Region:Global

Author(s):Dev

Product Code:KRAA0452

Pages:93

Published On:August 2025

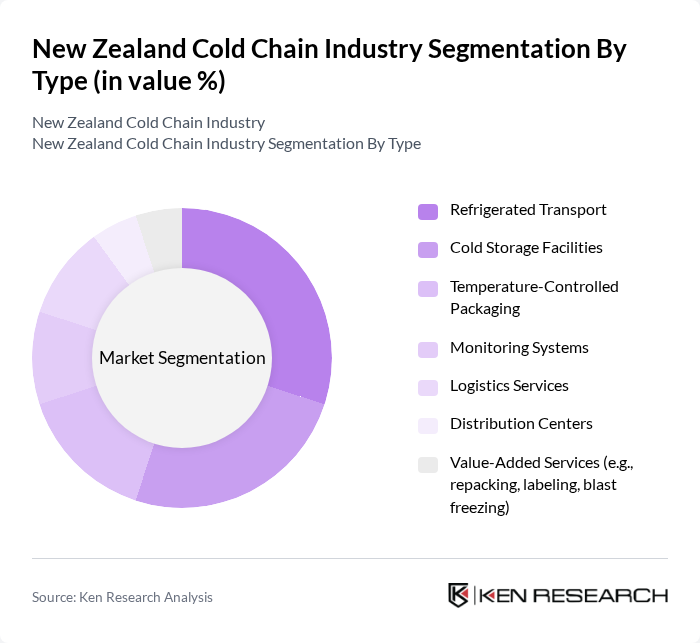

By Type:The cold chain industry is segmented into Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, Monitoring Systems, Logistics Services, Distribution Centers, and Value-Added Services. Refrigerated transport and cold storage facilities form the backbone of the industry, ensuring the safe movement and storage of perishable goods. Temperature-controlled packaging and monitoring systems are increasingly critical for real-time tracking and integrity assurance, while logistics services and distribution centers support efficient supply chain operations. Value-added services such as repacking, labeling, and blast freezing provide customized solutions for specific client needs .

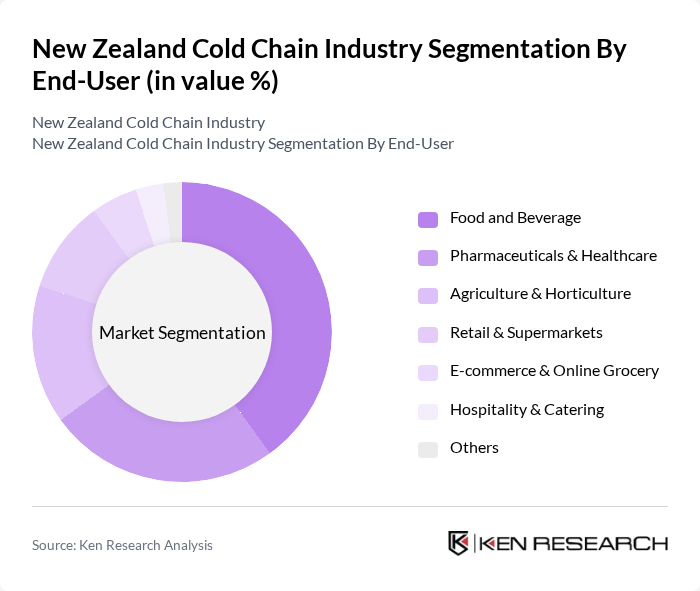

By End-User:The cold chain industry serves end-users such as Food and Beverage, Pharmaceuticals & Healthcare, Agriculture & Horticulture, Retail & Supermarkets, E-commerce & Online Grocery, Hospitality & Catering, and Others. Food and beverage remain the largest segment, driven by the need for fresh and frozen foods. Pharmaceuticals and healthcare are rapidly growing due to increased demand for temperature-controlled storage and distribution of vaccines, biologics, and specialty medicines. The agriculture and horticulture segment relies on cold chain logistics for export-quality produce, while retail, e-commerce, and hospitality sectors require reliable cold storage and distribution for perishable goods .

The New Zealand Cold Chain Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Mainfreight, Cold Storage Nelson, New Zealand Cold Storage Ltd, Freightways, Lineage Logistics, TIL Logistics Group, AgriChain, Freshmax, Port of Tauranga, NZ Post, Foodstuffs North Island, Bidfood New Zealand, Silver Fern Farms, Zespri International, and Fonterra Co-operative Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the New Zealand cold chain industry appears promising, driven by technological innovations and increasing consumer demand for fresh produce. As the population grows and e-commerce expands, the need for efficient cold chain solutions will intensify. Additionally, government initiatives aimed at enhancing infrastructure and sustainability will likely bolster the sector. However, addressing operational costs and supply chain vulnerabilities will be crucial for maintaining competitiveness and ensuring the industry's long-term viability in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Systems Logistics Services Distribution Centers Value-Added Services (e.g., repacking, labeling, blast freezing) |

| By End-User | Food and Beverage Pharmaceuticals & Healthcare Agriculture & Horticulture Retail & Supermarkets E-commerce & Online Grocery Hospitality & Catering Others |

| By Product Type | Dairy & Frozen Desserts Meat, Fish & Seafood Fruits & Vegetables Frozen Foods Pharmaceuticals & Biologics Bakery & Confectionery Others |

| By Temperature Range | Chilled (0°C to 5°C) Frozen (-18°C and below) Controlled Ambient (Above 5°C to 15°C) Others |

| By Distribution Channel | Direct Sales Online Sales Retail Outlets Wholesale/Distributors Others |

| By Service Type | Transportation Services Warehousing & Storage Services Packaging & Repacking Services Monitoring & Compliance Services Others |

| By Technology | Advanced Refrigeration Technology IoT & Real-Time Monitoring Solutions Automation & Robotics Energy Management Systems Blockchain for Traceability Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Cold Chain | 100 | Logistics Managers, Supply Chain Coordinators |

| Pharmaceutical Cold Storage | 80 | Quality Assurance Managers, Compliance Officers |

| Biotechnology Product Transport | 60 | Operations Managers, Research & Development Managers |

| Retail Cold Chain Management | 70 | Store Managers, Inventory Control Specialists |

| E-commerce Cold Chain Logistics | 50 | eCommerce Operations Managers, Fulfillment Supervisors |

The New Zealand Cold Chain Industry is valued at approximately USD 650 million, reflecting its significant role within the broader Australia and New Zealand Cold Chain Logistics Market, which is valued at about USD 2.3 billion.