Region:Europe

Author(s):Shubham

Product Code:KRAA2242

Pages:81

Published On:August 2025

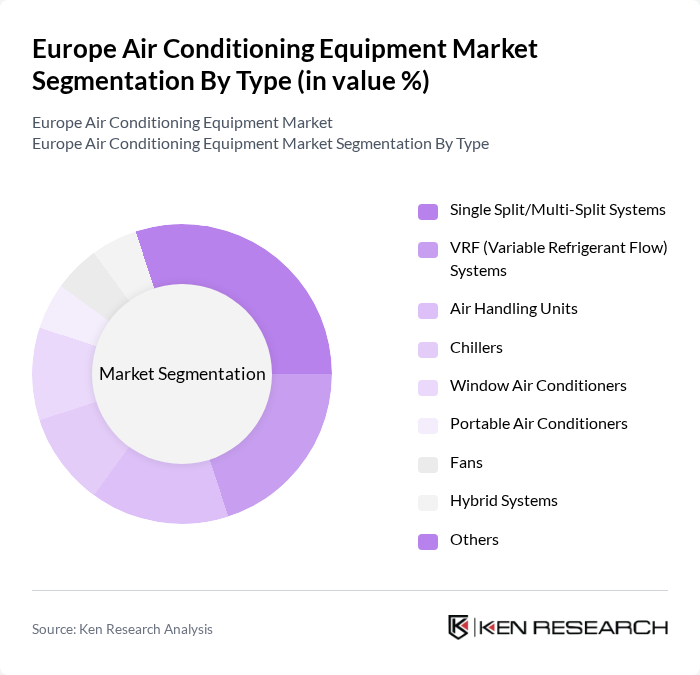

By Type:The market is segmented into various types of air conditioning systems, including Single Split/Multi-Split Systems, VRF (Variable Refrigerant Flow) Systems, Air Handling Units, Chillers, Window Air Conditioners, Portable Air Conditioners, Fans, Hybrid Systems, and Others. Each type addresses specific consumer needs and operational requirements, with Single Split and Multi-Split Systems and VRF Systems seeing increased demand in both residential and commercial applications due to their energy efficiency and flexibility. Air Handling Units and Chillers are primarily used in large-scale commercial and industrial facilities, while portable and window ACs cater to smaller spaces and temporary cooling needs. Hybrid and smart systems are gaining traction as consumers seek integrated, sustainable, and connected solutions .

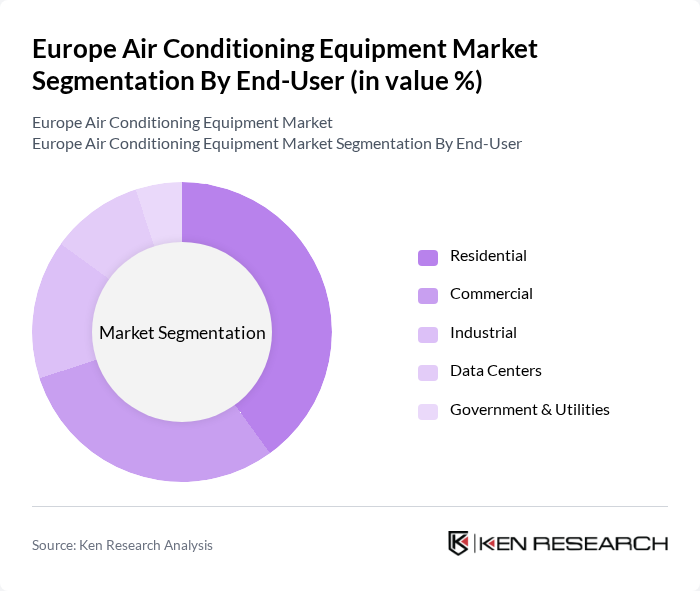

By End-User:The market is categorized based on end-users, including Residential, Commercial, Industrial, Data Centers, and Government & Utilities. Each segment has distinct requirements and preferences, influencing the types of air conditioning systems adopted in various settings. The residential segment is driven by the need for comfort and indoor air quality, while the commercial and industrial segments prioritize energy efficiency, scalability, and integration with building management systems. Data centers require precision cooling for equipment reliability, and government & utilities focus on sustainable and regulatory-compliant solutions .

The Europe Air Conditioning Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin Industries, Ltd., Mitsubishi Electric Corporation, Carrier Global Corporation, Trane Technologies plc, LG Electronics Inc., Panasonic Corporation, Johnson Controls International plc, Gree Electric Appliances, Inc., Fujitsu General Limited, Hitachi, Ltd., Samsung Electronics Co., Ltd., Lennox International Inc., Rheem Manufacturing Company, York International Corporation (Johnson Controls brand), Midea Group Co., Ltd., Whirlpool Corporation, Bosch Thermotechnology (Robert Bosch GmbH), Stulz GmbH, Systemair AB, FläktGroup contribute to innovation, geographic expansion, and service delivery in this space.

The future of the European air conditioning market is poised for transformation, driven by technological advancements and evolving consumer preferences. The integration of smart technologies and IoT in HVAC systems is expected to enhance energy efficiency and user experience. Additionally, the increasing focus on sustainability will likely accelerate the adoption of eco-friendly refrigerants and energy-efficient systems, aligning with the EU's environmental goals. As urbanization continues, the demand for innovative cooling solutions will remain robust, shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Single Split/Multi-Split Systems VRF (Variable Refrigerant Flow) Systems Air Handling Units Chillers Window Air Conditioners Portable Air Conditioners Fans Hybrid Systems Others |

| By End-User | Residential Commercial Industrial Data Centers Government & Utilities |

| By Component | Compressors Condensers Evaporators Expansion Valves Controls & Sensors Others |

| By Sales Channel | Direct Sales Distributors Online Retail Retail Stores |

| By Distribution Mode | Wholesale Retail E-commerce |

| By Price Range | Budget Mid-Range Premium |

| By Application | Residential Cooling Commercial Cooling Industrial Cooling Data Center Cooling HVAC Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Air Conditioning Market | 120 | Homeowners, Property Managers |

| Commercial HVAC Solutions | 90 | Facility Managers, Building Owners |

| Industrial Cooling Systems | 60 | Operations Managers, Plant Engineers |

| Energy-Efficient Technologies | 50 | Energy Consultants, Sustainability Officers |

| Smart HVAC Systems | 70 | IT Managers, Smart Home Technology Experts |

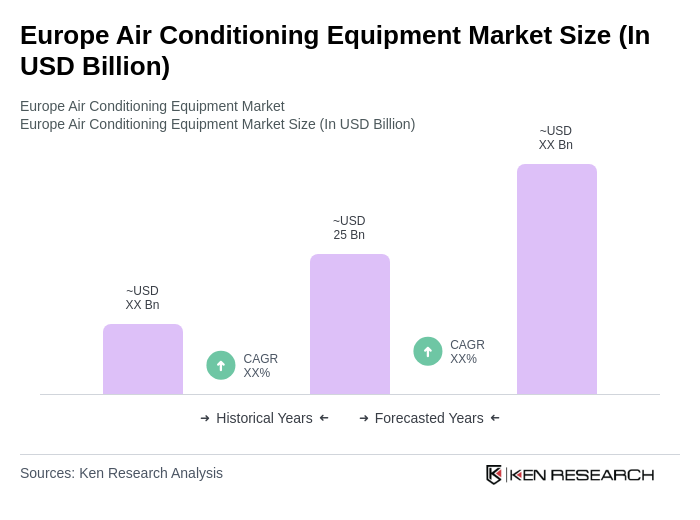

The Europe Air Conditioning Equipment Market is valued at approximately USD 25 billion, driven by factors such as rising temperatures, urbanization, and a focus on energy-efficient systems. This valuation is based on a five-year historical analysis of market trends.