Region:North America

Author(s):Shubham

Product Code:KRAC0807

Pages:95

Published On:August 2025

By Type:The air conditioning equipment market can be segmented into various types, including Central Air Conditioning Systems, Ductless Mini-Split Systems, Packaged Air Conditioners, Window Air Conditioners, Portable Air Conditioners, Hybrid Systems (including Heat Pumps), Smart Air Conditioners, and Others (e.g., VRF/VRV Systems). Each of these subsegments caters to different consumer needs and preferences, with varying levels of efficiency, installation complexity, and cost. Central air conditioning systems continue to dominate due to their widespread use in residential and commercial buildings, while ductless mini-split and smart systems are gaining traction for their energy efficiency and ease of installation .

By End-User:The market can also be segmented by end-user categories, which include Residential, Commercial (Offices, Retail, Hospitality, Healthcare, Education, etc.), Industrial (Manufacturing, Warehousing, Data Centers, etc.), and Government & Utilities. Each segment has distinct requirements and preferences, influencing the types of air conditioning systems adopted. The residential segment holds the largest share, driven by the growth in housing, smart home adoption, and consumer focus on indoor comfort and air quality. The commercial segment is also significant, fueled by real estate development and infrastructure upgrades .

The North America Air Conditioning Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carrier Global Corporation, Trane Technologies plc, Lennox International Inc., Daikin North America LLC, Rheem Manufacturing Company, Goodman Manufacturing Company, L.P., York International Corporation (Johnson Controls), Mitsubishi Electric US, Inc., Bosch Thermotechnology Corp., Fujitsu General America, Inc., Panasonic Corporation of North America, Hitachi America, Ltd., Samsung HVAC America, LLC, LG Electronics USA, Inc., Nortek Global HVAC LLC contribute to innovation, geographic expansion, and service delivery in this space. These companies maintain market leadership through extensive distribution networks, continuous product innovation, and a focus on sustainable, energy-efficient solutions .

The North American air conditioning equipment market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The integration of smart technologies is expected to enhance system efficiency and user experience, while sustainability initiatives will push manufacturers towards eco-friendly solutions. As urbanization continues, the demand for innovative HVAC systems will rise, creating opportunities for growth. Companies that adapt to these trends and invest in R&D will likely gain a competitive edge in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Central Air Conditioning Systems Ductless Mini-Split Systems Packaged Air Conditioners Window Air Conditioners Portable Air Conditioners Hybrid Systems (including Heat Pumps) Smart Air Conditioners Others (e.g., VRF/VRV Systems) |

| By End-User | Residential Commercial (Offices, Retail, Hospitality, Healthcare, Education, etc.) Industrial (Manufacturing, Warehousing, Data Centers, etc.) Government & Utilities |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Distributors/Dealers |

| By Application | Residential Cooling Commercial Cooling Industrial Cooling HVAC Systems (Integrated Heating, Ventilation, and Air Conditioning) |

| By Price Range | Budget Mid-Range Premium |

| By Energy Source | Electric Gas Renewable Energy (e.g., Solar-powered AC) |

| By Region | Northeast Midwest South West |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Air Conditioning Purchases | 100 | Homeowners, Property Managers |

| Commercial HVAC System Installations | 80 | Facility Managers, Building Owners |

| Energy Efficiency Upgrades | 60 | Energy Auditors, Sustainability Consultants |

| Retail HVAC Equipment Sales | 50 | Sales Representatives, Store Managers |

| Technological Innovations in HVAC | 40 | R&D Managers, Product Development Engineers |

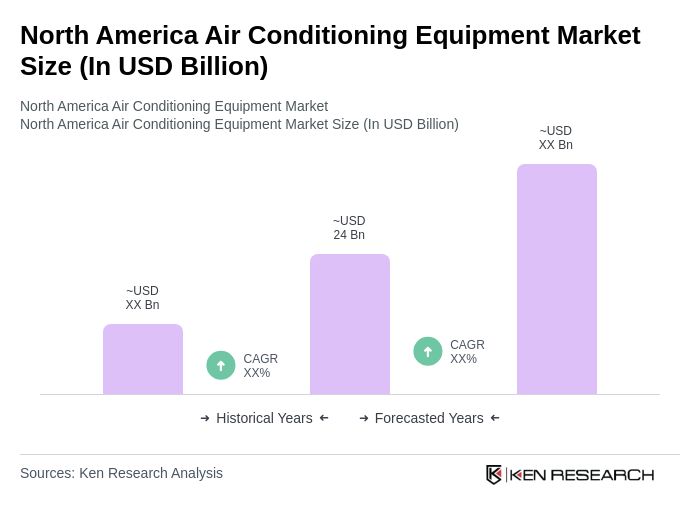

The North America Air Conditioning Equipment Market is valued at approximately USD 24 billion, driven by factors such as rising temperatures, urbanization, and a growing emphasis on energy-efficient systems. This market is expected to continue growing as demand for cooling solutions increases.