Region:North America

Author(s):Shubham

Product Code:KRAA1100

Pages:85

Published On:August 2025

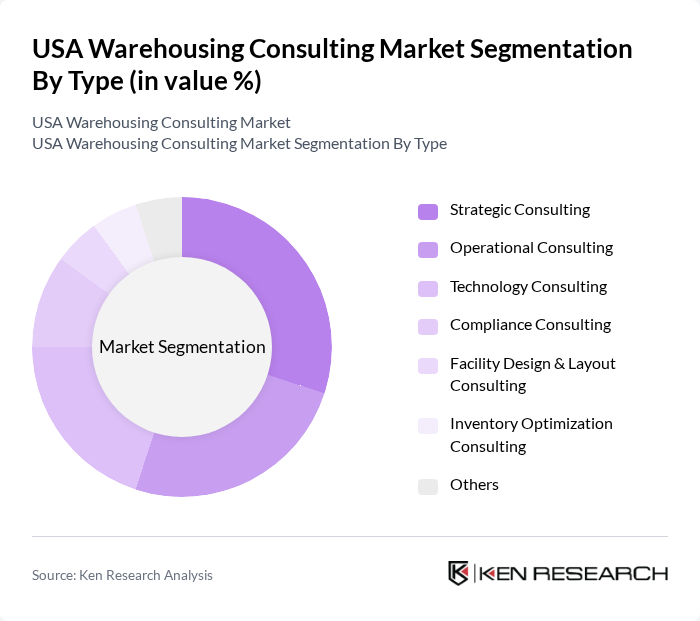

By Type:The warehousing consulting market is segmented into strategic consulting, operational consulting, technology consulting, compliance consulting, facility design & layout consulting, inventory optimization consulting, and others. Strategic consulting remains the leading sub-segment, driven by the need for businesses to align warehousing strategies with broader corporate objectives. The increasing complexity of supply chains, the integration of digital technologies, and the demand for cost optimization are prompting companies to seek expert guidance for enhancing warehouse performance and resilience .

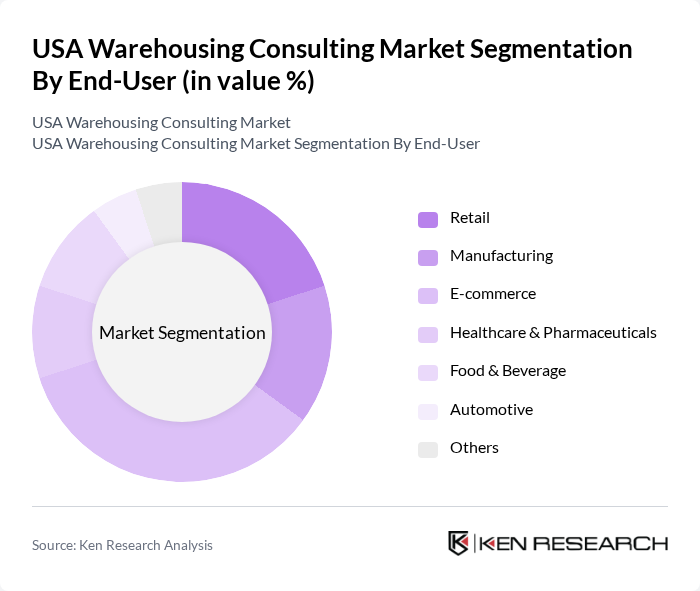

By End-User:The end-user segmentation of the warehousing consulting market includes retail, manufacturing, e-commerce, healthcare & pharmaceuticals, food & beverage, automotive, and others. The e-commerce sector is the dominant end-user, as the rapid expansion of online shopping and omnichannel retailing has driven significant demand for advanced warehousing solutions. E-commerce companies require sophisticated logistics strategies, automation, and inventory management to ensure fast and accurate order fulfillment, making them a primary driver for warehousing consulting services .

The USA Warehousing Consulting Market is characterized by a dynamic mix of regional and international players. Leading participants such as McKinsey & Company, Boston Consulting Group (BCG), Deloitte Consulting, Accenture, KPMG, PwC Advisory Services, Chainalytics (A NTT DATA Company), GEP Worldwide, C.H. Robinson (TMC, a division of C.H. Robinson), Ryder Supply Chain Solutions, XPO Logistics, DB Schenker, Geodis, St. Onge Company, enVista, Fortna Inc., Miebach Consulting, Bricz, Sedlak Supply Chain Consultants, Tompkins Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the USA warehousing consulting market appears promising, driven by ongoing technological advancements and the increasing complexity of supply chains. As companies prioritize efficiency and sustainability, the demand for expert consulting services is expected to rise. Additionally, the integration of AI and automation technologies will further enhance operational capabilities, allowing businesses to adapt to evolving market conditions and consumer expectations, thereby solidifying the role of consultants in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Strategic Consulting Operational Consulting Technology Consulting Compliance Consulting Facility Design & Layout Consulting Inventory Optimization Consulting Others |

| By End-User | Retail Manufacturing E-commerce Healthcare & Pharmaceuticals Food & Beverage Automotive Others |

| By Service Model | Project-Based Consulting Retainer-Based Consulting On-Demand Consulting Advisory Services Others |

| By Geographic Focus | National Level Regional Level Local Level Others |

| By Industry Vertical | Consumer Goods Automotive Food and Beverage Pharmaceuticals Electronics Chemicals Others |

| By Consulting Duration | Short-Term Consulting Long-Term Consulting Project-Based Consulting Others |

| By Pricing Model | Fixed Pricing Hourly Pricing Value-Based Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 60 | Warehouse Managers, Logistics Coordinators |

| Manufacturing Supply Chain | 50 | Operations Managers, Supply Chain Analysts |

| E-commerce Fulfillment Centers | 45 | eCommerce Operations Managers, Inventory Control Specialists |

| Cold Storage Facilities | 40 | Facility Managers, Quality Assurance Officers |

| Third-Party Logistics Providers | 50 | Business Development Managers, Client Relationship Managers |

The USA Warehousing Consulting Market is valued at approximately USD 9.5 billion, reflecting a significant growth driven by the increasing demand for efficient supply chain management and advancements in logistics technologies.