Region:Africa

Author(s):Dev

Product Code:KRAA0454

Pages:85

Published On:August 2025

By Service Type:The service type segmentation includes various components essential for maintaining the integrity of temperature-sensitive products. The subsegments are Cold Storage, Refrigerated Transportation, Value-Added Services (e.g., packaging, labeling, order picking), Temperature Monitoring & Analytics Solutions, and Others. Among these, Cold Storage is the leading subsegment, driven by the increasing need for long-term storage of perishable goods and the expansion of the food and beverage industry. The adoption of advanced temperature monitoring and analytics is also rising, supporting real-time tracking and compliance .

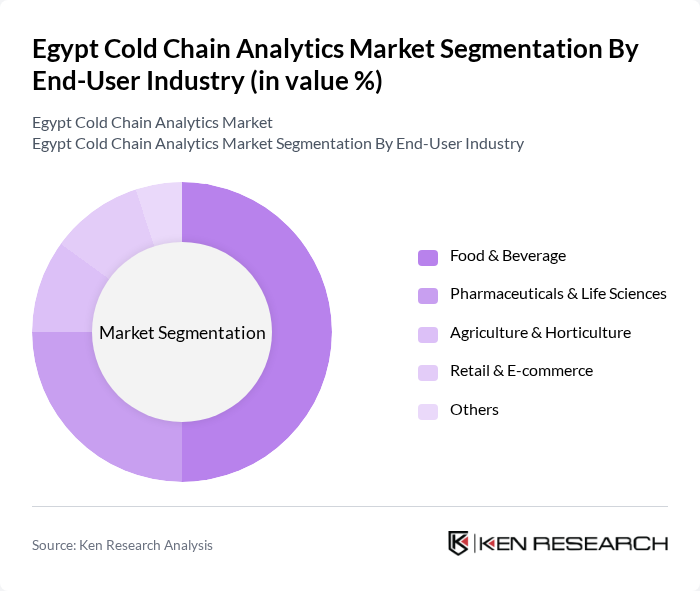

By End-User Industry:The end-user industry segmentation encompasses various sectors that rely on cold chain solutions, including Food & Beverage, Pharmaceuticals & Life Sciences, Agriculture & Horticulture, Retail & E-commerce, and Others. The Food & Beverage sector is the dominant segment, driven by the increasing demand for fresh and frozen products, coupled with stringent food safety regulations that necessitate effective cold chain management. The pharmaceutical and life sciences sector is also expanding its reliance on cold chain logistics for vaccine and medicine distribution .

The Egypt Cold Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Logistica, Arab Company for Food Industries and Cooling (ACFIC), Custom Storage Company (CSC), Agility Logistics, Kuehne + Nagel, DB Schenker, DHL Supply Chain, Maersk, CEVA Logistics, YCH Group, Al Madina Logistics Services, Misr Cold Stores, Raya Logistics, International Free Trade Company (IFTC), United Trans contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain analytics market in Egypt appears promising, driven by technological advancements and increasing consumer demand for fresh products. The integration of IoT and data analytics is expected to enhance operational efficiency, allowing stakeholders to monitor temperature and humidity in real-time. Additionally, as the government continues to invest in infrastructure improvements, the market is likely to see a rise in partnerships between logistics providers and food producers, fostering a more resilient cold chain ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Cold Storage Refrigerated Transportation Value-Added Services (e.g., packaging, labeling, order picking) Temperature Monitoring & Analytics Solutions Others |

| By End-User Industry | Food & Beverage Pharmaceuticals & Life Sciences Agriculture & Horticulture Retail & E-commerce Others |

| By Temperature Range | Chilled (0°C to 5°C) Frozen (-18°C and below) Controlled Room Temperature (15°C to 25°C) Others |

| By Technology Adoption | Traditional (Manual Monitoring) IoT-Enabled Systems Advanced Analytics & Predictive Monitoring Blockchain for Traceability Others |

| By Geography | Greater Cairo Alexandria Suez Canal Region Upper Egypt Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 100 | Supply Chain Managers, Quality Assurance Directors |

| Pharmaceutical Cold Chain Management | 60 | Logistics Coordinators, Regulatory Affairs Managers |

| Retail Cold Storage Solutions | 50 | Operations Managers, Inventory Control Specialists |

| Technology Providers in Cold Chain | 40 | Product Managers, Business Development Executives |

| Government and Regulatory Bodies | 40 | Policy Makers, Industry Analysts |

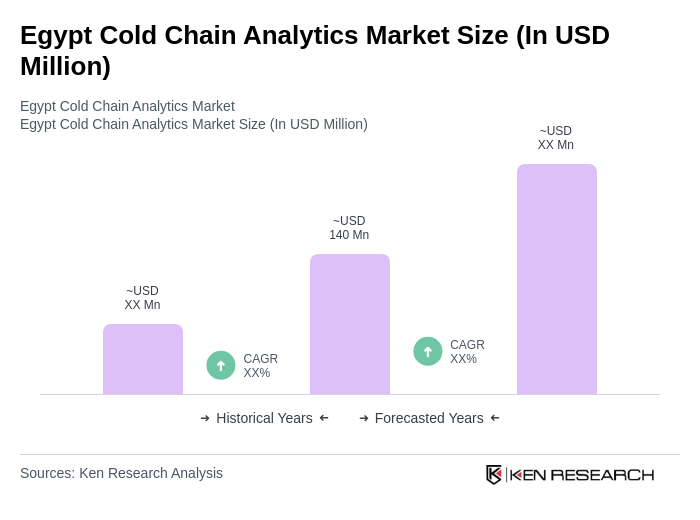

The Egypt Cold Chain Analytics Market is valued at approximately USD 140 million, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, as well as the growth of e-commerce and retail.