Region:Africa

Author(s):Shubham

Product Code:KRAA0964

Pages:88

Published On:August 2025

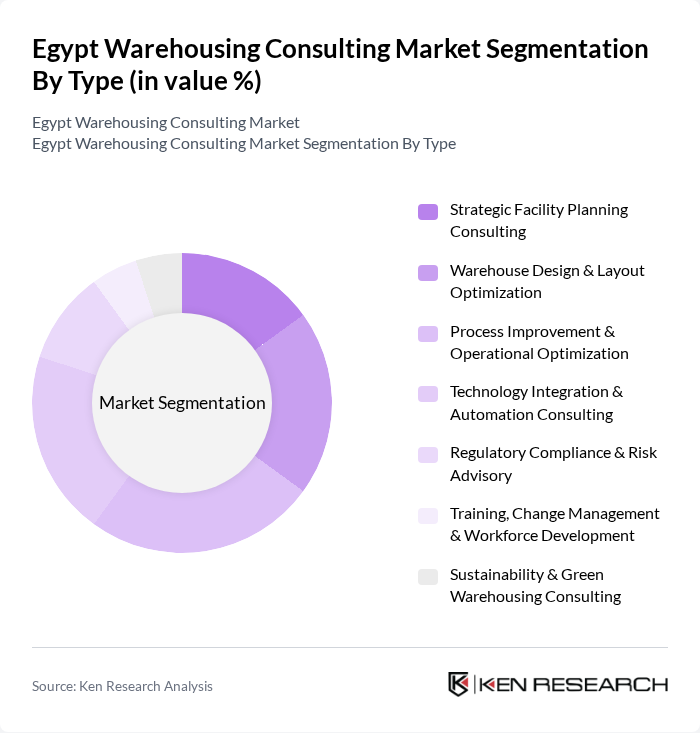

By Type:The market is segmented into various types of consulting services that cater to the specific needs of warehousing operations. The subsegments include:

Among these subsegments, Process Improvement & Operational Optimization is the leading segment, driven by the increasing need for businesses to enhance efficiency and reduce operational costs. Companies are focusing on streamlining their processes to adapt to the fast-paced market demands, leading to a surge in demand for consulting services that can provide tailored solutions. The emphasis on technology integration further supports this trend, as businesses seek to leverage data analytics and automation to optimize their warehousing operations .

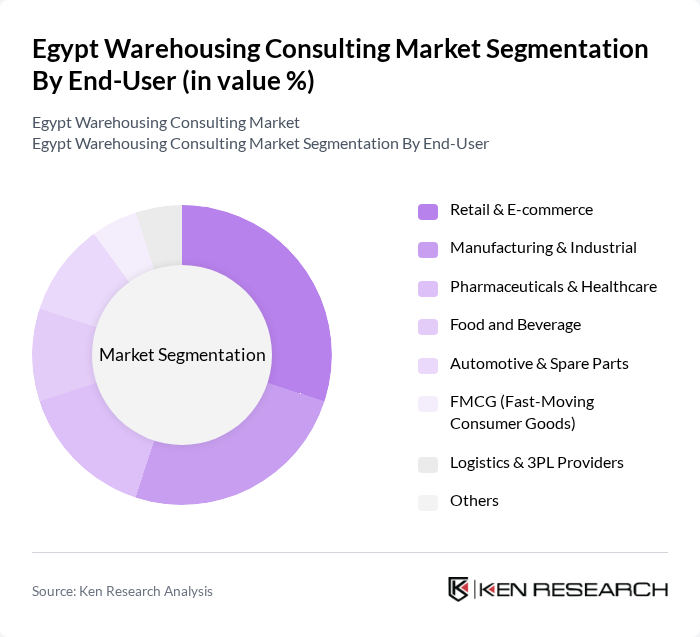

By End-User:The market is also segmented based on the end-users of warehousing consulting services. The subsegments include:

Retail & E-commerce is the dominant end-user segment, reflecting the rapid growth of online shopping and the need for efficient warehousing solutions to manage inventory and fulfill orders promptly. The increasing consumer preference for fast delivery options has compelled retailers to invest in advanced warehousing strategies, thereby driving the demand for consulting services tailored to this sector. Additionally, the manufacturing and industrial sectors are also significant contributors, as they seek to optimize their supply chains and improve operational efficiencies .

The Egypt Warehousing Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as JLL Egypt, CBRE Egypt, Savills Egypt, Colliers International Egypt, Aramex Egypt, Agility Logistics Egypt, DB Schenker Egypt, Kuehne + Nagel Egypt, DHL Supply Chain Egypt, CEVA Logistics Egypt, Giza Systems, Egytrans, Naqla, Trella, BPE Partners contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt warehousing consulting market appears promising, driven by ongoing investments in infrastructure and technology. As e-commerce continues to expand, businesses will increasingly prioritize efficient logistics and supply chain management. The integration of advanced technologies, such as AI and automation, will further enhance operational efficiency. Additionally, the government's commitment to improving logistics frameworks will create a conducive environment for consulting services, enabling companies to adapt to evolving market demands and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Facility Planning Consulting Warehouse Design & Layout Optimization Process Improvement & Operational Optimization Technology Integration & Automation Consulting Regulatory Compliance & Risk Advisory Training, Change Management & Workforce Development Sustainability & Green Warehousing Consulting |

| By End-User | Retail & E-commerce Manufacturing & Industrial Pharmaceuticals & Healthcare Food and Beverage Automotive & Spare Parts FMCG (Fast-Moving Consumer Goods) Logistics & 3PL Providers Others |

| By Service Model | Full-Service Consulting Specialized/Niche Consulting On-Demand/Project-Based Consulting Retainer-Based Advisory Implementation Support Services Others |

| By Project Size | Small Scale Projects (<5,000 sqm) Medium Scale Projects (5,000–20,000 sqm) Large Scale Projects (20,000–50,000 sqm) Mega Projects (>50,000 sqm) Others |

| By Geographic Focus | Greater Cairo Alexandria & Northern Coast Suez Canal Economic Zone Upper Egypt Industrial Zones (e.g., 6th of October, 10th of Ramadan) Others |

| By Duration of Engagement | Short-Term Engagements (<6 months) Medium-Term Engagements (6–18 months) Long-Term Engagements (>18 months) Project-Based Engagements Others |

| By Pricing Model | Fixed Fee Time & Materials (Hourly/Daily Billing) Performance-Based Pricing Retainer Fees Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Supply Chain Management | 50 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 40 | E-commerce Operations Managers, Inventory Control Specialists |

| Cold Storage Facilities | 40 | Facility Managers, Quality Assurance Officers |

| Third-Party Logistics Providers | 40 | Business Development Managers, Client Relationship Managers |

The Egypt Warehousing Consulting Market is valued at approximately USD 160 billion, reflecting significant growth driven by the expansion of e-commerce, demand for efficient supply chain solutions, and government infrastructure initiatives.