Region:Central and South America

Author(s):Shubham

Product Code:KRAA1051

Pages:93

Published On:August 2025

By Type:The logistics consulting market can be segmented into various types, including Supply Chain Strategy Consulting, Operational Improvement Consulting, Technology Implementation Consulting, Compliance and Risk Management Consulting, Freight Forwarding & Transportation Consulting, Warehousing & Inventory Optimization Consulting, and Others. Each of these segments plays a crucial role in addressing specific client needs and enhancing operational efficiencies .

The Supply Chain Strategy Consulting segment is currently dominating the market due to the increasing complexity of global supply chains, the rise of nearshoring, and the need for businesses to optimize their logistics operations. Companies are focusing on strategic planning to enhance efficiency, reduce costs, and improve service levels. This segment is particularly appealing to organizations looking to gain a competitive edge through better supply chain management practices. The growing trend of digital transformation and adoption of advanced analytics in logistics is also driving demand for strategic consulting services .

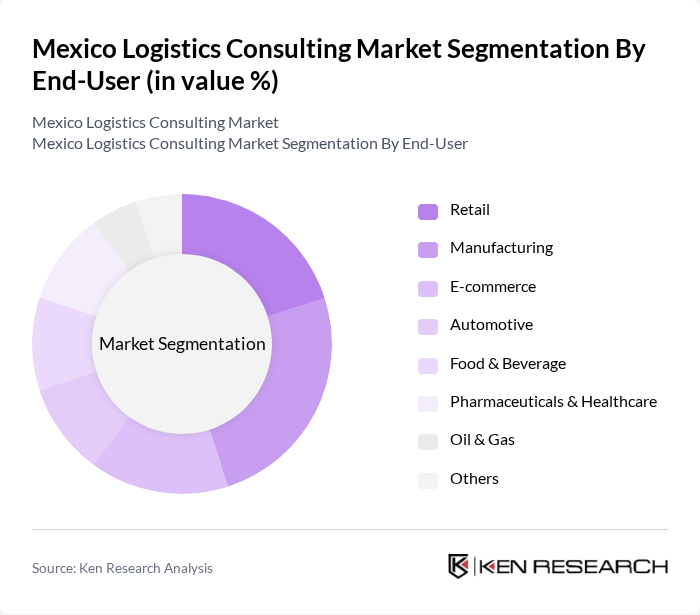

By End-User:The logistics consulting market is segmented by end-user industries, including Retail, Manufacturing, E-commerce, Automotive, Food & Beverage, Pharmaceuticals & Healthcare, Oil & Gas, and Others. Each of these sectors has unique logistics needs and challenges, driving demand for specialized consulting services .

The Manufacturing sector is the leading end-user in the logistics consulting market, driven by the need for efficient supply chain management and operational improvements. Manufacturers are increasingly adopting advanced logistics strategies to streamline their operations, reduce costs, and enhance product delivery timelines. The rise of Industry 4.0, automation, and nearshoring in manufacturing processes further fuels the demand for specialized consulting services tailored to this sector .

The Mexico Logistics Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deloitte Mexico, PwC Mexico, KPMG Mexico, EY Mexico, Accenture Mexico, BCG Mexico, McKinsey & Company Mexico, Capgemini Mexico, Roland Berger Mexico, A.T. Kearney Mexico, Oliver Wyman Mexico, Sintec Consulting, Miebach Consulting Mexico, Tsol (Total Solutions Logistics), Grupo Prodensa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics consulting market in Mexico appears promising, driven by ongoing investments in infrastructure and technology. As e-commerce continues to expand, businesses will increasingly seek expert guidance to optimize their supply chains. Additionally, the focus on sustainability and green logistics practices will shape consulting strategies, encouraging firms to adopt eco-friendly solutions. Overall, the market is expected to evolve, with consulting firms playing a pivotal role in helping businesses adapt to changing consumer demands and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Supply Chain Strategy Consulting Operational Improvement Consulting Technology Implementation Consulting Compliance and Risk Management Consulting Freight Forwarding & Transportation Consulting Warehousing & Inventory Optimization Consulting Others |

| By End-User | Retail Manufacturing E-commerce Automotive Food & Beverage Pharmaceuticals & Healthcare Oil & Gas Others |

| By Service Model | Project-Based Consulting Retainer-Based Consulting On-Demand Consulting Digital/Remote Consulting Others |

| By Industry Vertical | Food and Beverage Pharmaceuticals Consumer Goods Electronics Construction Agriculture Others |

| By Geographic Focus | Northern Mexico (Border/Cross-Border Logistics) Central Mexico (Mexico City & Surroundings) Southern Mexico Gulf Coast Region Pacific Coast Region Others |

| By Consulting Duration | Short-Term Consulting Long-Term Consulting Project-Based Consulting Others |

| By Client Size | Small Enterprises Medium Enterprises Large Enterprises Multinational Corporations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 100 | Logistics Coordinators, Supply Chain Managers |

| Manufacturing Supply Chain | 80 | Operations Directors, Procurement Managers |

| Third-Party Logistics Providers | 60 | Business Development Managers, Account Executives |

| Last-Mile Delivery Services | 50 | Delivery Operations Managers, Fleet Supervisors |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Logistics Analysts |

The Mexico Logistics Consulting Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for efficient supply chain management, digitalization, nearshoring trends, and the expansion of e-commerce.