Region:Africa

Author(s):Rebecca

Product Code:KRAA4601

Pages:97

Published On:September 2025

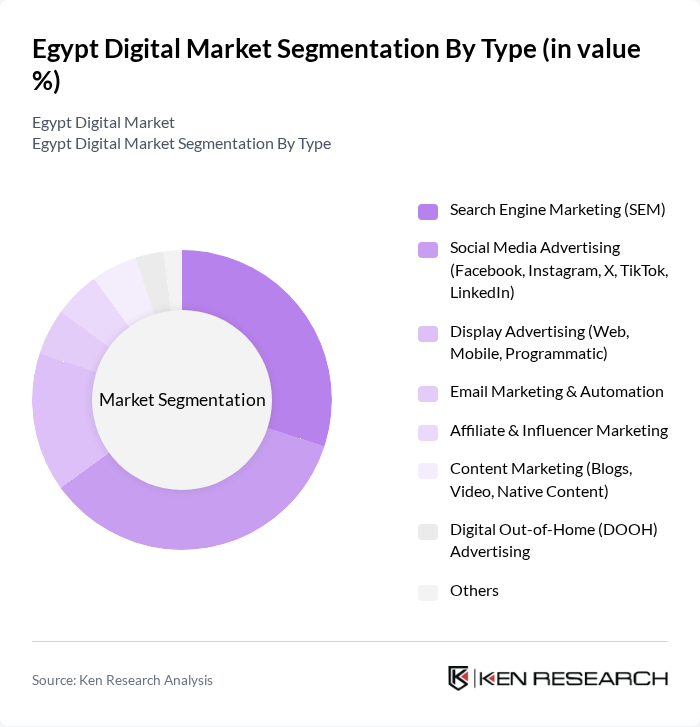

By Type:The digital marketing landscape in Egypt is diverse, encompassing a range of strategies. Search Engine Marketing (SEM) and Social Media Advertising are particularly prominent, with businesses prioritizing these channels to enhance visibility and directly engage users. The prevalence of platforms such as Facebook (with over 48 million users), Instagram, and X (formerly Twitter) has led to a significant increase in social media advertising. The adoption of AI tools and data-driven targeting further strengthens the effectiveness of these segments, as agencies focus on personalized and measurable campaigns .

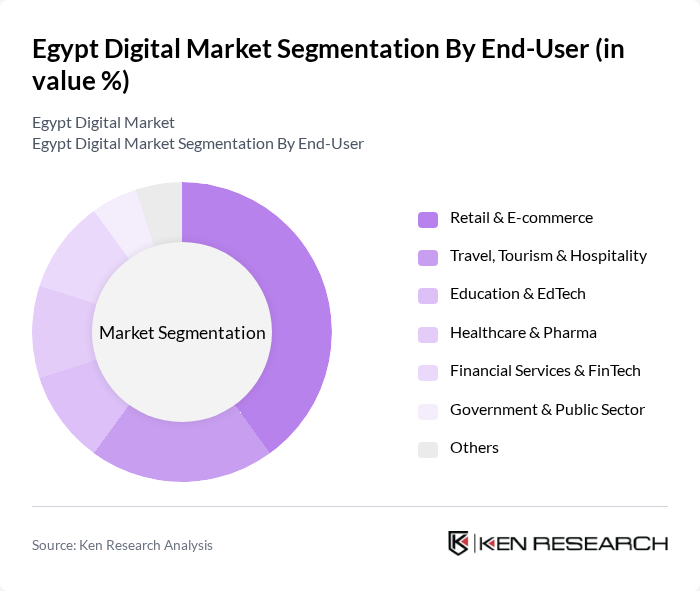

By End-User:The end-user segmentation of the digital marketing landscape in Egypt highlights the dominance of Retail & E-commerce and Travel, Tourism & Hospitality. Retail & E-commerce continues to expand digital marketing efforts to capture the growing online consumer base, while the Travel and Tourism sector leverages digital platforms for destination promotion and customer engagement. Other sectors such as Education, Healthcare, and Financial Services are also increasing their digital marketing investments to reach targeted audiences and drive sector-specific growth .

The Egypt Digital Marketing and AdTech market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumia Egypt, AdFalcon, Digital Republic, Kijamii, Socialize Agency, Egyptian Media Group, Wuzzuf, OMD Egypt, DMS (Digital Media Science) Egypt, Tarek Nour Communications, The Worx, MENA Media, E-Marketing Egypt, Adwise, Digital Marketing Egypt, MO4 Network, Media Pan Arab, FP7 McCann Cairo, Mindshare Egypt, BSocial Egypt contribute to innovation, geographic expansion, and service delivery in this space.

The Egypt digital market is poised for significant transformation as technological advancements and consumer behaviors evolve. By future, the integration of artificial intelligence in marketing strategies will enhance personalization, allowing brands to tailor their messages effectively. Additionally, the rise of video content marketing is expected to capture consumer attention, driving engagement. As businesses adapt to these trends, the market will likely witness increased investment in innovative advertising technologies, fostering a more dynamic digital ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Search Engine Marketing (SEM) Social Media Advertising (Facebook, Instagram, X, TikTok, LinkedIn) Display Advertising (Web, Mobile, Programmatic) Email Marketing & Automation Affiliate & Influencer Marketing Content Marketing (Blogs, Video, Native Content) Digital Out-of-Home (DOOH) Advertising Others |

| By End-User | Retail & E-commerce Travel, Tourism & Hospitality Education & EdTech Healthcare & Pharma Financial Services & FinTech Government & Public Sector Others |

| By Industry Vertical | E-commerce Telecommunications & ICT Automotive Real Estate & Construction FMCG & Consumer Goods Entertainment & Media Others |

| By Sales Channel | Direct Sales (In-house Marketing) Online Sales Platforms Digital Agencies & Resellers Retail Outlets Others |

| By Advertising Format | Video Ads (YouTube, Facebook, TikTok, OTT) Banner & Display Ads Native & Sponsored Content Audio Ads (Podcasts, Streaming) Search Ads Others |

| By Geographic Focus | Greater Cairo Alexandria Urban Governorates Upper Egypt Canal Cities & Sinai Rural Areas Others |

| By Customer Segment | B2B (Business-to-Business) B2C (Business-to-Consumer) D2C (Direct-to-Consumer) C2C (Consumer-to-Consumer) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Agency Owners, Account Managers |

| E-commerce Businesses | 80 | Marketing Directors, E-commerce Managers |

| Consumer Insights | 120 | Online Shoppers, Social Media Users |

| SME Digital Marketing Strategies | 60 | Business Owners, Marketing Executives |

| Brand Managers in Various Sectors | 90 | Brand Managers, Product Marketing Specialists |

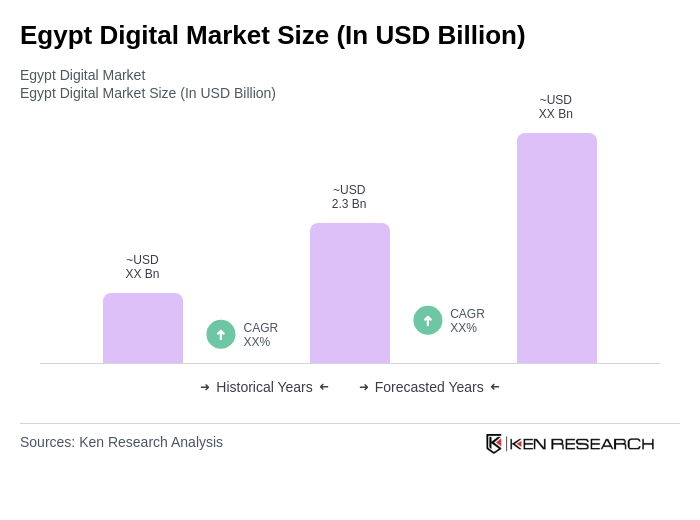

The Egypt Digital Marketing and AdTech market is valued at approximately USD 2.3 billion, driven by factors such as increased internet penetration, social media usage, e-commerce growth, and the integration of artificial intelligence in marketing strategies.