Region:Europe

Author(s):Dev

Product Code:KRAA2221

Pages:92

Published On:August 2025

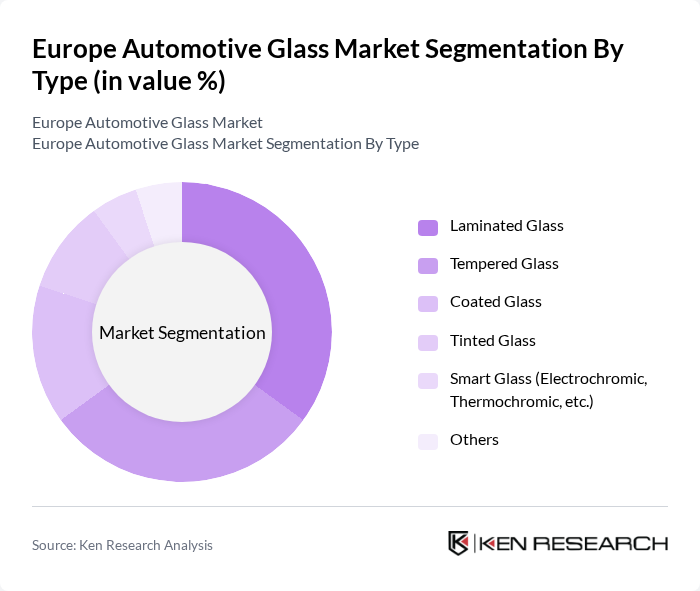

By Type:The market is segmented into various types of automotive glass, including laminated glass, tempered glass, coated glass, tinted glass, smart glass, and others. Each type serves specific functions and caters to different consumer preferences and safety standards. Laminated glass is primarily used for windshields due to its shatter-resistant properties and ability to reduce noise and UV radiation. Tempered glass is commonly used for side and rear windows, offering high impact resistance. Coated and tinted glass enhance comfort by reducing glare and heat, while smart glass technologies are increasingly adopted in electric and premium vehicles for dynamic light control and energy efficiency .

The dominant segment in the automotive glass market is laminated glass, which is preferred for its safety features and ability to reduce noise and UV radiation. This type of glass is increasingly used in windshields due to its shatter-resistant properties, making it a popular choice among consumers and manufacturers alike. The growing emphasis on vehicle safety and regulatory requirements further solidifies laminated glass's leading position in the market .

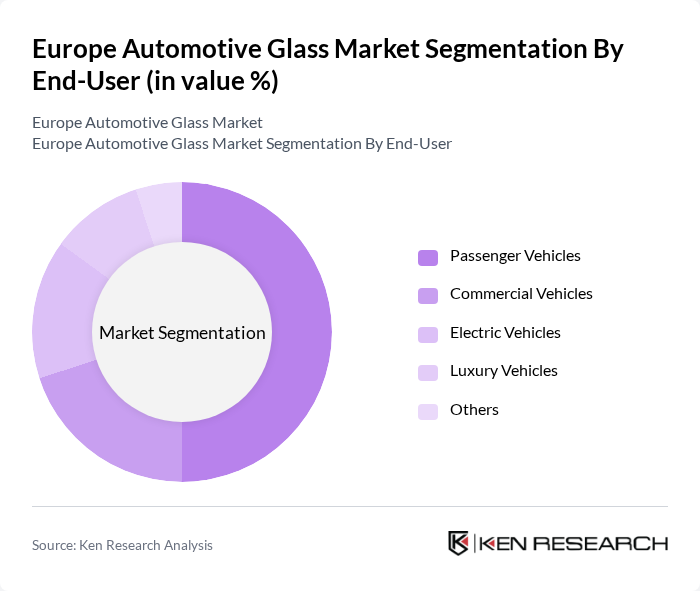

By End-User:The market is categorized based on end-users, including passenger vehicles, commercial vehicles, electric vehicles, luxury vehicles, and others. Each category reflects the diverse applications of automotive glass in different vehicle types. Passenger vehicles represent the largest share, driven by high production volumes and consumer demand for advanced safety and comfort features. Commercial vehicles increasingly adopt durable and functional glass solutions, while electric and luxury vehicles are key adopters of innovative smart and coated glass technologies .

Passenger vehicles dominate the automotive glass market, accounting for a significant share due to the high volume of production and consumer preference for personal vehicles. The increasing focus on safety and comfort features in passenger cars drives the demand for advanced glass solutions, such as laminated and tinted glass, enhancing the overall driving experience .

The Europe Automotive Glass Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saint-Gobain S.A., AGC Inc. (Asahi Glass Co.), Pilkington Group Limited (NSG Group), Guardian Industries Corp. (a Koch Industries company), Fuyao Glass Industry Group Co., Ltd., Xinyi Glass Holdings Limited, Nippon Sheet Glass Co., Ltd., Webasto SE, Vitro S.A.B. de C.V., Sika AG, Eastman Chemical Company, Soliver NV, Splintex Europe (AGC Automotive Europe), Press Glass S.A., Carlex Glass Europe (Nippon Sheet Glass Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive glass market in Europe appears promising, driven by ongoing innovations and a shift towards sustainability. As manufacturers increasingly adopt lightweight materials and smart glass technologies, the market is expected to evolve significantly. Additionally, the integration of advanced safety features will continue to be a priority, aligning with consumer preferences for enhanced vehicle safety. Overall, the market is poised for growth, supported by favorable economic conditions and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Laminated Glass Tempered Glass Coated Glass Tinted Glass Smart Glass (Electrochromic, Thermochromic, etc.) Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles Luxury Vehicles Others |

| By Application | Windshields Side Windows Rear Windows Sunroofs & Panoramic Roofs Quarter Glass & Vent Glass Others |

| By Distribution Channel | OEMs Aftermarket Online Sales Others |

| By Region | Western Europe Eastern Europe Northern Europe Southern Europe |

| By Price Range | Economy Mid-Range Premium |

| By Policy Support | Subsidies for Green Technologies Tax Incentives for Manufacturers Research Grants for Innovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Automotive Manufacturers | 100 | Product Development Managers, Procurement Officers |

| Aftermarket Glass Suppliers | 80 | Sales Managers, Operations Directors |

| Automotive Repair Shops | 60 | Shop Owners, Service Managers |

| Glass Technology Innovators | 50 | R&D Engineers, Product Managers |

| Regulatory Bodies and Associations | 40 | Policy Makers, Compliance Officers |

The Europe Automotive Glass Market is valued at approximately USD 16 billion, driven by the increasing demand for lightweight vehicles, advancements in glass technology, and the rising production of electric vehicles requiring specialized glass solutions.