Region:Asia

Author(s):Geetanshi

Product Code:KRAA0162

Pages:90

Published On:August 2025

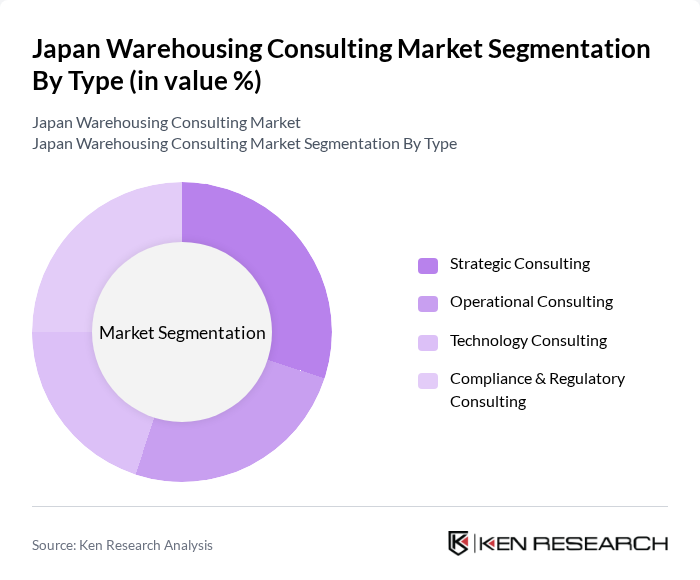

By Type:The market is segmented into four main types of consulting services:Strategic Consulting,Operational Consulting,Technology Consulting, andCompliance & Regulatory Consulting. Each of these segments plays a crucial role in addressing the diverse needs of businesses seeking to optimize their warehousing operations. Strategic Consulting focuses on aligning warehousing with corporate goals and long-term planning. Operational Consulting addresses process optimization and cost reduction. Technology Consulting emphasizes digital transformation, automation, and data analytics. Compliance & Regulatory Consulting ensures adherence to local and international standards, including environmental and labor regulations .

TheStrategic Consultingsegment is currently leading the market due to the increasing need for businesses to align their warehousing strategies with overall corporate goals. Companies are focusing on long-term planning and resource allocation to enhance operational efficiency. This segment is characterized by a growing trend towards data-driven decision-making, where analytics and market insights are leveraged to optimize warehousing processes. As businesses seek to improve their competitive edge, the demand for strategic consulting services remains robust .

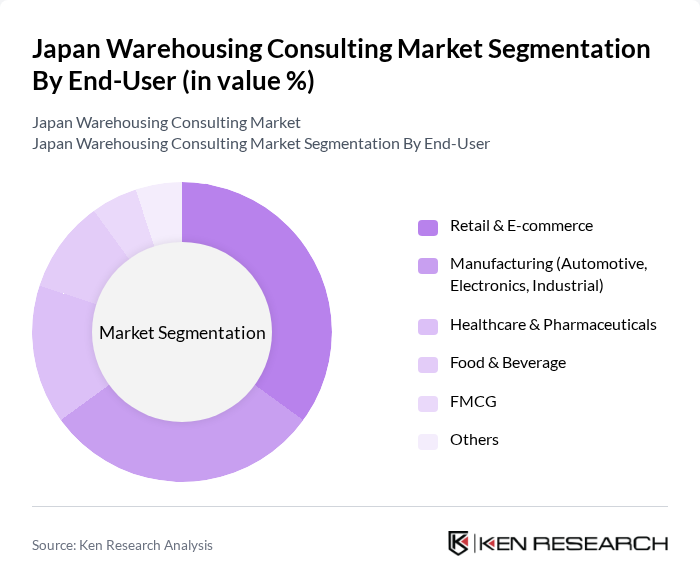

By End-User:The end-user segmentation includesRetail & E-commerce,Manufacturing (Automotive, Electronics, Industrial),Healthcare & Pharmaceuticals,Food & Beverage,FMCG, andOthers. Each sector has unique requirements and challenges that influence their demand for warehousing consulting services. Retail & E-commerce requires rapid fulfillment and inventory accuracy. Manufacturing emphasizes just-in-time delivery and supply chain integration. Healthcare & Pharmaceuticals need temperature-controlled storage and regulatory compliance. Food & Beverage focuses on perishability and traceability, while FMCG demands high throughput and distribution efficiency .

TheRetail & E-commercesector is the dominant end-user in the market, driven by the rapid growth of online shopping and the need for efficient inventory management. As consumer preferences shift towards convenience and speed, retailers are increasingly investing in advanced warehousing solutions to enhance their logistics capabilities. This trend is further supported by the rise of omnichannel retailing, where seamless integration between online and offline channels is crucial for success .

The Japan Warehousing Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Co., Ltd., Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd., Kintetsu World Express, Inc., Hitachi Transport System, Ltd. (now LOGISTEED, Ltd.), Seino Holdings Co., Ltd., Marubeni Corporation (Logistics Division), Mitsui-Soko Holdings Co., Ltd., Asahi Logistics Co., Ltd., Kuehne + Nagel Japan Ltd., DB Schenker Japan, DSV Solutions Japan, CEVA Logistics Japan, Geodis Japan, XPO Logistics (Japan Operations) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan warehousing consulting market appears promising, driven by ongoing digital transformation and the integration of advanced technologies. As businesses increasingly adopt automation and AI-driven solutions, the demand for expert consulting services will likely grow. Additionally, the focus on sustainability and green logistics practices will create new avenues for consulting firms to assist clients in meeting regulatory requirements and consumer expectations, positioning them favorably in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Operational Consulting Technology Consulting Compliance & Regulatory Consulting |

| By End-User | Retail & E-commerce Manufacturing (Automotive, Electronics, Industrial) Healthcare & Pharmaceuticals Food & Beverage FMCG Others |

| By Service Model | Project-Based Consulting Retainer-Based Consulting Performance-Based Consulting Hybrid Models |

| By Industry Vertical | Automotive Consumer Goods Electronics Food & Beverage Pharmaceuticals Others |

| By Geographic Focus | Urban Areas (Tokyo, Osaka, Nagoya, etc.) Regional Hubs (Fukuoka, Sapporo, etc.) Port Cities (Yokohama, Kobe, etc.) Rural Areas |

| By Consulting Duration | Short-Term Engagements Long-Term Projects Ongoing Support & Managed Services Others |

| By Client Size | Small Enterprises Medium Enterprises Large Enterprises Multinational Corporations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 80 | Warehouse Managers, Logistics Coordinators |

| Automotive Supply Chain Management | 60 | Supply Chain Managers, Operations Directors |

| Pharmaceutical Distribution Centers | 40 | Compliance Officers, Warehouse Supervisors |

| E-commerce Fulfillment Centers | 70 | eCommerce Operations Managers, Logistics Analysts |

| Cold Chain Logistics | 50 | Temperature Control Specialists, Warehouse Managers |

The Japan Warehousing Consulting Market is valued at approximately USD 1.3 billion, driven by the increasing demand for efficient supply chain management, automation in logistics, and the growth of e-commerce, which necessitates optimized warehousing solutions.