Region:Europe

Author(s):Geetanshi

Product Code:KRAC0131

Pages:98

Published On:August 2025

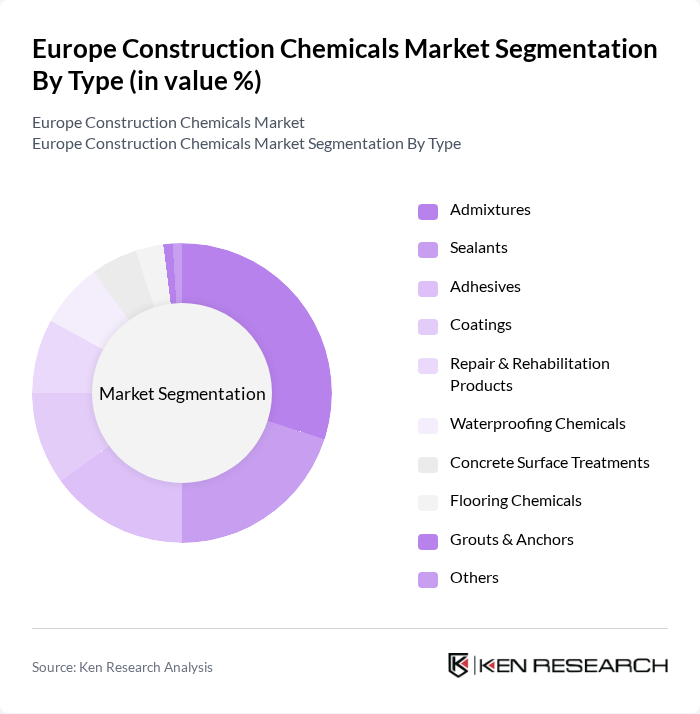

By Type:The market is segmented into various types of construction chemicals, including admixtures, sealants, adhesives, coatings, repair & rehabilitation products, waterproofing chemicals, concrete surface treatments, flooring chemicals, grouts & anchors, and others. Among these, admixtures and sealants are particularly prominent due to their essential roles in enhancing the properties of concrete and ensuring durability in construction projects. The increasing focus on high-performance and eco-friendly materials has led to a surge in demand for these products, especially admixtures, adhesives, and sealants, which are widely used for improving workability, strength, and sustainability in modern construction.

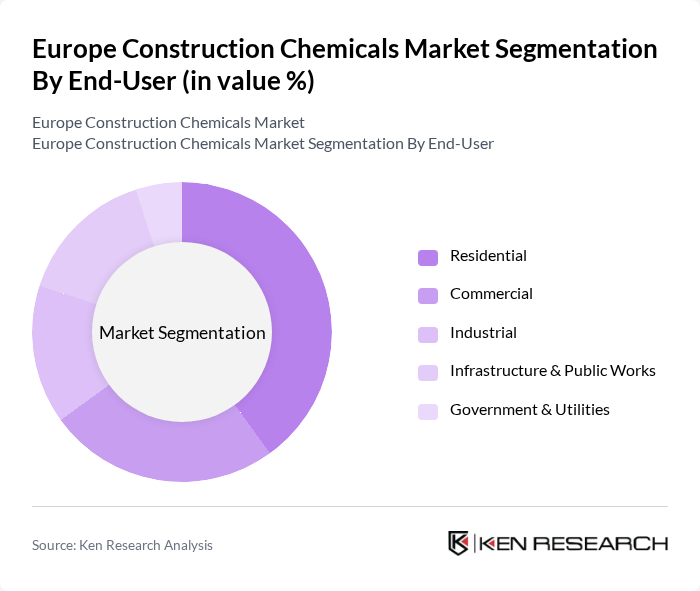

By End-User:The end-user segmentation includes residential, commercial, industrial, infrastructure & public works, and government & utilities. The industrial and institutional sector is a leading consumer of construction chemicals, driven by investments in manufacturing, healthcare, and education infrastructure. The residential sector also holds a significant share, supported by ongoing urbanization and renovation activities. The commercial and infrastructure sectors contribute substantially as urban development and public projects expand across Europe.

The Europe Construction Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Sika AG, Dow Inc., Saint-Gobain S.A., Mapei S.p.A., RPM International Inc., Huntsman Corporation, Fosroc International Limited, Bostik SA, Ardex GmbH, Pidilite Industries Limited, Ceresit (Henkel AG & Co. KGaA), Wacker Chemie AG, TREMCO illbruck (RPM International Inc.), KÖMMERLING Chemische Fabrik GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe construction chemicals market appears promising, driven by increasing investments in infrastructure and a strong focus on sustainability. As the demand for eco-friendly products rises, manufacturers are likely to innovate and develop advanced solutions that meet regulatory standards. Additionally, the integration of digital technologies in construction processes will enhance efficiency and reduce costs, positioning the market for robust growth. Overall, the landscape is evolving towards a more sustainable and technologically advanced future.

| Segment | Sub-Segments |

|---|---|

| By Type | Admixtures Sealants Adhesives Coatings Repair & Rehabilitation Products Waterproofing Chemicals Concrete Surface Treatments Flooring Chemicals Grouts & Anchors Others |

| By End-User | Residential Commercial Industrial Infrastructure & Public Works Government & Utilities |

| By Application | Infrastructure (Roads, Bridges, Tunnels) Residential Buildings Commercial Buildings Industrial Facilities Renovation & Refurbishment Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Retail Others |

| By Region | Western Europe (Germany, France, UK, Benelux, Others) Eastern Europe (Poland, Russia, Czech Republic, Others) Northern Europe (Nordic Countries, Baltics) Southern Europe (Italy, Spain, Portugal, Greece, Others) |

| By Price Range | Low Medium High |

| By Product Formulation | Water-based Solvent-based Powder-based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Project Managers | 100 | Project Managers, Site Supervisors |

| Construction Chemical Suppliers | 60 | Sales Managers, Product Development Leads |

| Regulatory Compliance Officers | 40 | Compliance Managers, Environmental Officers |

| Architects and Designers | 50 | Architects, Interior Designers |

| Construction Industry Analysts | 40 | Market Analysts, Research Directors |

The Europe Construction Chemicals Market is valued at approximately USD 22 billion, driven by factors such as urbanization, infrastructure development, and the increasing demand for sustainable construction practices across the region.