Region:Africa

Author(s):Dev

Product Code:KRAA1605

Pages:88

Published On:August 2025

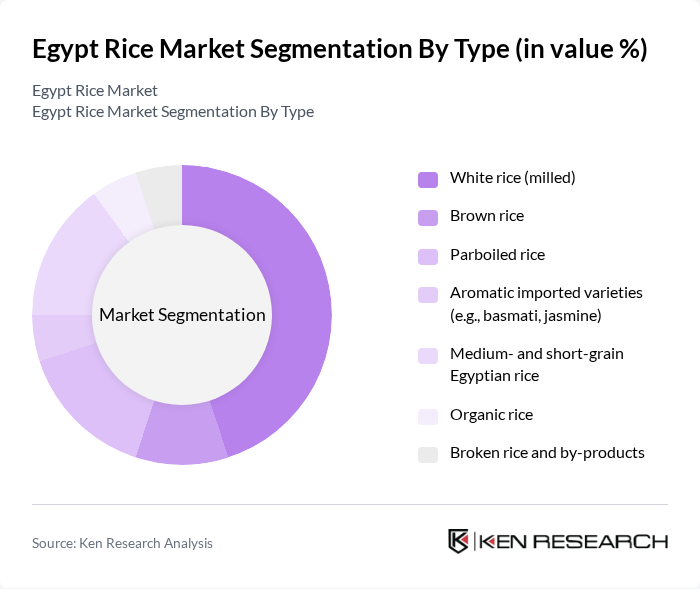

By Type:The rice market can be segmented into various types, including white rice (milled), brown rice, parboiled rice, aromatic imported varieties (e.g., basmati, jasmine), medium- and short-grain Egyptian rice, organic rice, and broken rice and by-products. Among these, white rice (milled) is the most consumed type due to its versatility and preference among consumers for everyday meals. The demand for organic rice is also on the rise as health-conscious consumers seek healthier options.

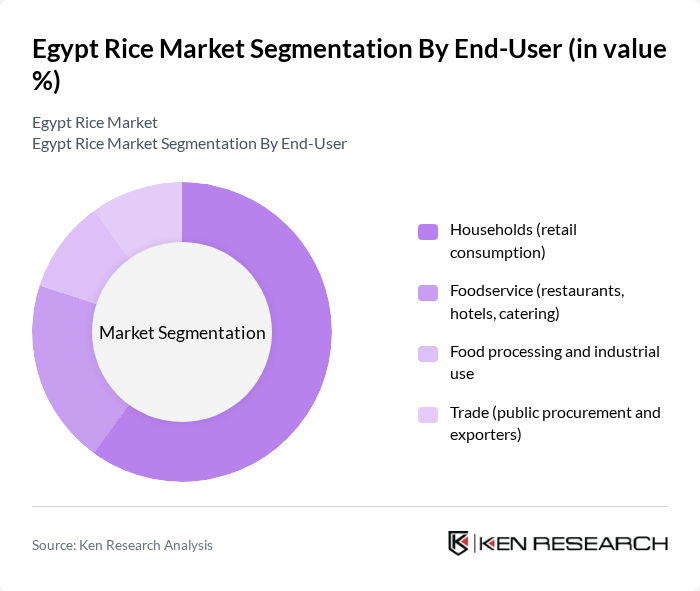

By End-User:The end-user segmentation includes households (retail consumption), foodservice (restaurants, hotels, catering), food processing and industrial use, and trade (public procurement and exporters). Households represent the largest segment, driven by the staple nature of rice in daily meals. The foodservice sector is also growing, as more restaurants and catering services incorporate rice dishes into their menus, reflecting changing consumer preferences.

The Egypt Rice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Egyptian Holding Company for Food Industries (EHCFI), General Authority for Supply Commodities (GASC), Al Doha for Food Industries, El Maleka for Food Industries, Edita Food Industries (rice snacks and cereals portfolio), Abo Donkol for Food Industries (Rice Land), El Weleily Group (grains trading and milling), Americana Egypt (foodservice procurement), Seoudi Supermarket (private label rice), Carrefour Egypt (Majid Al Futtaim Retail – private label rice), HyperOne (private label and distribution), BIM Egypt (B?M) – discount retail private label, Metro Markets & Fresh Food Market (retail private label), Rashid Rice Mills (Kafr El Sheikh), North Delta Rice Mills (Dakahlia) contribute to innovation, geographic expansion, and service delivery in this space.

The Egypt rice market is poised for significant developments as it navigates challenges and opportunities. With a focus on sustainable practices and modern farming techniques, the sector is likely to enhance productivity and resilience. The government's commitment to supporting local farmers through subsidies and training programs will be crucial. Additionally, the increasing consumer demand for organic and value-added rice products presents a promising avenue for growth, potentially transforming the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | White rice (milled) Brown rice Parboiled rice Aromatic imported varieties (e.g., basmati, jasmine) Medium- and short-grain Egyptian rice Organic rice Broken rice and by-products |

| By End-User | Households (retail consumption) Foodservice (restaurants, hotels, catering) Food processing and industrial use Trade (public procurement and exporters) |

| By Distribution Channel | Supermarkets and hypermarkets Traditional grocery and kirana stores Wholesale markets Online retail and quick commerce |

| By Packaging Type | Bulk (25–50 kg sacks) Retail packs (1–10 kg) Institutional packs (10–25 kg) Eco-friendly and recyclable packaging |

| By Price Range | Premium Mid-range Economy |

| By Quality | Premium quality (low broken, high whiteness) Standard quality Value/low quality (higher broken) |

| By Region | Nile Delta (Kafr El Sheikh, Dakahlia, Sharqia) Greater Cairo and Giza Alexandria and West Delta Upper Egypt |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rice Farmers | 120 | Smallholder Farmers, Large-scale Producers |

| Rice Mill Operators | 90 | Mill Managers, Production Supervisors |

| Distributors and Wholesalers | 80 | Supply Chain Managers, Sales Representatives |

| Retailers | 70 | Store Managers, Category Buyers |

| Consumers | 140 | Household Decision Makers, Health-conscious Shoppers |

The Egypt Rice Market is valued at approximately USD 2.0 billion, driven by increasing demand for rice as a staple food and government initiatives aimed at enhancing agricultural productivity and food security.