Region:Africa

Author(s):Dev

Product Code:KRAA0414

Pages:85

Published On:August 2025

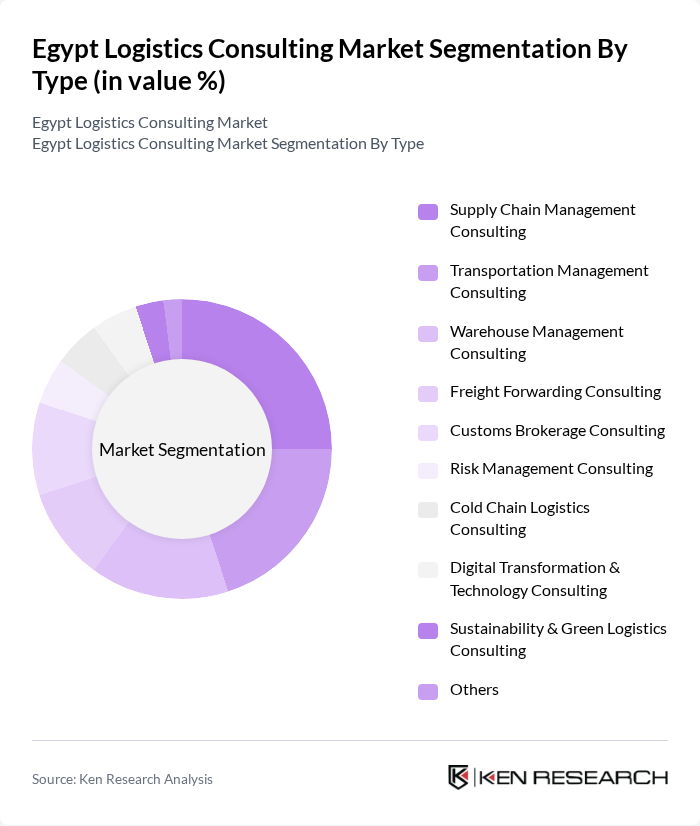

By Type:The logistics consulting market is segmented into Supply Chain Management Consulting, Transportation Management Consulting, Warehouse Management Consulting, Freight Forwarding Consulting, Customs Brokerage Consulting, Risk Management Consulting, Cold Chain Logistics Consulting, Digital Transformation & Technology Consulting, Sustainability & Green Logistics Consulting, and Others. Each segment addresses specific logistics challenges, such as optimizing supply chains, improving transportation efficiency, enhancing warehouse operations, ensuring regulatory compliance, and integrating digital technologies for better visibility and control .

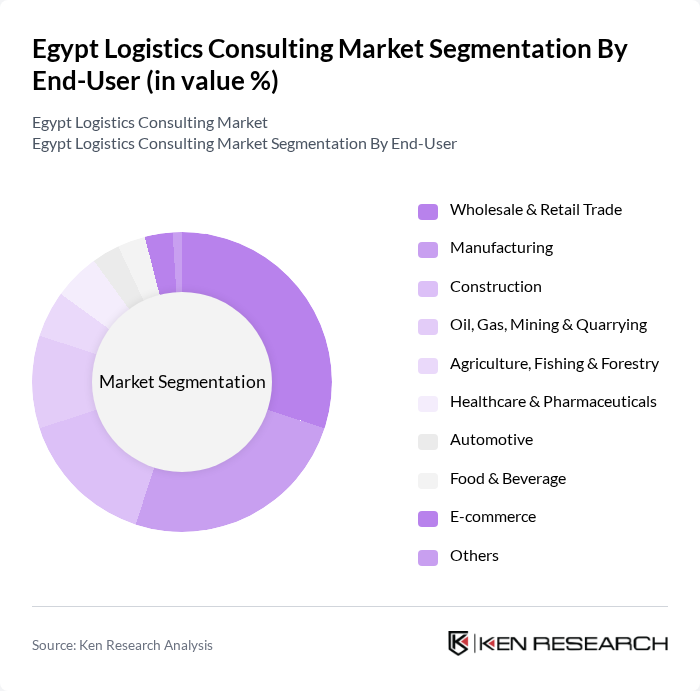

By End-User:The end-user segments in the logistics consulting market include Wholesale & Retail Trade, Manufacturing, Construction, Oil, Gas, Mining & Quarrying, Agriculture, Fishing & Forestry, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, E-commerce, and Others. Consulting firms provide tailored solutions to address the distinct logistics requirements of each sector, such as supply chain optimization for manufacturing, cold chain solutions for healthcare and food, and digital transformation for e-commerce .

The Egypt Logistics Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as A.T. Kearney, Deloitte Consulting, PwC Advisory Services, McKinsey & Company, Accenture, KPMG, Ernst & Young, Roland Berger, BCG (Boston Consulting Group), Capgemini, Oliver Wyman, Bain & Company, GEP Worldwide, Chainalytics, Agility Logistics, DB Schenker Egypt, CEVA Logistics Egypt, Maersk Egypt, Nile Logistics, and Egytrans (Egyptian Transport & Commercial Services Co.) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Egypt logistics consulting market appears promising, driven by ongoing digital transformation and sustainability initiatives. As businesses increasingly prioritize efficiency and environmental responsibility, consulting firms will play a crucial role in guiding these transitions. The anticipated growth in renewable energy logistics and smart logistics solutions will create new avenues for consulting services, enabling firms to capitalize on emerging trends and enhance their competitive edge in a rapidly evolving market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Supply Chain Management Consulting Transportation Management Consulting Warehouse Management Consulting Freight Forwarding Consulting Customs Brokerage Consulting Risk Management Consulting Cold Chain Logistics Consulting Digital Transformation & Technology Consulting Sustainability & Green Logistics Consulting Others |

| By End-User | Wholesale & Retail Trade Manufacturing Construction Oil, Gas, Mining & Quarrying Agriculture, Fishing & Forestry Healthcare & Pharmaceuticals Automotive Food & Beverage E-commerce Others |

| By Service Model | Project-Based Consulting Retainer-Based Consulting On-Demand Consulting Managed Services Others |

| By Industry Vertical | Consumer Goods Pharmaceuticals Electronics Construction Telecommunications Oil & Gas Agriculture Others |

| By Geographic Focus | Greater Cairo Alexandria & Coastal Regions Suez Canal Corridor Upper Egypt Others |

| By Technology Utilization | AI and Machine Learning IoT Solutions Blockchain Technology Cloud-Based Solutions Automation & Robotics Others |

| By Client Size | Large Enterprises Medium Enterprises Small Enterprises Startups Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Freight Forwarding Services | 100 | Logistics Coordinators, Freight Managers |

| Warehousing Solutions | 80 | Warehouse Managers, Operations Directors |

| Last-Mile Delivery Services | 70 | Delivery Managers, Supply Chain Managers |

| Cold Chain Logistics | 50 | Quality Control Managers, Logistics Supervisors |

| Logistics Technology Adoption | 90 | IT Managers, Digital Transformation Leads |

The Egypt Logistics Consulting Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for efficient supply chain solutions, e-commerce expansion, and infrastructure investments.