Region:Global

Author(s):Shubham

Product Code:KRAC0584

Pages:86

Published On:August 2025

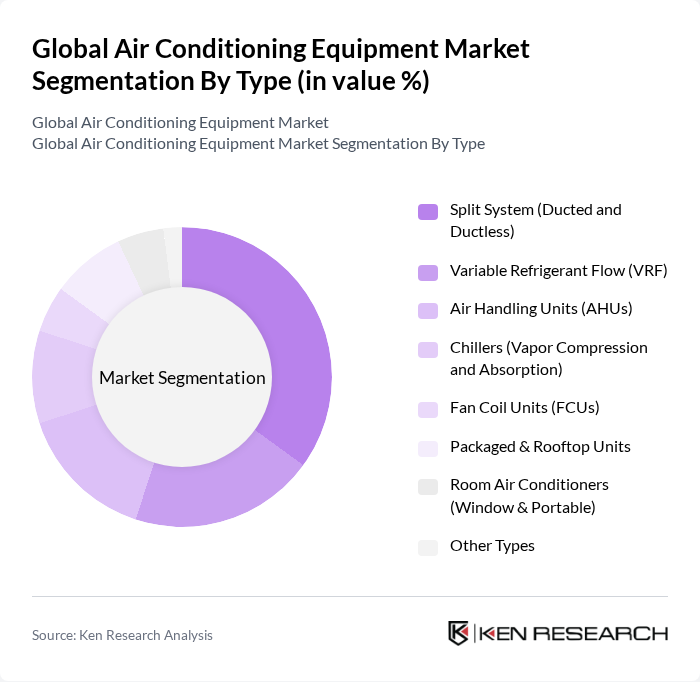

By Type:The air conditioning equipment market can be segmented into various types, including Split System (Ducted and Ductless), Variable Refrigerant Flow (VRF), Air Handling Units (AHUs), Chillers (Vapor Compression and Absorption), Fan Coil Units (FCUs), Packaged & Rooftop Units, Room Air Conditioners (Window & Portable), and Other Types. Among these, the Split System (Ducted and Ductless) segment is currently leading the market due to its versatility and efficiency, making it a preferred choice for both residential and commercial applications. The prominence of split systems is reinforced by widespread adoption in APAC residential and small commercial settings and regulatory emphasis on inverter efficiency classes .

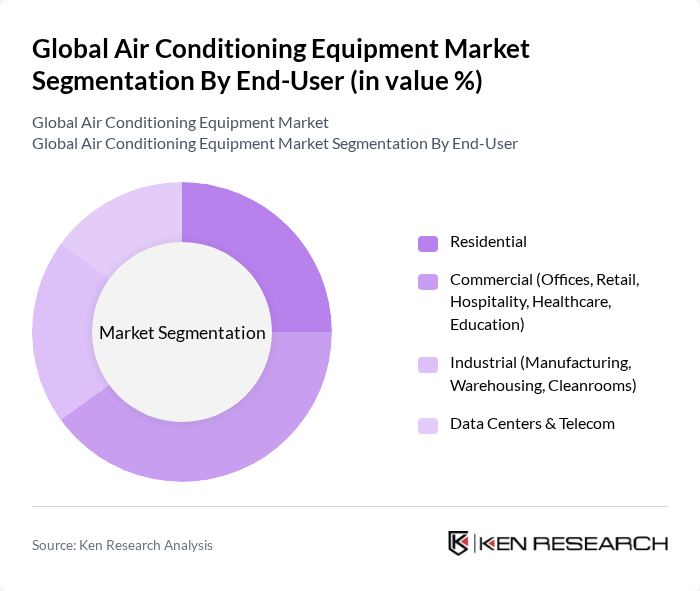

By End-User:The market can also be segmented by end-user categories, including Residential, Commercial (Offices, Retail, Hospitality, Healthcare, Education), Industrial (Manufacturing, Warehousing, Cleanrooms), and Data Centers & Telecom. The Commercial segment is currently the largest due to the increasing demand for air conditioning in office buildings, retail spaces, and hospitality sectors, driven by the need for comfortable environments and improved indoor air quality. APAC’s large installed base in commercial facilities and ongoing new-build activity further underpins commercial leadership .

The Global Air Conditioning Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Daikin Industries, Ltd., Carrier Global Corporation, Trane Technologies plc, Mitsubishi Electric Corporation, LG Electronics Inc., Panasonic Holdings Corporation, Johnson Controls International plc (York), Rheem Manufacturing Company, Gree Electric Appliances, Inc. of Zhuhai, Fujitsu General Limited, Hitachi, Ltd. (Johnson Controls–Hitachi Air Conditioning), Samsung Electronics Co., Ltd., Lennox International Inc., Haier Smart Home Co., Ltd. (Haier HVAC/MRCOOL brands), Midea Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the air conditioning equipment market is poised for transformation, driven by technological advancements and changing consumer preferences. The integration of smart technologies and IoT capabilities is expected to enhance system efficiency and user experience. Additionally, as sustainability becomes a priority, manufacturers will increasingly focus on eco-friendly refrigerants and energy-efficient designs. These trends will shape the market landscape, fostering innovation and creating new opportunities for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Split System (Ducted and Ductless) Variable Refrigerant Flow (VRF) Air Handling Units (AHUs) Chillers (Vapor Compression and Absorption) Fan Coil Units (FCUs) Packaged & Rooftop Units Room Air Conditioners (Window & Portable) Other Types |

| By End-User | Residential Commercial (Offices, Retail, Hospitality, Healthcare, Education) Industrial (Manufacturing, Warehousing, Cleanrooms) Data Centers & Telecom |

| By Application | Comfort Cooling Process Cooling Data Center & Mission-Critical Cooling Indoor Air Quality & Ventilation-Integrated Systems Others |

| By Distribution Channel | Direct (Project Sales/EPC) Dealer/Distributor Network Retail (Brand Stores & Multi-brand Outlets) Online/E-commerce Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Entry-Level Mid-Range Premium |

| By Energy & Efficiency | Inverter vs. Non-Inverter Efficiency Ratings (SEER/EER/IEER) Refrigerant Type (R-32, R-410A, R-290, Low-GWP Alternatives) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Air Conditioning Market | 140 | Homeowners, Property Managers |

| Commercial HVAC Systems | 110 | Facility Managers, Building Owners |

| Industrial Cooling Solutions | 80 | Operations Managers, Plant Engineers |

| Energy Efficiency Programs | 70 | Energy Auditors, Sustainability Consultants |

| Smart Air Conditioning Technologies | 90 | Product Managers, Technology Officers |

The Global Air Conditioning Equipment Market is valued at approximately USD 140 billion, reflecting significant demand across residential, commercial, and industrial applications. This valuation is based on a comprehensive five-year historical analysis of the market.