Region:Asia

Author(s):Shubham

Product Code:KRAA1061

Pages:90

Published On:August 2025

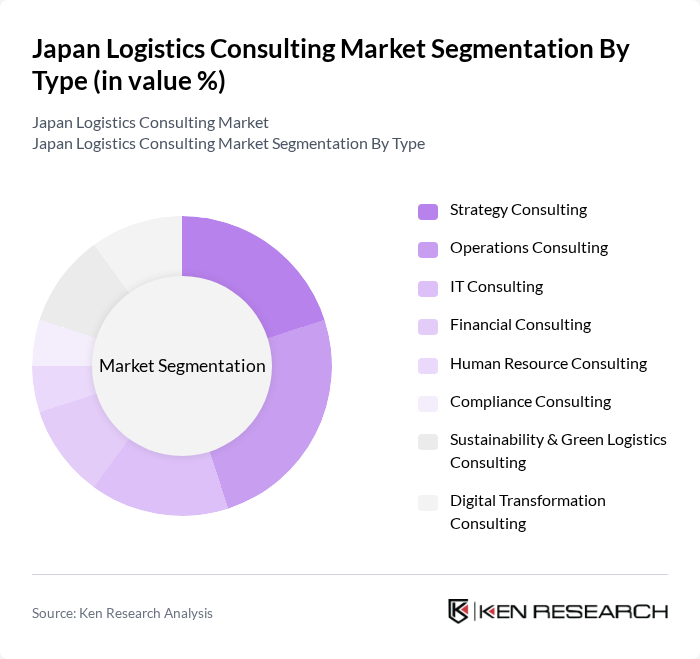

By Type:The market is segmented into various types of consulting services, including Strategy Consulting, Operations Consulting, IT Consulting, Financial Consulting, Human Resource Consulting, Compliance Consulting, Sustainability & Green Logistics Consulting, and Digital Transformation Consulting. Each of these segments addresses specific needs within the logistics sector, such as supply chain optimization, regulatory compliance, technology integration, and environmental sustainability .

The Operations Consulting segment is currently dominating the market due to the increasing demand for efficiency and cost reduction in logistics processes. Companies are focusing on optimizing their supply chains, which has led to a surge in the need for operational expertise. This segment is characterized by a high volume of projects aimed at improving logistics performance, reducing lead times, and enhancing service levels. The growing trend of automation, digital transformation, and technology integration further supports the expansion of this segment .

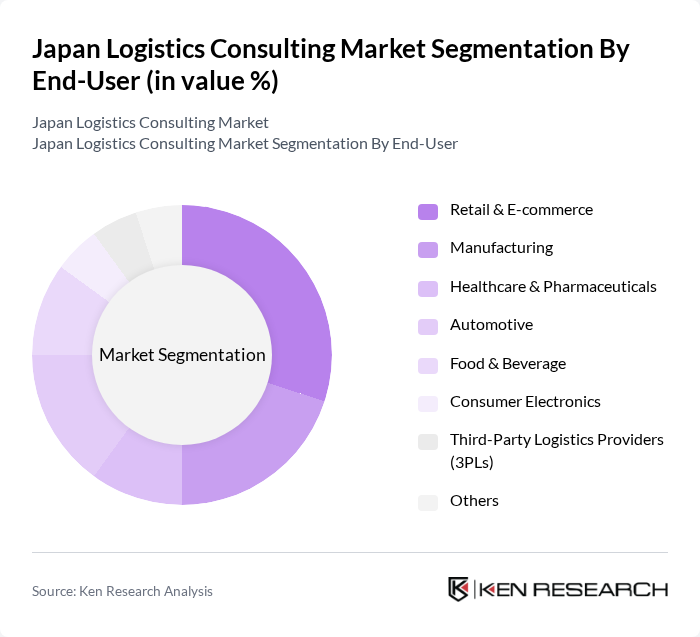

By End-User:The market is segmented by end-users, including Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, Consumer Electronics, Third-Party Logistics Providers (3PLs), and Others. Each end-user segment has unique requirements and challenges that logistics consulting services aim to address, such as supply chain resilience, regulatory compliance, and technology adoption .

The Retail & E-commerce segment is leading the market due to the rapid growth of online shopping, increased consumer expectations for fast and reliable delivery, and the need for efficient logistics solutions to meet these demands. This segment requires specialized consulting services to enhance supply chain visibility, manage inventory effectively, and ensure timely deliveries. The increasing competition in the e-commerce space and the adoption of omnichannel strategies further drive the demand for logistics consulting services tailored to this sector .

The Japan Logistics Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Co., Ltd., Yamato Transport Co., Ltd. (Yamato Holdings), Kintetsu World Express, Inc., Hitachi Transport System, Ltd. (Logisteed, Ltd.), Seino Holdings Co., Ltd., SG Holdings Co., Ltd. (Sagawa Express), Mitsui-Soko Holdings Co., Ltd., Senko Group Holdings Co., Ltd., Marubeni Logistics Corporation, Fujitsu Limited (Fujitsu Logistics), Daiseki Co., Ltd., Kuehne + Nagel Japan Ltd., DB Schenker Japan, CEVA Logistics Japan, Deloitte Tohmatsu Consulting LLC (Japan Logistics Practice) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Japan logistics consulting market appears promising, driven by ongoing digital transformation and a growing emphasis on sustainability. As companies increasingly adopt integrated supply chain solutions, the demand for expert consulting services will rise. Furthermore, the focus on real-time data analytics will enhance decision-making processes, enabling firms to respond swiftly to market changes. Collaborative logistics models are also expected to gain traction, fostering partnerships that optimize resource utilization and improve service delivery across the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategy Consulting Operations Consulting IT Consulting Financial Consulting Human Resource Consulting Compliance Consulting Sustainability & Green Logistics Consulting Digital Transformation Consulting |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Consumer Electronics Third-Party Logistics Providers (3PLs) Others |

| By Service Model | On-site Consulting Remote Consulting Hybrid Consulting |

| By Project Duration | Short-term Projects Long-term Projects |

| By Industry Focus | Supply Chain Management Logistics Optimization Risk & Compliance Management Technology Integration |

| By Geographic Focus | Domestic Logistics International Logistics |

| By Pricing Model | Fixed Pricing Hourly Billing Performance-based Pricing Retainer-based Consulting |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 60 | Logistics Managers, Supply Chain Analysts |

| Manufacturing Supply Chain | 50 | Operations Directors, Procurement Managers |

| Third-Party Logistics Providers | 40 | Business Development Managers, Account Executives |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Logistics Coordinators |

| Last-Mile Delivery Solutions | 50 | Delivery Operations Managers, Customer Experience Leads |

The Japan Logistics Consulting Market is valued at approximately USD 3.7 billion, reflecting a five-year historical analysis. This growth is driven by the increasing complexity of supply chains and the rapid expansion of e-commerce.