Region:Europe

Author(s):Shubham

Product Code:KRAA0920

Pages:94

Published On:August 2025

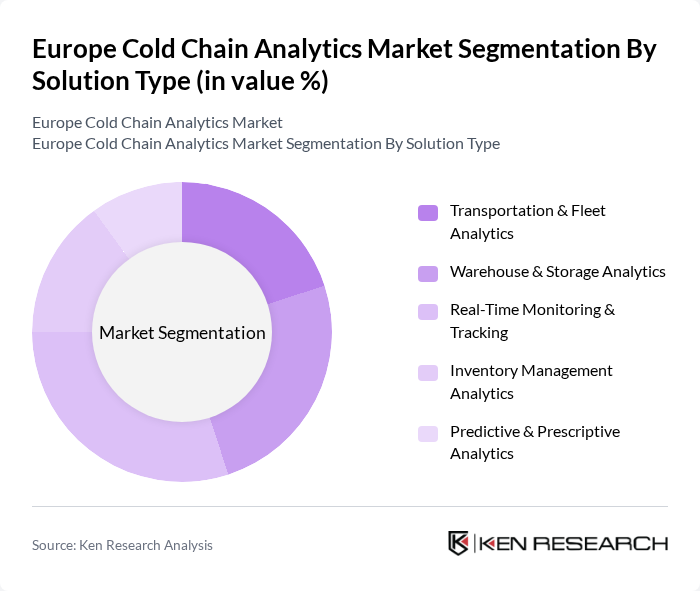

By Solution Type:The solution type segment includes analytics solutions that optimize cold chain operations. The subsegments are Transportation & Fleet Analytics, Warehouse & Storage Analytics, Real-Time Monitoring & Tracking, Inventory Management Analytics, and Predictive & Prescriptive Analytics. Among these, Real-Time Monitoring & Tracking is the leading subsegment, driven by the need for continuous visibility and control over temperature-sensitive shipments. Adoption is further propelled by regulatory compliance requirements and the need to minimize spoilage and losses .

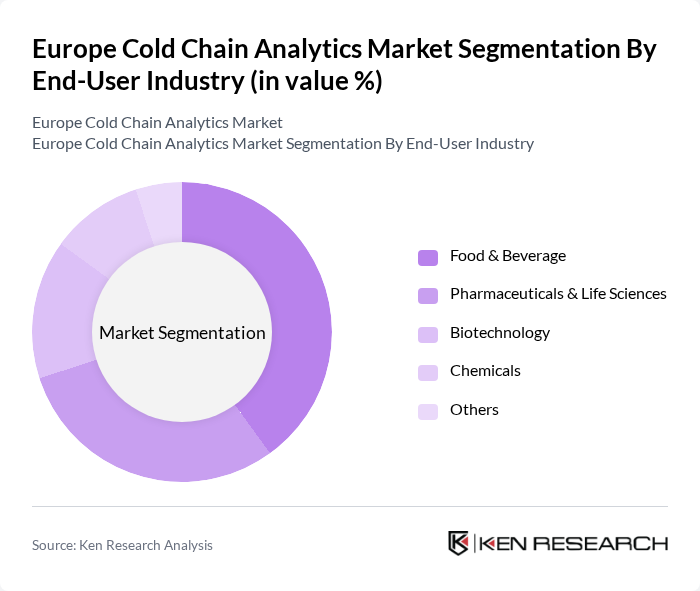

By End-User Industry:The end-user industry segment includes sectors that rely on cold chain analytics to maintain product integrity. This includes Food & Beverage, Pharmaceuticals & Life Sciences, Biotechnology, Chemicals, and Others. The Food & Beverage sector is the dominant segment, requiring stringent temperature control for safety and quality. Growing consumer demand for fresh, organic, and ready-to-eat products, as well as regulatory pressures, are driving the adoption of analytics in this sector .

The Europe Cold Chain Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, Lineage Logistics, Americold Logistics, Sensitech (Carrier Global Corporation), ORBCOMM, Tive Inc., Controlant, UPS Supply Chain Solutions, Maersk, CEVA Logistics, Emerson (Emerson Electric Co.), Zebra Technologies, Frigga (Shenzhen Freshliance Electronics Co., Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe cold chain analytics market appears promising, driven by technological advancements and evolving consumer preferences. The integration of AI and machine learning is expected to revolutionize data analytics, enhancing predictive capabilities and operational efficiency. Additionally, the growing emphasis on sustainability will likely lead to the development of eco-friendly cold chain solutions, aligning with regulatory pressures and consumer demand for environmentally responsible practices. These trends will shape the market landscape significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Transportation & Fleet Analytics Warehouse & Storage Analytics Real-Time Monitoring & Tracking Inventory Management Analytics Predictive & Prescriptive Analytics |

| By End-User Industry | Food & Beverage Pharmaceuticals & Life Sciences Biotechnology Chemicals Others |

| By Deployment Mode | On-Premise Cloud-Based Hybrid |

| By Application | Temperature Monitoring Asset Tracking Risk & Compliance Management Route Optimization Others |

| By Component | Hardware (Sensors, Data Loggers, RFID, etc.) Software (Analytics Platforms, Dashboards) Services (Consulting, Integration, Support) |

| By Country | Germany United Kingdom France Italy Spain Benelux Nordics Rest of Europe |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Management | 60 | Supply Chain Managers, Quality Assurance Officers |

| Food & Beverage Cold Storage Solutions | 70 | Logistics Coordinators, Operations Managers |

| Temperature-Controlled Transportation | 50 | Fleet Managers, Distribution Supervisors |

| Cold Chain Technology Adoption | 40 | IT Managers, Technology Officers |

| Retail Cold Chain Practices | 45 | Retail Operations Managers, Supply Chain Analysts |

The Europe Cold Chain Analytics Market is valued at approximately EUR 1.1 billion, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with advancements in IoT and analytics technologies.