Region:North America

Author(s):Shubham

Product Code:KRAA0952

Pages:100

Published On:August 2025

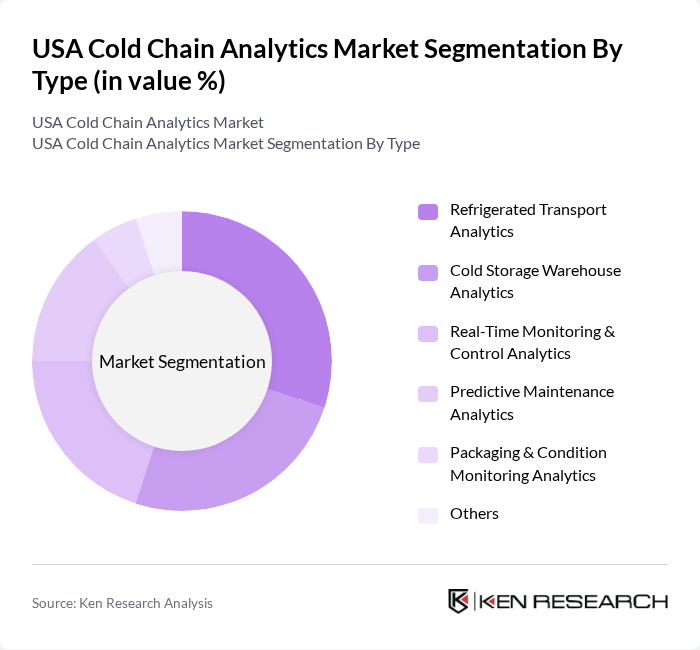

By Type:The market is segmented into Refrigerated Transport Analytics, Cold Storage Warehouse Analytics, Real-Time Monitoring & Control Analytics, Predictive Maintenance Analytics, Packaging & Condition Monitoring Analytics, and Others. Each of these segments plays a crucial role in ensuring the integrity and traceability of temperature-sensitive products throughout the supply chain. Real-time monitoring and predictive analytics are increasingly adopted to prevent spoilage, reduce waste, and maintain regulatory compliance .

The Refrigerated Transport Analytics segment is currently leading the market due to the rising demand for efficient logistics solutions that ensure the safe transportation of perishable goods. This segment benefits from advancements in GPS tracking, IoT-enabled sensors, and temperature monitoring technologies, which enhance visibility and control over the supply chain. The increasing focus on reducing food waste and ensuring product quality during transit further drives the adoption of refrigerated transport analytics .

By End-User:The market is segmented by end-users, including Food and Beverage, Pharmaceuticals, Biotechnology, Chemicals, Retail & E-commerce, and Others. Each end-user category has unique requirements and challenges that cold chain analytics solutions address, such as regulatory compliance, product integrity, and operational efficiency .

The Food and Beverage sector dominates the market, driven by the increasing consumer demand for fresh and safe food products. This segment's growth is supported by stringent regulations regarding food safety and quality, prompting companies to invest in advanced cold chain analytics solutions to maintain compliance and enhance operational efficiency. The rise of e-commerce in the food sector and the need for traceable, temperature-controlled logistics further contribute to the growing need for effective cold chain management .

The USA Cold Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americold Logistics, Lineage Logistics, United States Cold Storage, Cold Chain Technologies, Sensitech (a Carrier company), Controlant, ORBCOMM, Emerson Electric (Thermo King/ProAct), DHL Supply Chain, C.H. Robinson, Maersk, DB Schenker, Kuehne + Nagel, RLS Logistics, Blue Yonder (JDA Software) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA cold chain analytics market appears promising, driven by technological innovations and increasing consumer demand for safe, temperature-sensitive products. As companies adopt IoT and AI technologies, operational efficiencies are expected to improve significantly. Furthermore, the growing emphasis on sustainability will likely lead to the development of eco-friendly cold chain solutions, enhancing the industry's resilience against climate change and regulatory pressures while meeting consumer expectations for transparency and safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Analytics Cold Storage Warehouse Analytics Real-Time Monitoring & Control Analytics Predictive Maintenance Analytics Packaging & Condition Monitoring Analytics Others |

| By End-User | Food and Beverage Pharmaceuticals Biotechnology Chemicals Retail & E-commerce Others |

| By Application | Food Distribution Optimization Healthcare & Vaccine Logistics Analytics Retail Supply Chain Analytics E-commerce Fulfillment Analytics Regulatory Compliance & Audit Analytics Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) Analytics E-commerce Platform Analytics Others |

| By Component | Hardware (Sensors, Data Loggers, RFID, etc.) Software (Analytics Platforms, Dashboards, etc.) Services (Consulting, Managed Services, etc.) Others |

| By Sales Channel | Direct Sales Channel Partners/Distributors Online Platforms Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Infrastructure Development Regulatory Compliance Mandates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 100 | Supply Chain Managers, Quality Assurance Directors |

| Pharmaceutical Cold Storage | 80 | Logistics Coordinators, Compliance Officers |

| Biotechnology Product Distribution | 60 | Operations Managers, Regulatory Affairs Specialists |

| Retail Cold Chain Management | 50 | Inventory Managers, Procurement Specialists |

| Cold Chain Technology Solutions | 40 | IT Managers, Technology Adoption Officers |

The USA Cold Chain Analytics Market is valued at approximately USD 14.2 billion, driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors, along with advancements in IoT and AI technologies.