Region:Europe

Author(s):Shubham

Product Code:KRAC0721

Pages:93

Published On:August 2025

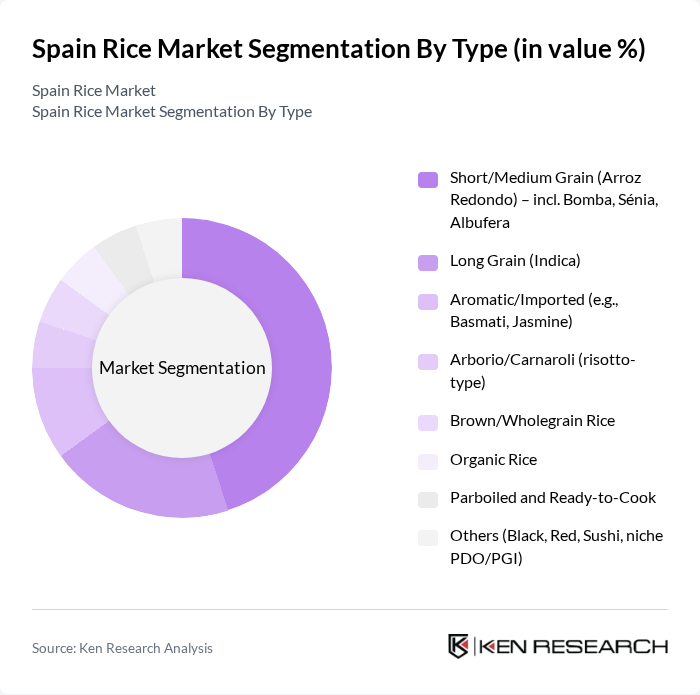

By Type:The rice market in Spain is segmented into various types, including short/medium grain, long grain, aromatic/imported, Arborio/Carnaroli, brown/wholegrain, organic, parboiled, and others. Among these, short/medium grain rice, particularly varieties like Bomba and Sénia, dominates the market due to their widespread use in traditional Spanish dishes such as paella. The preference for these rice types is driven by their texture and ability to absorb flavors, making them a staple in households and restaurants alike .

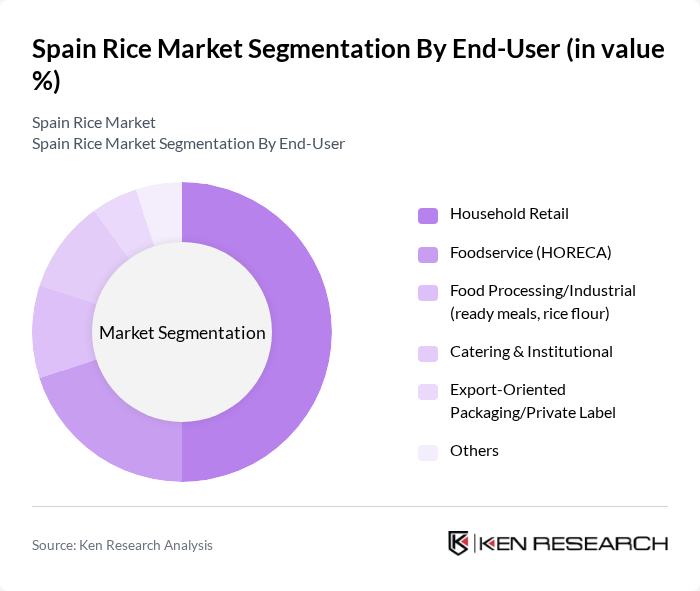

By End-User:The end-user segmentation of the rice market in Spain includes household retail, foodservice (HORECA), food processing/industrial, catering & institutional, export-oriented packaging/private label, and others. The household retail segment is the largest, driven by strong at-home cooking culture and supermarket dominance in rice sales, with supermarkets accounting for the majority of purchases; increased home consumption has structurally supported this channel .

The Spain Rice Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ebro Foods, S.A. (brands: SOS, Brillante, La Fallera, La Cigala Spain), Herba Ricemills, S.L.U. (Ebro subsidiary; Seville/Andalusia operations), Arrocerías Pons, S.A., Arroz Dacsa, S.A. (DACSA Group), Arrocerías Herba (Arroz SOS/Brillante manufacturing units), La Fallera (marca de Arroz – Valencia, Ebro Foods), Sivaris, S.L. (Arroz de Valencia PDO specialist), Arroz Tartana – Arrocerías Tartana, S.L., Illa d’Or Rice (Arrossaires del Delta de l’Ebre, SCCL – Nomen brand), Arrossaires del Delta de l’Ebre, SCCL (Nomen/Segadors del Delta), Arroz Brazal, S.L., Arroz de Calasparra – Consejo Regulador DOP (Cooperativa Virgen de la Esperanza / Virgen de la Esperanza S.C.L.), Arroz de Valencia – Consejo Regulador D.O.P., Arròs de Pals – Marca de Garantia (Productores de Pals), Arroz Nomen – Nomen Foods, S.L. contribute to innovation, geographic expansion, and service delivery in this space.

The Spain rice market is poised for growth, driven by increasing consumer preferences for organic and specialty rice varieties. Technological advancements in processing and sustainable farming practices are expected to enhance production efficiency. Additionally, the rise of e-commerce platforms will facilitate broader market access for local producers. As health-conscious consumers seek high-quality rice options, the market is likely to see a shift towards value-added products, further stimulating growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Short/Medium Grain (Arroz Redondo) – incl. Bomba, Sénia, Albufera Long Grain (Indica) Aromatic/Imported (e.g., Basmati, Jasmine) Arborio/Carnaroli (risotto-type) Brown/Wholegrain Rice Organic Rice Parboiled and Ready-to-Cook Others (Black, Red, Sushi, niche PDO/PGI) |

| By End-User | Household Retail Foodservice (HORECA) Food Processing/Industrial (ready meals, rice flour) Catering & Institutional Export-Oriented Packaging/Private Label Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/Direct-to-Consumer Specialty & Gourmet Stores Wholesale/Cash & Carry Convenience/Traditional Retail Others |

| By Packaging Type | Bulk (10–50 kg) for foodservice/industry Retail Packs (0.5–5 kg) Eco-Friendly/Recyclable Vacuum/Modified Atmosphere Ready-to-Heat (pouches/cups) Others |

| By Price Range | Economy Mid-Range Premium Specialty/PDO-PGI Others |

| By Quality | Standard Premium/Selected Organic/Certified Others |

| By Region | Eastern Spain (Valencia, Ebro Delta–Catalonia) Southern Spain (Andalusia, Extremadura) Central Spain (Castilla-La Mancha, Madrid) Northern Spain Balearic & Canary Islands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rice Producers | 90 | Farm Owners, Agricultural Managers |

| Distributors and Wholesalers | 80 | Supply Chain Managers, Sales Directors |

| Retail Sector | 70 | Store Managers, Category Buyers |

| Consumers | 140 | Household Decision Makers, Health-Conscious Shoppers |

| Food Service Industry | 60 | Restaurant Owners, Menu Planners |

The Spain Rice Market is valued at approximately EUR 1.1 billion, reflecting a consistent trade and consumption value. This valuation is supported by elevated import values and strong retail activity, particularly from leading companies like Ebro Foods and regional cooperatives.