Region:Europe

Author(s):Geetanshi

Product Code:KRAA2081

Pages:91

Published On:August 2025

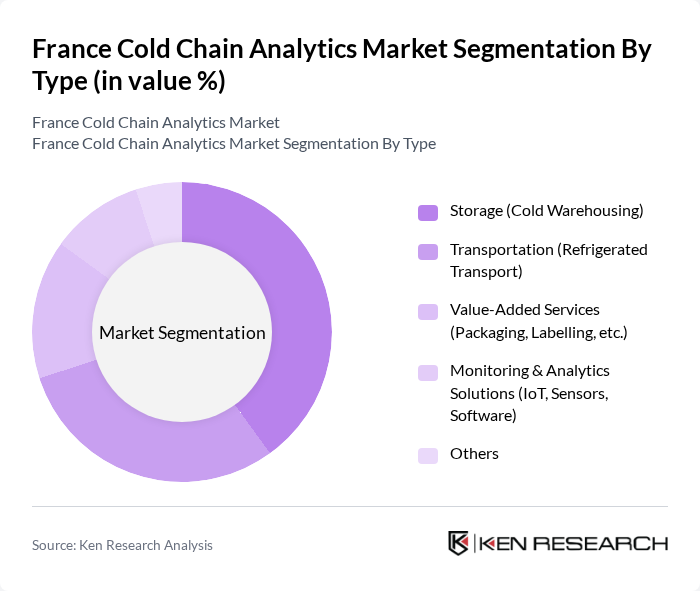

By Type:The market is segmented into various types, including Storage (Cold Warehousing), Transportation (Refrigerated Transport), Value-Added Services (Packaging, Labelling, etc.), Monitoring & Analytics Solutions (IoT, Sensors, Software), and Others. Among these, Storage (Cold Warehousing) is the leading sub-segment due to the rising demand for efficient storage solutions that maintain product integrity and extend shelf life. The increasing focus on food safety and quality assurance, as well as the adoption of automated and IoT-enabled storage solutions, further drives the growth of this segment .

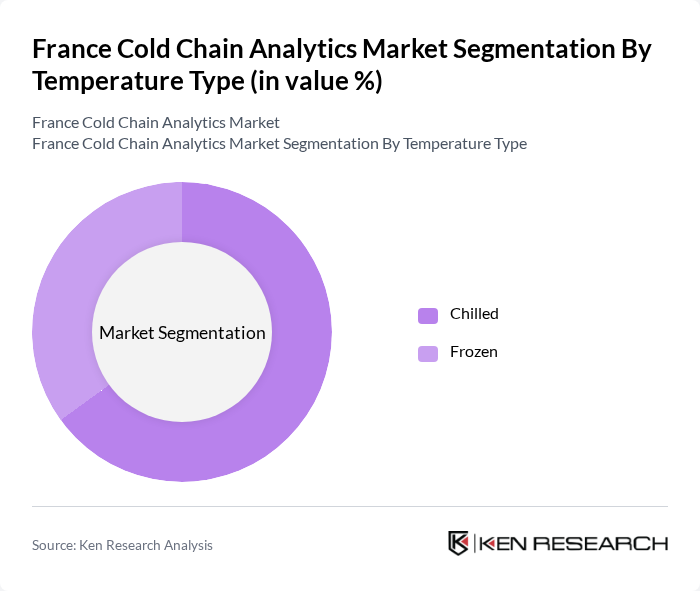

By Temperature Type:The market is categorized into Chilled and Frozen segments. The Chilled segment is currently dominating the market, driven by the increasing consumption of fresh produce, dairy products, and ready-to-eat foods, which require precise temperature control to maintain quality and safety. The growing trend of health-conscious consumers and the expansion of e-commerce grocery delivery further support the demand for chilled products .

The France Cold Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Geodis, Sofrilog, STEF, IRIS Logistics, XPO Logistics, Kuehne + Nagel, DB Schenker, Bolloré Logistics, Socopal, DHL Supply Chain, Lineage Logistics, Americold Logistics, Cold Chain Technologies, CMA CGM Logistics, Transports Chabas Santé contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain analytics market in France appears promising, driven by technological innovations and evolving consumer preferences. As the demand for perishable goods continues to rise, companies are expected to increasingly adopt automated solutions and AI-driven analytics. Furthermore, the emphasis on sustainability will likely lead to the development of eco-friendly cold chain practices. These trends will not only enhance operational efficiency but also ensure compliance with stringent regulations, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Storage (Cold Warehousing) Transportation (Refrigerated Transport) Value-Added Services (Packaging, Labelling, etc.) Monitoring & Analytics Solutions (IoT, Sensors, Software) Others |

| By Temperature Type | Chilled Frozen |

| By Application | Horticulture (Fresh Fruits and Vegetables) Dairy Products (Milk, Ice-cream, Butter, etc.) Meat and Fish Processed Food Products Pharmaceuticals, Life Sciences, and Chemicals Other Applications |

| By End-User | Food and Beverage Pharmaceuticals & Healthcare Biotechnology Retail & E-commerce Others |

| By Region | Northern France Southern France Eastern France Western France Central France |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Subsidies Tax Exemptions Grants Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Management | 60 | Supply Chain Managers, Quality Assurance Officers |

| Food & Beverage Cold Storage Solutions | 70 | Operations Directors, Logistics Coordinators |

| Temperature-Controlled Transportation | 50 | Fleet Managers, Compliance Officers |

| Cold Chain Technology Adoption | 40 | IT Managers, Data Analysts |

| Retail Cold Chain Practices | 45 | Retail Operations Managers, Inventory Control Specialists |

The France Cold Chain Analytics Market is valued at approximately USD 12.6 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with advancements in technology such as IoT-enabled tracking and real-time temperature monitoring.