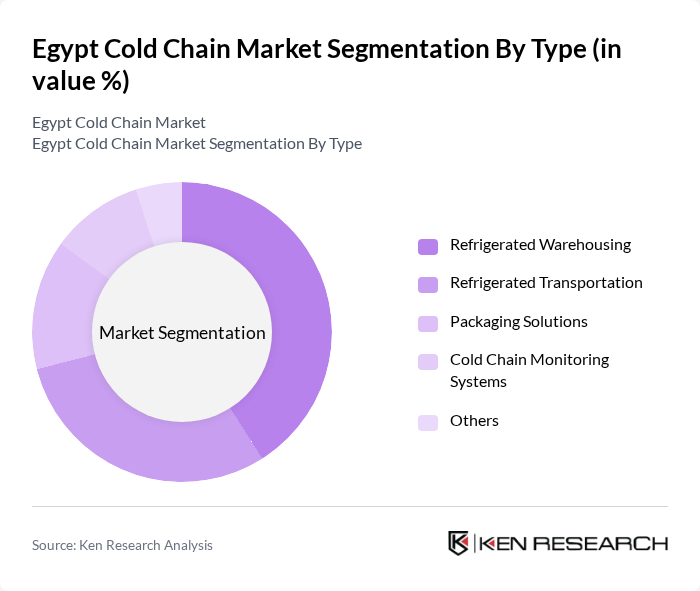

By Type:The cold chain market can be segmented into Refrigerated Warehousing, Refrigerated Transportation, Packaging Solutions, Cold Chain Monitoring Systems, and Others. Each of these segments is essential for maintaining the integrity of temperature-sensitive products throughout the supply chain. Refrigerated warehousing leads the market due to heavy investment in multi-temperature storage facilities, while refrigerated transportation is expanding with the adoption of advanced reefer vehicles and real-time tracking technologies .

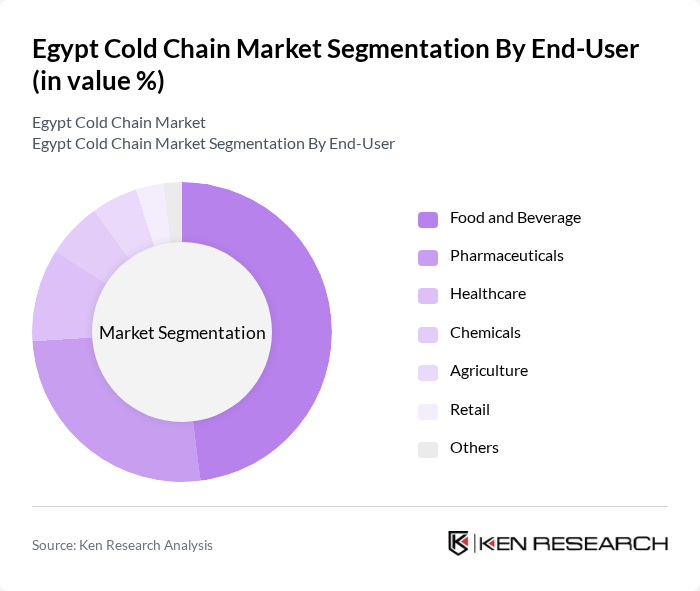

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Healthcare, Chemicals, Agriculture, Retail, and Others. Food and beverage remains the largest segment, driven by Egypt’s strong agricultural exports and growing demand for processed foods. Pharmaceuticals and healthcare segments are expanding rapidly due to increased vaccine and biologics distribution, as well as regulatory focus on temperature compliance .

The Egypt Cold Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agility Egypt, DB Schenker Egypt, Nile Cold Stores, YCH Logistics, Transmar, Egyptian German Cold Chain, Maersk Egypt, DHL Egypt, Kuehne + Nagel Egypt, Cold Box Egypt, Multi Fruit Egypt, Green Food Hub, Lineage Logistics, Americold Logistics, and United Group for Cold Storage contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain market in Egypt appears promising, driven by increasing investments in infrastructure and technology. As consumer preferences shift towards fresh and safe food products, businesses are likely to adopt advanced cold chain solutions. The integration of IoT technologies will enhance monitoring and efficiency, while government support for food safety initiatives will further bolster market growth. Overall, the sector is poised for significant transformation, aligning with global trends towards sustainability and efficiency.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehousing Refrigerated Transportation Packaging Solutions Cold Chain Monitoring Systems Others |

| By End-User | Food and Beverage Pharmaceuticals Healthcare Chemicals Agriculture Retail Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Application | Fruits and Vegetables Meat, Fish, and Seafood Dairy and Frozen Desserts Bakery and Confectionery Drugs and Pharmaceuticals Floral Supply Chain Others |

| By Sales Channel | Online Sales Offline Sales Distributors Others |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Companies | 100 | Logistics Managers, Supply Chain Directors |

| Pharmaceutical Cold Chain Providers | 80 | Operations Managers, Quality Assurance Managers |

| Retail Cold Storage Facilities | 60 | Warehouse Managers, Inventory Control Specialists |

| Transport Logistics Firms | 70 | Fleet Managers, Compliance Officers |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Managers |

The Egypt Cold Chain Market is valued at approximately USD 1.0 billion, driven by the increasing demand for temperature-sensitive goods, particularly in the food and pharmaceutical sectors, along with advancements in refrigeration technologies.