Region:Africa

Author(s):Dev

Product Code:KRAA0393

Pages:91

Published On:August 2025

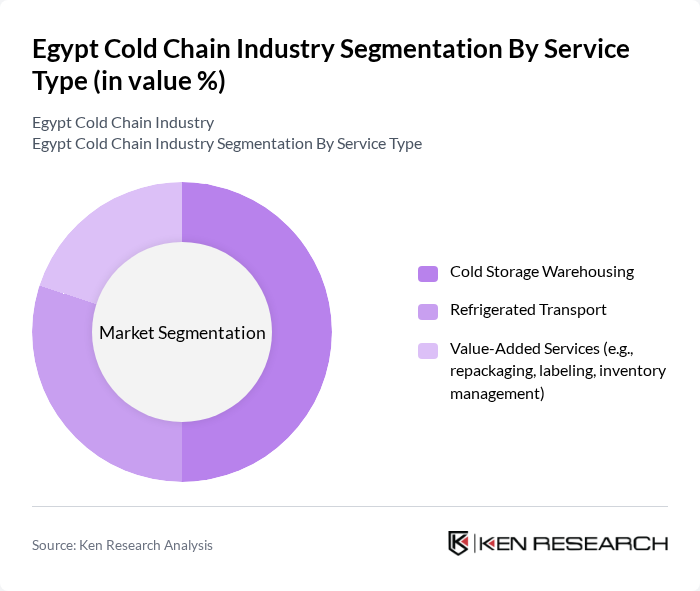

By Service Type:The service type segmentation includes Cold Storage Warehousing, Refrigerated Transport, and Value-Added Services such as repackaging, labeling, and inventory management. Cold Storage Warehousing is the most significant segment, driven by the increasing demand for storage of perishable goods, especially from agro-processors, dairy, and pharmaceutical sectors. Refrigerated Transport follows closely, as it is essential for maintaining the integrity of products during transit. Value-Added Services are gaining traction as companies seek to optimize their supply chains through services like real-time temperature monitoring and inventory management .

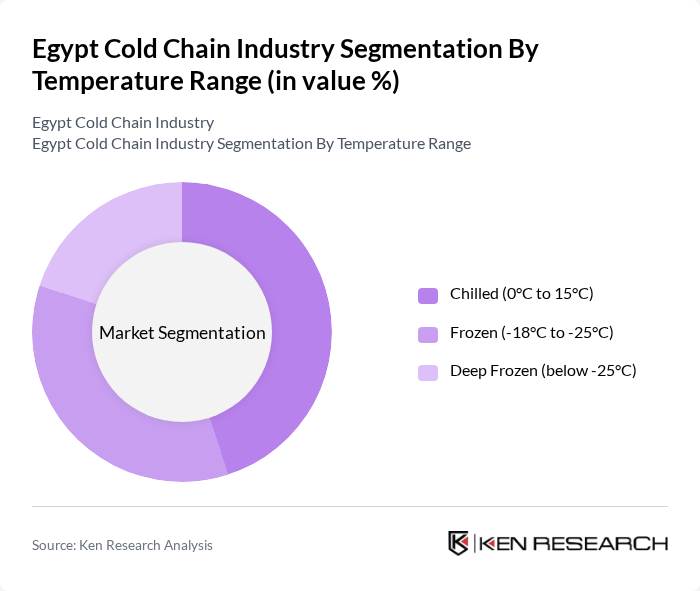

By Temperature Range:The temperature range segmentation includes Chilled (0°C to 15°C), Frozen (-18°C to -25°C), and Deep Frozen (below -25°C). The Chilled segment dominates the market due to high demand for fresh produce, dairy, and pharmaceuticals. The Frozen segment is also significant, particularly for meat and seafood, while the Deep Frozen segment is expanding as ready-to-eat meals and vaccine logistics require ultra-low temperature solutions .

The Egypt Cold Chain Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Logistica, Arab Company for Food Industries and Cooling (ACFIC), Custom Storage Company (CSC), Green Line Logistics, Multi Fruit Egypt, Agility Logistics, Kuehne + Nagel, DHL Global Forwarding Egypt, Imperial Logistics Egypt, Egyptian Cold Storage Company, Nile Logistics, Al-Masria for Cold Storage, Fresh Del Monte Produce Egypt, Wadi Group, Raya Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the cold chain industry in Egypt appears promising, driven by increasing consumer demand for fresh produce and government support for infrastructure development. As e-commerce continues to expand, businesses are likely to invest in advanced technologies, such as IoT and automation, to enhance efficiency. Furthermore, partnerships between public and private sectors may lead to innovative solutions that address current challenges, ultimately improving the overall cold chain ecosystem in the country.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Cold Storage Warehousing Refrigerated Transport Value-Added Services (e.g., repackaging, labeling, inventory management) |

| By Temperature Range | Chilled (0°C to 15°C) Frozen (-18°C to -25°C) Deep Frozen (below -25°C) |

| By End-User Industry | Fruits and Vegetables Dairy Products and Frozen Desserts Meat, Fish, and Seafood Pharmaceuticals and Life Sciences Processed Foods Retail and E-commerce |

| By Technology | Refrigeration Technology Insulation Technology Monitoring and Control Systems (IoT, GPS, Data Analytics) Blockchain and Traceability Solutions Energy-Efficient Solutions |

| By Distribution Channel | Direct Sales Distributors Online Platforms Retail Outlets |

| By Region | Greater Cairo Alexandria Delta Region Upper Egypt Suez Canal Zone |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Cold Chain | 60 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Storage | 40 | Quality Assurance Managers, Operations Directors |

| Retail Cold Chain Management | 45 | Store Managers, Inventory Control Specialists |

| Cold Chain Technology Providers | 40 | Product Development Managers, Technical Sales Representatives |

| Logistics and Transportation Services | 50 | Fleet Managers, Business Development Executives |

The Egypt Cold Chain Industry is valued at approximately USD 490 million, driven by increasing demand for perishable goods, growth in the horticulture and dairy sectors, and the rising need for temperature-controlled logistics in pharmaceuticals.